Tips to Increase Your Chances of Instant Loan Approval [Updated for 2025]

Getting instant loan approval is becoming more common thanks to the rise of online lenders and faster technology. However, getting approved right away means your application needs to be on point. By understanding what lenders look for and preparing your documents carefully, you can boost your chances significantly.

In this post, you’ll find practical tips to increase your chances of instant loan approval. You’ll learn how to strengthen your credit, choose the right lender, and organize your paperwork for a smoother, quicker approval process. These steps can save you time and make getting the funds you need much easier.

For more on improving your financial profile, check out this helpful guide on how to boost your personal loan approval odds.

#InstantLoanApproval #QuickLoans2025 #LoanApprovalTips

Understanding How Instant Loan Approval Works

Getting instant loan approval isn’t just about applying quickly; it’s a mix of several key factors working behind the scenes. Lenders today rely heavily on your credit score, how clean and accurate your digital paperwork is, and automated systems that decide whether you say “yes” or “no” right away. Understanding how these pieces fit together gives you an edge in meeting the expectations for speedy approvals.

Role of Credit Scores in Instant Approvals

Your credit score is the foundation for most loan decisions. Think of it as your financial report card — the higher your score, the more trustworthy you appear to lenders. Scores typically range from 300 to 850, and lenders often have cutoff points for instant approval.

- Why credit scores matter: A high score suggests you manage debt well and pay on time. A low score may signal risk, making lenders hesitate or slow down your approval.

- Real-world impact: According to experts, borrowers with scores above 750 have a much higher chance of instant approval and better loan terms, while scores below 620 often lead to manual review or denial.

- Improvement tips: Paying bills on time, reducing credit card balances, and avoiding new debt before applying can boost your score.

If you want to dive deeper into how your score affects loan chances, this explainer from the Consumer Financial Protection Bureau breaks it down clearly.

Digital Documentation and Verification Process

Submitting your documents online is now the norm, but it must be done with care. Errors here can cause delays, or worse, rejection.

- What you need to submit: Common documents include proof of income, identity verification, bank statements, and employment details.

- Why accuracy matters: Automated systems scan these documents for completeness and consistency. Typos, expired IDs, or mismatched information can raise red flags.

- Tips to avoid issues: Double-check uploads, use clear scans or photos, and avoid submitting unnecessary files that might complicate the review.

Many lenders use cloud-based systems to store and verify documents efficiently. For a helpful overview of how this process improves lending service, see this article on digital loan applications.

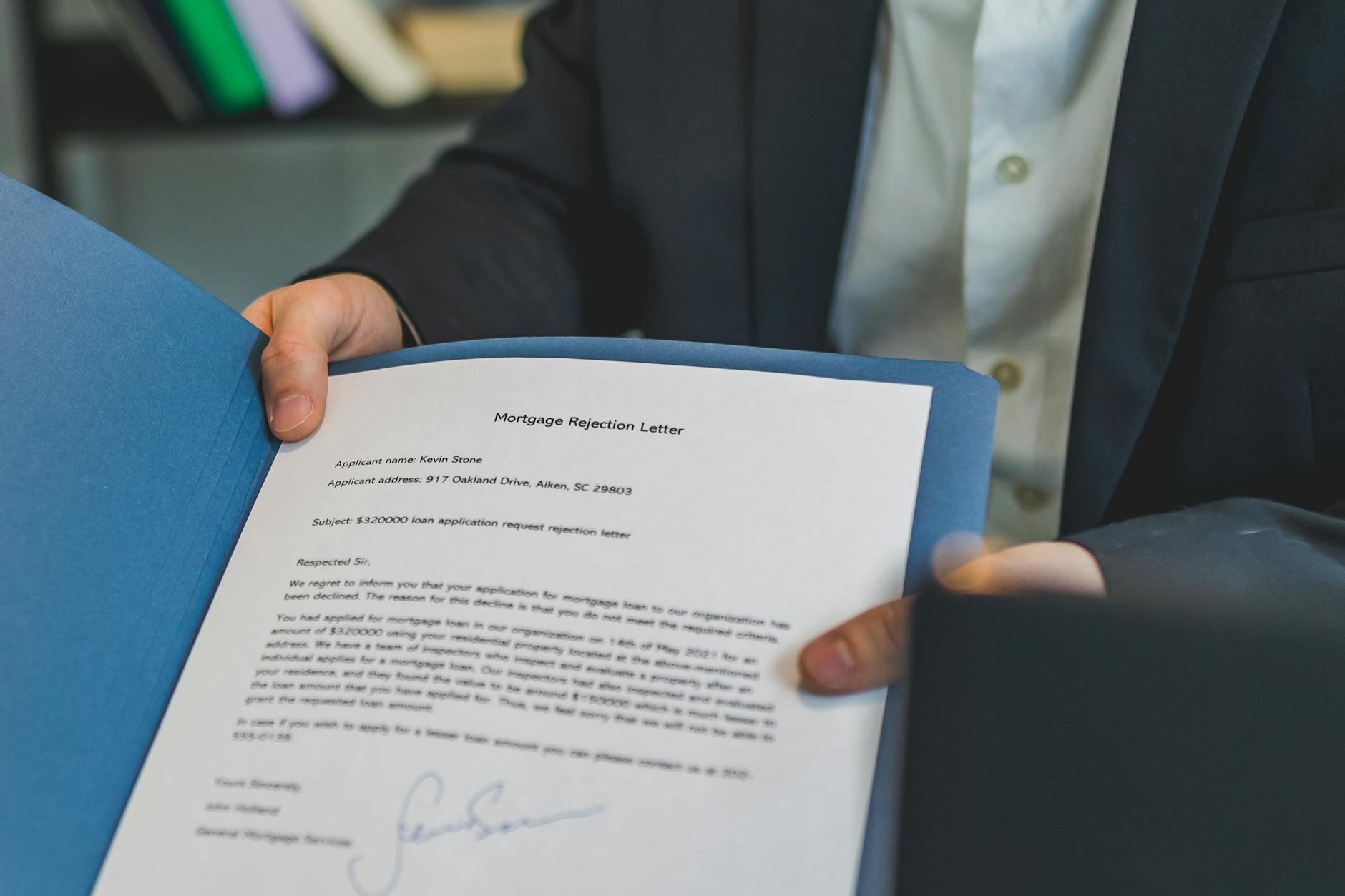

Photo by RDNE Stock project

Automated Decision Engines: What Lenders Look For

The fastest approvals come from automated decision engines — software that quickly reviews your application using preset algorithms.

- What these systems check: Your credit score, debt-to-income ratio, employment status, and sometimes even real-time bank account activity.

- Triggers for instant approval: Strong credit, steady income, and clean application data.

- Triggers for instant rejection: Low credit score, inconsistent information, or high debt levels.

- Manual review fallback: If the system flags an issue, your application goes to a human underwriter, slowing approval.

Automated decisions help lenders cut down processing time and reduce subjectivity. For more about how these engines function, this detailed guide on automated decision engines offers solid insights.

Understanding these core factors—credit scores, digital document accuracy, and automated processing—not only helps you prepare but also increases your chances of meeting the lender’s instant approval criteria. The next sections will explore actionable steps you can take to optimize each part of your loan application.

#TipsToIncreaseYourChancesOfInstantLoanApproval #InstantLoanApproval #LoanTips2025

Essential Pre-Application Preparations to Boost Approval Odds

Before you hit the “apply” button for a loan, taking a little extra time to prepare can dramatically increase your chances of instant loan approval. Lenders want to see that you’re financially responsible and ready to repay the loan. This means getting a clear picture of your finances, fixing any errors that could hurt your creditworthiness, and picking the right lender and loan type for your unique needs. Let’s break down these essential steps so you can go into your loan application confident and well-prepared.

Evaluating Your Financial Health

Knowing exactly where you stand financially is like having a map before embarking on a journey—it helps you avoid unexpected detours or dead ends. The two key factors lenders focus on are your debt-to-income ratio (DTI) and whether you have any outstanding debts.

- Calculate your debt-to-income ratio: This measures how much of your monthly income goes towards paying debts. To calculate it, add up all your monthly debt payments and divide by your monthly gross income. For example, if your debts total $1,200 monthly and your income is $4,000, your DTI is 30%. Most lenders prefer a DTI below 36% for loan approval.

- Check for outstanding debts: Make a list of all your debts, including credit cards, personal loans, and any unpaid bills. Pay special attention to debts in collections or overdue payments, as these raise red flags.

- Assess your financial readiness: Beyond numbers, consider your income stability, upcoming expenses, and available savings. Showing lenders that you have a steady income and a financial cushion boosts their confidence.

If you want a more detailed guide on how to perform a financial checkup before applying for a loan, this resource on conducting financial checkups offers practical advice to start with.

Correcting Errors in Your Credit Report Before Applying

Your credit report is a central part of the lender’s decision. Even small mistakes can cause a lender to hesitate or reject your application outright. Here’s how to make sure your report is accurate:

- Obtain a copy of your credit report from the major reporting agencies. You can get a free report once a year from sites like AnnualCreditReport.com.

- Review your report carefully, checking for wrong addresses, accounts that aren’t yours, outdated negative items, or mistaken balances.

- Dispute errors quickly by contacting both the credit bureau and the creditor reporting the error. Provide any proof you have, such as payment receipts or statements.

- Follow up and confirm corrections have been made. Even correcting minor errors frequently improves your credit score and your loan approval chances dramatically.

Resources like the Consumer Financial Protection Bureau’s guide on disputing credit report errors walk you through the process in detail and highlight common mistakes to watch for.

Choosing the Right Lender and Loan Product

Picking the right lender and loan is like choosing a pair of shoes—you want it to fit well and feel comfortable, or you’ll struggle along the way. Different lenders have different criteria, interest rates, and loan terms. Here’s how to choose wisely:

- Match your needs to the loan product: Decide what fits your financial situation best—whether it’s a personal loan, payday loan, or secured loan. Each has pros and cons that affect approval odds.

- Compare lenders: Look beyond the flashy ads. Review lender requirements, average approval times, and customer feedback. Some lenders specialize in quick approvals for certain borrower profiles or loan types.

- Check lender reputation: Trust matters. Choose lenders that are transparent on fees, have strong customer service, and good reviews to avoid surprises down the line.

Before you finalize your choice, it helps to ask the right questions. For a helpful checklist, this article on questions to ask when choosing a lender offers practical pointers.

Photo by RDNE Stock project

Taking these pre-application steps seriously sets a strong foundation for your loan request. Once you understand your financial health, clear up any credit report errors, and commit to the right lender and product, your chances to increase your chances of instant loan approval rise significantly. For deeper insights on improving your financial health and loan readiness, this article on loan approval tips can be a great companion.

Optimizing Your Loan Application for Instant Approval

Applying for a loan and expecting instant approval isn’t just a matter of luck—it requires careful preparation and a clear strategy. The way you present your information, organize your documents, and time your submission can push your application to the top of the pile. Think of your loan application as a package: if it’s neat, complete, and tailored to what the lender wants, it travels faster through the approval process. Let’s break down the critical steps to optimize your loan application for that quick green light.

Providing Accurate and Complete Information

Accuracy is the foundation of any successful loan application. Lenders rely on the details you provide to make fast decisions, so any wrong or missing information can slow you down or lead to rejection. Tailor your application to fit the lending institution’s exact requirements. This means:

- Double-check all personal details: Name, address, date of birth, and Social Security number must be error-free.

- Provide consistent employment and income information: Align the data you enter with your pay stubs and employer records.

- Avoid common mistakes: Typos, forgetting to fill mandatory fields, or submitting outdated information can cause automatic rejections.

- Be honest about your financial situation. Embellishing income or employment details often leads to trouble during verification.

Filling out your application carefully shows lenders that you are organized and trustworthy. It also speeds up the verification process as there are fewer questions or flags on your file.

Uploading Proper Documentation: Tips and Checklists

Your documents are the proof lenders look for—and they need to be crystal clear. Uploading the right files in the correct format tells the lender you’re serious and ready. Here’s how to get this right every time:

- Essential documents commonly required:

- Government-issued ID (driver’s license, passport)

- Recent pay stubs or proof of income (usually last 2–3 months)

- Bank account statements (last 2–3 months)

- Proof of residence (utility bill, lease agreement)

- File standards matter: Use common formats like PDF or JPEG. Make sure files are under size limits (usually 5MB) and aren’t corrupted.

- Avoid blurry or incomplete uploads: Scan documents under good lighting, keep the camera steady, and ensure all edges of the document are visible.

- Check for expiration: IDs and proofs should be current, not expired.

Think of uploading your documents like presenting your ID at a security checkpoint—you want everything sharp and clear without a pause or second look.

Photo by RDNE Stock project

Timing Your Application Strategically

When you apply can influence how fast you get approved. Timing your application around your financial calendar maximizes your chances:

- Apply just after your pay cycle: This ensures your proof of income and bank balances reflect your healthiest financial position, making your application look stronger.

- Avoid applying right after large payments: If you’ve just cleared big debts or credit cards, give it a day or two so your accounts reflect the new balances.

- Consider lender processing times: Many lenders process applications faster mid-week when work volumes are moderate, avoiding weekend backlogs.

- Avoid holidays or month-end: These periods often slow down processing due to staff shortages or system maintenance.

Strategic timing means you’re presenting your strongest financial snapshot at a moment when the lender is most ready to look at it.

By focusing on providing exact and complete information, submitting flawless documents, and scheduling your application wisely, you dramatically increase your chances of instant loan approval. Think of it as setting up a smooth highway for your loan request—it helps the approval travel without bumps or roadblocks.

For more guidance on improving your loan application, explore practical steps to prepare for your loan that complement these tips.

#InstantLoanApproval #LoanApplicationTips #QuickLoanApprovals #LoanApproval2025

Common Reasons for Instant Loan Rejection and How to Prevent Them

Facing an instant loan rejection can feel like hitting a wall just when you expected smooth sailing. Understanding the common pitfalls that lead to these swift “no”s can help you steer your application in the right direction. Let’s explore key reasons why lenders often reject applications instantly and practical ways to avoid these traps. By addressing these issues upfront, you position yourself far better to get the approval you need without the frustrating delays.

Insufficient Credit History or Score

A thin credit file or low credit score is one of the most frequent reasons lenders deny instant loan approval. If you have limited or no credit history, lenders lack the information to confidently assess your ability to repay.

How to fix this:

- Build your credit gradually: Start with secured credit cards or small loans to create a positive payment history.

- Use alternative data: Some lenders accept utility payments, rent history, or even employment records to evaluate creditworthiness beyond traditional scores.

- Consider specialized lenders: Look for lenders who focus on borrowers with limited credit history. They tend to use alternative scoring models that weigh your overall financial behavior differently.

- Monitor your credit score: Use free tools and regularly check your credit report to ensure accuracy and track improvement.

Millions of people face this challenge, but with steady effort on credit building and seeking the right lender, you can overcome the thin file hurdle and increase your approval odds.

Mismatch in Personal Information or Fraud Flags

Even small inconsistencies in your application — misspelled names, outdated addresses, or mismatched Social Security numbers — can trigger instant rejection. Lenders use automated systems that raise fraud flags at the slightest sign of mismatch to protect themselves from identity theft.

Steps to prevent this:

- Review all personal details carefully: Double-check your application before submitting, making sure names, addresses, and other identifiers match your official documents exactly.

- Keep your records updated: Notify creditors and lenders immediately if you move or legally change your name.

- Correct errors in credit reports: Any misinformation in your credit report that conflicts with your application can lead to automatic denials.

- Use consistent documentation: Submit documents that reflect the same information you provide in your application, such as employment verification and ID.

Think of your loan application like a passport for trust—any discrepancy is a red flag that halts the process until it’s cleared up.

Unstable Employment or Income Documentation

Lenders prioritize steady income and employment because these show your ability to repay the loan reliably. If you have gig work, multiple income sources, or recently switched jobs, your application might appear risky without clear proof.

Ways to strengthen your application:

- Provide detailed income documentation: Include pay stubs, tax returns, bank statements, or contracts detailing your income sources.

- Explain employment gaps or changes: Offer a brief, honest explanation for job changes or fluctuating income in a cover letter or in the application notes.

- Show consistent cash flow: For gig workers, demonstrate regular deposits and realistic projections of earnings.

- Consider co-signers or guarantors: Adding someone with stable income can reduce lender concerns and speed approval.

By painting a clear, transparent picture of your income, you reduce lender uncertainty and increase your chances for instant approval.

Photo by RDNE Stock project

Addressing these common causes of loan rejection directly improves your odds and prevents unnecessary delays. Taking proactive steps to build credit, verify your identity, and document income accurately are essential tips to increase your chances of instant loan approval.

#InstantLoanApproval #LoanRejectionSolutions #ImproveLoanApprovalChances

Proven Advanced Strategies to Increase Your Chances of Instant Loan Approval

Knowing the basics of loan applications is a good start, but to really boost your chances of instant loan approval, you need to go beyond the basics. This section highlights advanced strategies that you may not have considered but can make a significant difference. From tapping into pre-approval offers without damaging your credit, to using the latest fintech tools, and building strong relationships with your bank, these approaches will position you as a low-risk borrower and speed up your approval process.

Using Pre-Approval and Pre-Qualification Offers Wisely

Pre-approval and pre-qualification are powerful tools that can give you an edge without leaving a scar on your credit history. Many lenders offer these checks as a way to give you an idea of your chances before you fully apply. The key is understanding the difference between soft and hard inquiries:

- Soft inquiries do not impact your credit score. Pre-qualification checks often fall into this category and let lenders review your financial data without a full investigation.

- Hard inquiries usually result from a formal loan application and can lower your credit score slightly.

To maximize pre-approval benefits without risking your credit score:

- Shop around for pre-qualification first. Use lenders or apps that allow multiple soft inquiries so you can compare offers.

- Avoid multiple hard inquiries in a short period, which can signal risk to lenders.

- Use pre-approval offers as leverage in negotiations or to confidently apply knowing your odds are solid.

Many reputable lenders provide pre-approval tools online. Taking advantage of these helps you target your applications smartly, which reduces waste and preserves your credit.

Leveraging Technology and Fintech Platforms

Technology has reshaped lending, making the process swifter and more flexible. Fintech platforms specialize in using data efficiently to assess risk faster and more accurately than traditional banks, giving you an advantage if you apply through them.

Here’s how fintech can help boost your instant loan approval:

- Automated income verification: Uploading pay stubs, bank statements, or even syncing your bank account through open banking APIs lets lenders see real-time income and spending patterns.

- Alternative credit data: Some platforms use alternative data — utility payments, rental history, or even smartphone data — to supplement traditional credit scores.

- Faster decisions: Sophisticated algorithms analyze your application within minutes, providing instant responses.

- User-friendly interfaces: Streamlined application processes reduce errors and incomplete forms, common reasons for delays or denials.

Apps and online lenders often encourage you to link accounts or share data securely to increase transparency, which builds lender confidence and speeds approvals.

For practical fintech solutions tailored to your needs, researching options beyond traditional banks might be worth your while, especially if your credit profile is complex or non-traditional.

Building Positive Banking Relationships

Long-term relationships with your financial institution are often overlooked, yet they can be a cornerstone for instant loan approval. When banks recognize you as a loyal and responsible customer, they are more likely to fast-track your application.

Ways to strengthen your banking relationships:

- Maintain active accounts: Use your checking, savings, or investment accounts regularly and maintain healthy balances.

- Set up direct deposit: Having your salary or income regularly deposited reflects financial stability.

- Manage accounts responsibly: Avoid overdrafts, keep credit cards or lines of credit in good standing, and pay bills on time.

- Communicate proactively: If you anticipate applying for a loan, discuss it with your bank manager or contact. Early transparency helps them prepare to support your request.

- Use multiple services: Banks prefer clients who engage with various products like savings, checking, credit cards, or mortgages as it shows commitment.

In many cases, having a prior positive history with your bank reduces paperwork, and eligibility checks may be expedited because they already trust your financial behavior.

Photo by Ketut Subiyanto

Using these advanced strategies enhances your overall profile and brings you closer to instant loan approval. For more insights on preparing for your loan application, check out this detailed guide on loan application readiness for practical steps that perfectly complement these tips.

#InstantLoanApproval #LoanApprovalTips #FintechLoans #BankingRelationships #PreApprovalBenefits

Conclusion

Increasing your chances of instant loan approval takes a combination of clear financial understanding, accurate documentation, and strategic timing. Strengthening your credit, correcting errors, and choosing the right lender create the foundation. Adding advanced tactics like smart pre-approval use and building relationships with your bank can give you a noticeable edge.

Every detail counts, from submitting complete and consistent information to applying when your finances look their best. Following these proven steps makes the approval process smoother and faster, helping you get the funds you need without unnecessary delays.

Keep refining your approach and consider exploring related topics on loan management and personal finance to stay informed. Sharing your experiences can also help others on the same path toward better loan approval results.

#TipsToIncreaseYourChancesOfInstantLoanApproval #InstantLoanApproval #LoanApplicationTips #QuickLoanApprovals #LoanApproval2025

I’m truly enjoying the design and layout of your website. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a developer to create your theme? Fantastic work!

I抣l immediately grab your rss as I can’t find your email subscription link or e-newsletter service. Do you have any? Please let me know in order that I could subscribe. Thanks.

I am extremely impressed with your writing skills and also with the layout on your blog. Is this a paid theme or did you customize it yourself? Anyway keep up the nice quality writing, it抯 rare to see a great blog like this one nowadays..

It’s best to take part in a contest for the most effective blogs on the web. I’ll advocate this website!

hey there and thanks on your information ?I have certainly picked up anything new from right here. I did on the other hand experience several technical points the use of this web site, since I experienced to reload the web site many times previous to I may just get it to load properly. I had been wondering if your web hosting is OK? No longer that I am complaining, but slow loading cases times will sometimes impact your placement in google and could damage your high quality ranking if ads and ***********|advertising|advertising|advertising and *********** with Adwords. Well I抦 adding this RSS to my e-mail and can look out for much more of your respective interesting content. Make sure you replace this once more soon..

I think this is one of the most important information for me. And i am glad reading your article. But want to remark on some general things, The web site style is wonderful, the articles is really excellent : D. Good job, cheers

Thanks for sharing your ideas here. The other point is that any time a problem appears with a personal computer motherboard, folks should not have some risk associated with repairing it themselves because if it is not done properly it can lead to permanent damage to the full laptop. It will always be safe just to approach a dealer of the laptop for the repair of that motherboard. They have got technicians who’ve an competence in dealing with notebook motherboard issues and can carry out the right diagnosis and conduct repairs.

Good write-up. I certainly appreciate this website. Keep it up!

Greetings! Very helpful advice in this particular article! It’s the little changes that will make the most significant changes. Thanks a lot for sharing!