Personal loans are the “Swiss-army knife” of retail credit in India: fast, unsecured, flexible, and (when used smartly) a powerful tool for consolidating expensive debt, funding emergencies, or financing planned expenses. But personal loans are also one of the easiest ways to overpay—because the final rate you get depends heavily on your credit profile, employer/income stability, existing EMIs, and even your relationship with the lender.

This guide is designed as a practical, learn-by-doing handbook—covering:

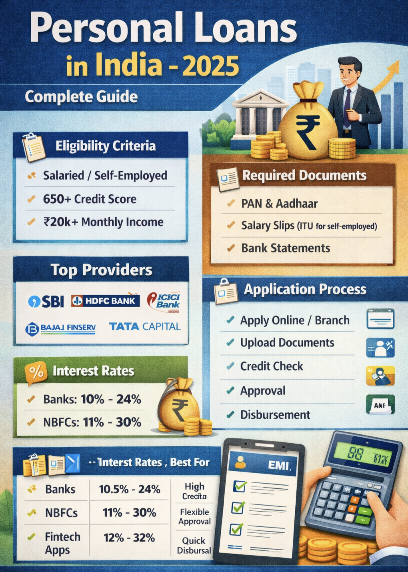

- eligibility rules lenders actually use

- documents and application workflow

- lender-wise options (banks + NBFCs)

- interest rate comparison (indicative)

- approval tactics to get better rates

- common rejection reasons and how to fix them

- FAQs and a decision checklist

Important note about rates: Personal loan interest rates change frequently and vary by customer profile. Wherever you see “starts from” or a range, treat it as indicative and verify on the lender’s official page/app before applying.

1) What is a personal loan in India?

A personal loan is an unsecured loan (no collateral) given to salaried or self-employed borrowers for a wide range of uses:

- medical emergencies

- travel/wedding

- education shortfall

- home renovation

- debt consolidation

- big purchases (appliances, gadgets)

- working capital for self-employed professionals (sometimes)

Why it’s popular

- quick approval/disbursal (sometimes same day)

- minimal paperwork compared to secured loans

- fixed EMI and fixed tenure

What it is not

A personal loan is not “free money.” It’s usually among the costlier mainstream loans because the lender takes unsecured risk.

2) Personal loan costs you must understand (beyond interest rate)

Most people compare only “interest rate,” but real cost = rate + fees + timing + terms.

A) Interest rate type

- Fixed rate (common): EMI remains same.

- Floating rate (rare in retail PL): EMI may change.

B) Processing fee

Usually 1%–3% of loan amount + GST (varies).

Some lenders offer “zero processing fee” campaigns—always check if they compensate via higher rate.

C) Insurance / add-ons

Some lenders bundle credit shield / life cover. Optional in many cases—confirm before accepting.

D) Foreclosure / part-prepayment charges

- Some banks waive charges after a certain number of EMIs.

- Many NBFCs have foreclosure fees.

- Always ask: “Can I part-prepay? Is there a minimum? Any charge?”

E) Penal interest / bounce charges

EMI bounce fees + penalties can snowball fast. Keep an EMI buffer.

3) Eligibility for personal loans (what lenders check in real life)

Eligibility differs across banks/NBFCs, but the underwriting logic is similar.

A) Age

Typically:

- Salaried: 21–60 years (some up to 65 depending on pension/retirement policy)

- Self-employed: 24–65 years (varies)

B) Minimum income

Depends on city tier and employer profile. Many lenders prefer:

- stable monthly income

- salary account with bank

- consistent inflow for self-employed

C) Employment stability

- Salaried: time in current job + total experience

- Self-employed: business vintage + income stability + ITR consistency

D) Credit score (CIBIL/Experian/CRIF)

- 750+ generally unlocks best pricing and limits

- 700–749: still possible but higher rate

- <700: approvals drop sharply or rates become expensive

E) FOIR / EMI burden

Lenders often use FOIR (Fixed Obligation to Income Ratio).

Example rule-of-thumb:

- If your net monthly income is ₹60,000, lenders may allow total EMIs around ₹30,000–₹36,000 depending on profile.

F) Relationship & internal score

If you already have:

- salary account

- credit card with good history

- existing loan with clean repayment

…your approval odds and pricing often improve.

4) Required documents (Salaried vs Self-Employed)

A) Salaried documents

- PAN card

- Aadhaar / address proof

- Salary slips (usually last 3 months)

- Bank statements (last 6 months, sometimes 12)

- Employment proof (ID card/offer letter—sometimes)

B) Self-employed documents

- PAN + address proof

- Business proof (GST, shop act, etc. depending)

- ITR (usually last 1–3 years)

- Bank statements (6–12 months)

- Financials (P&L / balance sheet) if asked

Best practice

Before applying, download clean PDFs of:

- bank statement (6 months)

- salary slips / ITR

- PAN/Aadhaar

This reduces “pending docs” delays.

5) Personal loan application process (step-by-step)

Step 1: Check eligibility (soft check if possible)

Prefer platforms/bank flows that do soft checks (not always visible). Avoid multiple hard enquiries in a short time.

Step 2: Choose loan amount + tenure strategically

A common mistake is selecting maximum tenure “to reduce EMI.”

Lower EMI is good, but longer tenure increases interest outgo.

Rule: choose the shortest tenure that keeps EMI comfortable.

Step 3: Submit KYC + income documents

- eKYC (Aadhaar OTP)

- salary slips/ITR

- bank statement upload

Step 4: Verification

- phone verification

- residence/office verification (sometimes digital)

- internal credit checks

Step 5: Offer generation + acceptance

You receive:

- approved amount

- ROI (rate of interest)

- EMI

- tenure

- fees

Read the Key Fact Statement carefully.

Step 6: Disbursal

Often within hours to 2–3 working days depending on lender and documentation.

6) Interest rates in India: what decides your final ROI?

Your final rate is mostly determined by:

- Credit score + repayment history

- Income stability + employer category

- Existing obligations (credit card utilization, other EMIs)

- Loan amount and tenure

- Relationship with bank

- Risk policy (bank vs NBFC vs fintech partner)

Two people applying for the same “advertised” personal loan can get wildly different final rates.

7) Lender-wise personal loan comparison (Banks + NBFCs)

Below is a practical list of common personal loan providers used in India, what they’re known for, and how to choose.

Quick lender selection logic

- Best rates (often): large banks for strong profiles

- Fastest approvals: digital flows / NBFCs / fintech partnerships

- Higher approval chance for mid scores: NBFCs (but costlier)

8) Interest rate comparison table (indicative)

Rates are indicative and may vary by profile, city, policy updates. Verify before applying.

Also note: interest rates are influenced by broader rate cycles; for example, SBI MCLR changes impact loans linked to MCLR.

| Lender Type | Examples | Typical ROI Range (Indicative) | Best For | Watch-outs |

|---|---|---|---|---|

| Large Banks | SBI, HDFC, ICICI, Axis, Kotak | ~10.5%–20% | High credit score, salaried | Stricter eligibility |

| New-age Banks | IDFC FIRST etc. | ~10.5%–22% | Digital process, faster | Rates vary widely |

| NBFCs | Bajaj Finserv, Tata Capital, etc. | ~11%–24% | Speed, flexible underwriting | Fees + foreclosure charges |

| Fintech partners | varies | ~12%–30% | convenience | avoid too many enquiries |

Example of rate movement news: Tata Capital announced a personal loan interest reduction to 11.50% p.a. (promotional/starting rate; eligibility-based).

9) Lender-wise breakdown (what you should know before applying)

A) SBI Personal Loan (bank)

Best for: salaried customers, existing SBI relationship, government/PSU salary accounts

Strengths

- trusted bank ecosystem

- potentially competitive pricing for strong profiles

Limitations - stricter underwriting and documentation

- slower for some segments (depends on branch/digital path)

Pro tip: If you have salary account + good CIBIL, ask for preferential offer.

B) HDFC Bank Personal Loan

Best for: strong salaried profiles, existing HDFC relationship

Strengths

- strong digital flow for existing customers

- quick disbursal for pre-approved offers

Limitations - pricing depends heavily on relationship + score

- fees must be checked carefully

C) ICICI Bank Personal Loan

Best for: digital-first salaried customers

Strengths

- quick workflow if eligible

- good service footprint

Limitations - rate/fees can vary widely

D) Axis Bank Personal Loan

Best for: salaried, metro city profiles

Strengths

- decent approval speed

Limitations - ensure clarity on foreclosure rules

E) Kotak Mahindra Bank

Best for: certain city segments and relationship customers

Strengths

- can be competitive for strong profiles

Limitations - availability and terms vary by branch/city

F) Bajaj Finserv Personal Loan (NBFC)

Best for: faster approvals, flexible underwriting

Strengths

- widely known for quick disbursal and digital servicing

- useful for borrowers who need speed

Limitations - check foreclosure/part-payment rules carefully

- processing fees may be higher

Bajaj Finserv’s official product page highlights personal loan availability and terms (verify final ROI/fees during offer).

G) Tata Capital Personal Loan (NBFC)

Best for: mid-to-strong profiles seeking NBFC flexibility

Strengths

- strong brand and expanding retail presence

Limitations - ROI depends on profile; promotional “starting” rates are not universal

Rate reduction announcement referenced above.

10) Personal loan “real life” example: choosing amount + tenure wisely

Scenario: Debt consolidation

- Credit card outstanding: ₹2,50,000 at ~36% annualized (typical revolving cost)

- Personal loan available: ₹2,50,000 at ~13.5% for 24 months

Why this can make sense

- lower effective cost vs credit card revolve

- fixed EMI discipline

- improves credit utilization if you stop revolving cards

But only if:

- you stop using the card for new spending

- you don’t run both PL EMI + new card debt

- you have stable cashflow buffer

11) How to get a lower interest rate (actionable checklist)

Improve CIBIL to 750+

- pay dues on time

- reduce credit utilization below 30%

- avoid multiple new credit lines in short time

Choose the right lender order

- start with your salary account bank / relationship bank

- then compare 1–2 alternatives

Avoid 8–10 applications → too many enquiries → approvals drop.

Increase documentation quality

- clean bank statement (no frequent bounces)

- stable income proof

- reduce cash-heavy irregular credits (for self-employed)

Lower FOIR

- close small consumer loans if possible

- reduce credit card balances

Negotiate fees

- ask for processing fee waiver or reduction

- ask for zero foreclosure after X EMIs (if available)

12) Common rejection reasons (and fixes)

Rejection reason → Fix

- Low credit score → pay overdue, reduce utilization, wait 2–3 months

- High EMI burden → reduce obligations, apply for lower amount

- Recent multiple enquiries → pause applications for 30–60 days

- Unstable job/business vintage → apply after more stability

- Mismatch in documents → ensure consistent address, name spelling, PAN details

13) Personal loan application tips (fast approval + safe borrowing)

- Keep tenure 24–48 months unless you need lower EMI

- Avoid taking PL for investing/speculation

- Always read: processing fee, insurance add-ons, foreclosure policy

- Maintain 3–6 months EMI buffer for safety

- Never share OTPs or card credentials with “agents”

14) FAQs: Personal Loan in India

Q1) What credit score is ideal for personal loan approval?

Generally 750+ is ideal for best rates. You can still get a loan below that, but ROI may be higher.

Q2) Can I get a personal loan without income proof?

Rare with banks. Some lenders use alternative data, but it can be expensive and risky.

Q3) Is it better to take a longer tenure to reduce EMI?

Not always. Longer tenure increases total interest. Pick the shortest tenure that keeps EMI comfortable.

Q4) How many personal loans can I have?

There’s no fixed number, but lenders look at total obligations and repayment capacity.

Q5) Does prepayment reduce interest?

Yes—because interest is calculated over time. But check prepayment/foreclosure charges.

Q6) How fast can I get disbursal?

If pre-approved and documents are clean, same day is possible. Otherwise 1–3 working days is common.

15) Conclusion: the smart way to apply for a personal loan in 2025

A personal loan is best treated as structured credit—not emotional credit. If you:

- borrow only what you need

- choose tenure wisely

- keep total EMIs within safe limits

- compare offers (without spamming applications)

- read fee + foreclosure terms carefully

…you can get a personal loan that actually improves your financial life instead of creating long-term pressure.

Follow Us on Social Media