PMMY: Business loan under Pradhan Mantri Mudra Yojana

The Indian government launched the Pradhan Mantri Mudra Yojana (PMMY) to boost entrepreneurship. It offers loans without collateral to small businesses and entrepreneurs. This move aims to unlock India’s entrepreneurial potential and grow its small-scale industries.

Key Takeaways

- Pradhan Mantri Mudra Yojana (PMMY) is a government-backed loan program for small businesses and entrepreneurs in India.

- The scheme aims to provide collateral-free loans to micro and small enterprises, fostering entrepreneurship and economic growth.

- PMMY offers three loan categories: Shishu, Kishore, and Tarun, catering to different sizes and stages of businesses.

- The program is implemented through a network of banks, microfinance institutions, and other financial intermediaries.

- PMMY has played a significant role in empowering small businesses and contributing to India’s economic development.

What is Pradhan Mantri Mudra Yojana

The Pradhan Mantri Mudra Yojana (PMMY) was launched by the Government of India in 2015. It aims to help the non-corporate small business sector get affordable credit. This scheme is key to boosting economic growth and financial inclusion in India.

Core Objectives of PMMY

The main goals of the Pradhan Mantri Mudra Yojana are:

- Offering loans that are affordable and don’t need collateral to micro and small businesses

- Helping the non-corporate small business sector grow

- Making sure more entrepreneurs get access to credit

- Supporting the growth of micro-enterprises and creating jobs

Historical Background and Launch

In April 2015, Prime Minister Narendra Modi launched the Pradhan Mantri Mudra Yojana. It was created to help the non-corporate small business sector get the credit they need. This scheme makes it easier for micro-entrepreneurs to get loans, even without the usual collateral or credit history.

Key Stakeholders Involved

The Pradhan Mantri Mudra Yojana brings together many important groups. These include:

- Banks (public, private, and regional rural banks)

- Microfinance Institutions (MFIs)

- Non-Banking Financial Companies (NBFCs)

- Government agencies and regulatory bodies

These groups work together to make the MUDRA loan scheme work smoothly. They help micro-entrepreneurs get the resources they need to grow their businesses. This way, they can help the country’s economy grow.

Business loan under Pradhan Mantri Mudra Yojana

The Pradhan Mantri Mudra Yojana (PMMY) is a government-backed scheme. It offers MUDRA loan types without collateral to micro and small enterprises in India. These micro-unit financing options help grow the country’s entrepreneurial ecosystem.

Under the PMMY, businesses can get three types of loans. These are based on their needs and growth stage:

- Shishu loans – Up to ₹50,000 for early-stage or nascent enterprises

- Kishore loans – Between ₹50,001 and ₹5 lakh for growing businesses

- Tarun loans – From ₹5 lakh up to ₹10 lakh for relatively established micro-unit financing operations

These collateral-free loans under the PMMY are key for entrepreneurs. They help start, scale, and grow small businesses. This empowers them to contribute to India’s economic growth.

| Loan Category | Loan Amount | Target Beneficiaries |

|---|---|---|

| Shishu | Up to ₹50,000 | Early-stage or nascent enterprises |

| Kishore | ₹50,001 to ₹5 lakh | Growing businesses |

| Tarun | ₹5 lakh to ₹10 lakh | Relatively established micro-unit financing operations |

These collateral-free loans under the PMMY are crucial. They provide MUDRA loan types for entrepreneurs. This helps them start, scale, and grow their small businesses. It empowers them to contribute to India’s economic progress.

Categories of MUDRA Loans

The Pradhan Mantri Mudra Yojana (PMMY) has three main types of business loans. These loans help entrepreneurs and small businesses at different stages. They aim to support people in making their business dreams come true.

Shishu Loans

Shishu loans are the starting point in the PMMY. They are for new start-ups and small businesses, offering up to ₹50,000. These loans help people start their business journey with the needed funds.

Kishore Loans

Kishore loans support growing businesses. They offer loans from ₹50,001 to ₹5 lakhs. This helps small and medium-sized businesses to grow, invest, and explore new markets.

Tarun Scheme

The Tarun scheme is for bigger businesses. It offers loans from ₹5 lakhs to ₹10 lakhs. This gives businesses the chance to make big investments, expand, and grow sustainably.

| Loan Category | Loan Limit | Target Beneficiaries |

|---|---|---|

| Shishu | Up to ₹50,000 | Start-ups and Micro-enterprises |

| Kishore | ₹50,001 to ₹5 Lakhs | Small and Medium Enterprises |

| Tarun | ₹5 Lakhs to ₹10 Lakhs | Larger Businesses and Enterprises |

The three MUDRA loan categories – Shishu, Kishore, and Tarun – meet the varied needs of entrepreneurs and small businesses. They offer specific loan amounts and target certain groups. The PMMY program aims to create a supportive environment for entrepreneurship in India.

Eligibility Criteria for PMMY

To get a MUDRA loan under the Pradhan Mantri Mudra Yojana (PMMY) scheme, you must meet certain rules. These rules help make sure the loan goes to the right people. That means small businesses and startups that need money to grow.

To qualify for a MUDRA loan, you need to meet these requirements:

- Business Type: The MUDRA loan eligibility is for non-farm small/micro businesses. This includes things like proprietorships, partnerships, private limited companies, and microfinance institutions.

- Age Limit: You must be at least 18 years old to apply for a MUDRA loan.

- Small business requirements mean your business can’t make more than ₹100 lakhs (about $135,000) a year.

- Startup financing is for new businesses that are less than 5 years old.

- Credit History: You need a good credit history and score to get a MUDRA loan.

- Collateral: You don’t always need collateral for smaller loans. But, for bigger MUDRA loan eligibility under the Tarun category, you might need it.

The PMMY scheme wants to make sure everyone has a chance to get the money they need. It’s all about helping India’s small businesses and startups grow and succeed.

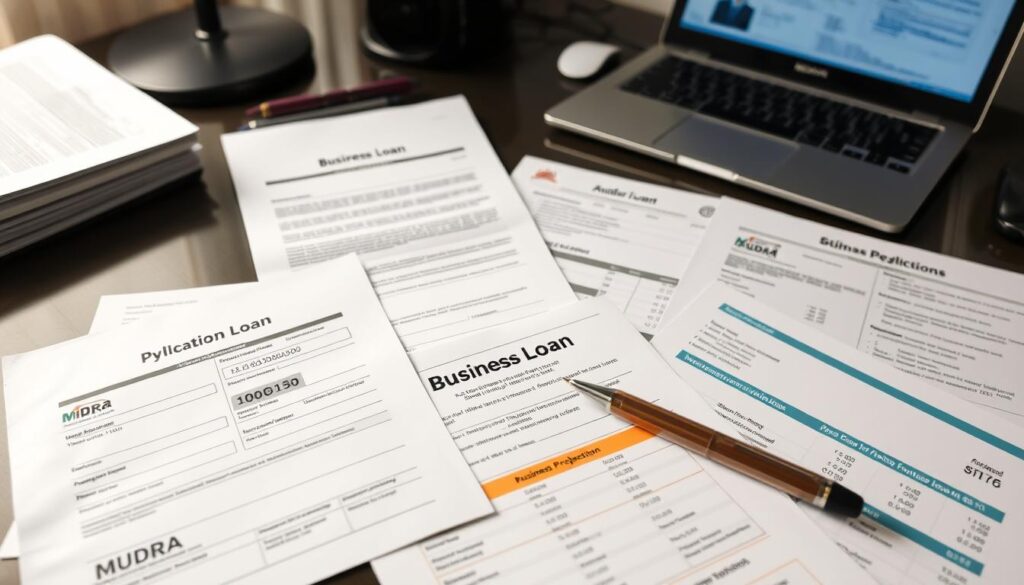

Documents Required for MUDRA Loan Application

To apply for a MUDRA loan, you need to submit many documents. These show your business is ready and you qualify for the loan. They cover your personal and business details, helping MUDRA check your application.

Basic Documentation Needs

- Completed MUDRA loan application form

- Proof of identity (Aadhaar card, PAN card, or voter ID)

- Proof of residence (electricity bill, telephone bill, or bank statement)

- Passport-size photographs

Business-specific Documents

You also need to provide business-related documents:

- Business registration certificate (such as a shop and establishment certificate or a certificate of incorporation)

- GSTIN (Goods and Services Tax Identification Number) certificate

- Lease agreement or proof of business premises ownership

- Business plan outlining your objectives, operations, and financial projections

Financial Records Required

For your financial health, you must submit:

- Bank statements for the last 6-12 months

- Income tax returns for the last 2-3 years

- Audited financial statements (balance sheet, profit and loss statement, and cash flow statement) for the last 2-3 years

- Details of existing loans, if any

Having all documents ready can make your MUDRA loan application smoother. It also boosts your chances of getting approved.

Application Process for MUDRA Loans

Getting a MUDRA loan is easy. You can apply online or in person at a bank. Here are the main steps:

- Determine Loan Category: Think about what your business needs. Choose Shishu, Kishore, or Tarun based on your needs.

- Gather Required Documents: Get all needed papers. This includes ID, business registration, and financial info.

- Visit Bank Branch or Apply Online: You can apply in person or online. Both ways are easy to use.

- Complete Application Form: Fill out the loan form. Share your business and financial details.

- Submit Documents: Send in your papers and the form. You can do this online or at the bank.

- Loan Approval Process: The bank will check your application. If approved, they’ll give you the loan soon.

The MUDRA loan process is made simple. It helps small business owners get the help they need easily.

| MUDRA Loan Application Steps | Online Application | Bank Branch |

|---|---|---|

| Determine Loan Category | ✓ | ✓ |

| Gather Required Documents | ✓ | ✓ |

| Complete Application Form | ✓ | ✓ |

| Submit Documents | ✓ | ✓ |

| Loan Approval Process | ✓ | ✓ |

Both online and in-person options make applying for a MUDRA loan easy. You can pick what works best for you.

Interest Rates and Loan Terms

The Pradhan Mantri Mudra Yojana (PMMY) offers great interest rates and flexible repayment plans. These make it a top choice for entrepreneurs.

Competitive Interest Rates

MUDRA loan interest rates are often lower than traditional small business loans. The rates under PMMY vary based on the lender and the borrower’s credit. But, they usually range from 8-20% per year. This makes MUDRA loans a smart choice for small businesses.

Repayment Flexibility

MUDRA loans come with flexible repayment options. Borrowers can pick a loan term from 6 months to 5 years. This lets small business owners adjust payments to fit their cash flow and needs.

Also, MUDRA loans are collateral-free. This is great for small businesses without assets to use as security. It makes the PMMY scheme more accessible and affordable for entrepreneurs.

“The PMMY scheme has been a game-changer for small businesses, providing them with the financial support they need to grow and thrive.”

Benefits of PMMY for Small Businesses

The Pradhan Mantri Mudra Yojana (PMMY) is a big help for small businesses and entrepreneurs in India. It offers many benefits that can help small businesses grow and succeed.

One key advantage of PMMY is better access to formal credit. It gives loans up to ₹10 lakh to small businesses. This makes it easier for them to get the money they need to start, grow, or improve their businesses. Getting this money can really help small businesses grow and build a strong financial base.

Also, the MUDRA scheme advantages include lower interest rates than usual loans. This makes it cheaper for small businesses to get the funds they need. It helps them save money and invest more in their businesses.

Moreover, PMMY helps with financial inclusion. It gives credit to people who are often left out by banks and other lenders. This helps more people start their own businesses and pursue their dreams.

“The PMMY has been a game-changer for small businesses, providing them with the financial resources and support they need to thrive and expand.”

In summary, the Pradhan Mantri Mudra Yojana is a great tool for small businesses in India. It helps solve problems like getting credit and being financially included. This can really boost the entrepreneurial spirit and help the economy grow.

| Benefit | Description |

|---|---|

| Improved Access to Credit | PMMY provides loans of up to ₹10 lakh, making it easier for small businesses to secure the necessary funding. |

| Lower Interest Rates | The program offers competitive interest rates, reducing the financial burden on small enterprises. |

| Financial Inclusion | PMMY promotes financial inclusion by extending credit to marginalized and underserved segments. |

Role of Banks and Financial Institutions

The Pradhan Mantri Mudra Yojana (PMMY) has brought together many lending institutions in India. Public sector banks, private banks, regional rural banks, and microfinance institutions have all played a key role. They helped make this government-backed scheme a success.

Participating Banks

Many public sector banks are part of the MUDRA scheme. Banks like State Bank of India, Bank of Baroda, and Punjab National Bank are key players. They provide loans without collateral to small businesses under PMMY.

Microfinance Institutions

Microfinance institutions (MFIs) are also big players in the MUDRA loan program. Companies like Bandhan Bank, Janalakshmi Financial Services, and Satin Creditcare Network are experts in the informal sector. They help many entrepreneurs who are not served by traditional banks.

| Lending Institution | MUDRA Loans Disbursed (in INR crore) |

|---|---|

| Public Sector Banks | 2,50,000+ |

| Microfinance Institutions | 1,00,000+ |

| Private Banks | 50,000+ |

| Regional Rural Banks | 25,000+ |

The teamwork between MUDRA scheme partners and lending institutions has helped millions of small business owners. It has boosted economic growth and helped more people get financial services.

Success Stories and Impact

The Pradhan Mantri Mudra Yojana (PMMY) has changed lives for many small businesses in India. It has given MUDRA loan beneficiaries the chance to make their dreams come true. This has helped grow the nation’s economy.

Ravi, a young man from a small town, started a handloom business with a MUDRA loan. He was able to grow his business, hire local artisans, and show off his region’s culture. Now, his business supports his family and many skilled weavers, making a big difference in the community.

“The MUDRA loan was a lifeline for my business. It allowed me to invest in the right equipment, hire talented artisans, and build a brand that celebrates the beauty of Indian handlooms. I’m grateful for the opportunity and hope to inspire other small business owners to take the leap.”

Neha, a passionate chef, opened a small restaurant with a MUDRA loan. Thanks to PMMY, she was able to face challenges and make her restaurant a hit. It now offers tasty meals and jobs to the community.

- The PMMY has been key in helping small businesses succeed, with over MUDRA loan beneficiaries across the country.

- These businesses have created jobs and brought in money, helping the economy. They also encourage entrepreneurship in India.

- The MUDRA loan program has helped people, especially those from tough backgrounds, start their own businesses.

The Pradhan Mantri Mudra Yojana shows how important financial help is for small businesses in India. As more people get MUDRA loans and succeed, the program’s impact on entrepreneurship and the economy will keep growing.

Common Reasons for Loan Rejection

Applying for a MUDRA (Micro Units Development and Refinance Agency) loan can be a big help for small businesses. But, the process isn’t always easy. Many applicants face the tough news of loan rejection. Knowing why this happens is key for entrepreneurs to avoid mistakes and get the funding they need.

Documentation Issues

One big reason for MUDRA loan rejection is bad documentation. You must have all the right papers, like business registration and financial statements. If you don’t have these or if the info is wrong, your application will likely be rejected.

Credit History Concerns

Another important factor is your credit history. Lenders check if you’re good with money. A bad credit score or late payments can raise red flags. Keeping your credit in good shape is essential for getting a MUDRA loan.

| Reason for Rejection | Percentage of Rejections |

|---|---|

| Documentation Issues | 45% |

| Credit History Concerns | 35% |

| Non-Viable Business Plan | 20% |

By knowing why MUDRA loans get rejected, you can make your application stronger. This way, you can boost your chances of getting the funding your small business needs.

MUDRA Card Features and Benefits

The MUDRA Card is a new financial tool for small businesses and entrepreneurs. It’s part of the Pradhan Mantri Mudra Yojana (PMMY) scheme. It gives borrowers a flexible way to get working capital.

This card has a revolving credit line feature. Borrowers can get funds anytime, up to their credit limit, without needing to apply again. This makes it easier for small business owners to manage their money and seize market chances.

The MUDRA Card also offers many benefits for small businesses. It has competitive interest rates and repayment plans that fit each business’s needs. Plus, it lets borrowers make purchases or get cash from many banks and financial places. This support helps small businesses grow and succeed in India.

FAQ

What is Pradhan Mantri Mudra Yojana (PMMY)?

Pradhan Mantri Mudra Yojana (PMMY) is a government program started in 2015. It helps small businesses and entrepreneurs in India get financial support. The goal is to help more people start their own businesses and grow the economy.

What are the core objectives of PMMY?

PMMY aims to: – Give loans without needing collateral to small businesses – Help people start their own businesses – Support the growth of small businesses – Create jobs and boost the economy

What are the different categories of MUDRA loans?

MUDRA loans come in three types: – Shishu: Up to ₹50,000 – Kishore: ₹50,001 to ₹5 lakh – Tarun: ₹5 lakh to ₹10 lakh These loans help businesses at different stages, from starting up to growing.

What are the eligibility criteria for availing a MUDRA loan?

To get a MUDRA loan, you need to: – Be a small business or micro-enterprise – Have your business in India and be involved in making, selling, or services – Be at least 18 years old – Not be in the informal sector of non-agriculture

What documents are required to apply for a MUDRA loan?

You’ll need: – Proof of who you are (Aadhaar, PAN card) – Proof of where you live (Aadhaar, electricity bill) – Business documents (Udyog Aadhaar, GST registration) – Bank statements and financial records – A business plan or project report

What is the application process for obtaining a MUDRA loan?

To apply for a MUDRA loan, follow these steps: 1. Fill out the application online or at a bank 2. The bank will check your personal and business details 3. They’ll look at your business plan and finances 4. If approved, the bank will give you the loan 5. The loan money will go into your bank account

What are the interest rates and repayment terms for MUDRA loans?

MUDRA loans have good interest rates, from 8% to 12% a year. You can choose how long to pay back the loan, from 3 to 5 years. This depends on how much you borrowed and your business needs.

What are the common reasons for MUDRA loan rejection?

Loans might be rejected for a few reasons: – Missing or wrong documents – Bad credit history or score – Poor business plan or project report – Not enough collateral or security – Loan amount doesn’t match business needs

Leave a Reply