How to Register an NBFC Company in India? A Step-by-Step Guidance.

Learn how to register an NBFC company in India with this complete step-by-step guide. Understand RBI guidelines, eligibility, documents, costs, and compliance.

📝 Introduction

Starting a Non-Banking Financial Company (NBFC) in India is one of the most rewarding ventures I’ve taken as a financial advisor. As the founder of a consultancy firm, I’ve walked through the entire registration process firsthand—navigating through the Ministry of Corporate Affairs (MCA), understanding RBI’s intricate requirements, collecting documents, and facing audits.

This blog will serve as your complete step-by-step guide to register an NBFC company in India, especially for those who are passionate about entering the financial services industry with legal clarity and confidence.

📖 Table of Contents

- Introduction

- MCA Rules and Regulations for Company Registration

- Guidelines for Registering NBFC Company in India

- Required Documents and Eligibility

- Licence Required from Other Govt Entities

- RBI Guidelines for NBFC Company

- Cost for NBFC Company Registration

- Roles, Responsibilities, and Limitations for Public Dealing

- Financial Services Provided by an NBFC Company

- Difference Between Bank and NBFC

- Govt Role in Monitoring NBFCs

- Importance of TaxGuru for Financial Awareness

- Conclusion

- Relevant Hashtags.

🏛 MCA Rules and Regulations for Company Registration

Before applying for NBFC registration, you must incorporate a company under the Companies Act, 2013, through the Ministry of Corporate Affairs (MCA).

Key MCA Guidelines:

- Choose a unique company name using the RUN (Reserve Unique Name) service.

- Get Digital Signature Certificate (DSC) and Director Identification Number (DIN) for all directors.

- Register your company as Private Ltd. or Public Ltd. under SPICe+ form.

- Have a minimum of two directors and shareholders.

- Maintain a registered office in India.

- Capital Requirement: Minimum ₹2 crore net owned fund (NOF) is mandatory for NBFCs.

Ministry of Corporate Affairs

Once you have your Certificate of Incorporation (COI), you can proceed to NBFC registration with RBI.

📌 Guidelines for Registering NBFC Company in India

The Reserve Bank of India (RBI) has a clear mandate on how a financial entity qualifies as an NBFC:

Step-by-Step Process:

- Company Incorporation (as mentioned above).

- Open a bank account and deposit the NOF of ₹2 crore.

- Ensure that the source of funds is clean and explained (Auditor certification is mandatory).

- Apply online through the COSMOS portal of RBI.

- Submit physical copies to RBI’s regional office.

- Wait for RBI’s inspection and clarifications (can take 90–180 days).

- Upon approval, you will receive a Certificate of Registration (CoR).

📄 Required Documents and Eligibility

Here’s a list of documents and eligibility criteria based on my personal checklist:

📌 Eligibility Criteria:

- Indian-registered company under Companies Act.

- At least one director with finance experience.

- Clean credit history (for directors and company).

- Minimum ₹2 crore capital (excluding borrowed capital).

📋 Documents Required:

- Certificate of Incorporation (COI)

- PAN of Company and Directors

- MOA & AOA (with NBFC-related business clause)

- Net Worth Certificate from CA

- Board resolution for starting NBFC

- Auditor’s report on NOF

- KYC documents of directors

- Income tax returns

- Structure of organization

- Detailed business plan.

🏢 Licences Required from Other Govt Entities

In some cases, apart from the RBI license, you may require:

- FIU-IND Registration (For anti-money laundering compliance)

- GST Registration (Mandatory for financial service providers)

- PAN/TAN Registration

- Professional Tax and Shops & Establishment License (State-wise)

- Registration under Credit Information Companies (CIC) like CIBIL if you report or access credit data.

🏦 RBI Guidelines for NBFC Company

RBI closely monitors NBFCs to maintain financial system integrity.

RBI’s Major Guidelines Include:

- Minimum NOF of ₹2 crore

- Compliance with KYC/AML norms

- Quarterly and Annual Return filings

- Maintain liquidity coverage ratio (LCR)

- Follow Fair Practices Code

- Cannot accept public deposits without special permission

- Board must consist of at least one member with financial experience.

💰 Cost for NBFC Company Registration

Here’s an estimated breakdown based on my personal journey:

| Item | Estimated Cost (INR) |

|---|---|

| Company Incorporation Fees (MCA) | ₹10,000–15,000 |

| Professional Fee (CA/CS/Legal) | ₹1,00,000–2,00,000 |

| Capital Infusion (NOF) | ₹2,00,00,000 |

| RBI Application & Documentation | ₹50,000–1,00,000 |

| Other Licenses and Compliance | ₹30,000–50,000 |

💡 Total Cost: ₹2.2–2.5 crore (including capital)

👥 Roles, Responsibilities & Limitations for Public Dealing

Roles:

- Provide loans and advances

- Credit facilitation

- Asset financing

- Investment advisory

- Micro-lending services

Responsibilities:

- Ethical and transparent lending

- Protect customer data

- Follow grievance redressal mechanisms

- Regular filings with RBI

Limitations:

- Cannot accept demand deposits

- Not part of payment & settlement systems

- Cannot issue cheques drawn on itself

- No credit creation like banks

📈 Financial Services Provided by an NBFC Company

An NBFC is a one-stop-shop for financial needs. Here’s what I offer under my affiliate NBFC structure:

- Personal Loans

- Business Loans

- Gold Loans

- Vehicle & Auto Loans

- Loan Against Property

- Credit Cards (via tie-ups)

- Insurance Services

- Investment in Bonds, Mutual Funds

- Microfinance & EMI Facilities

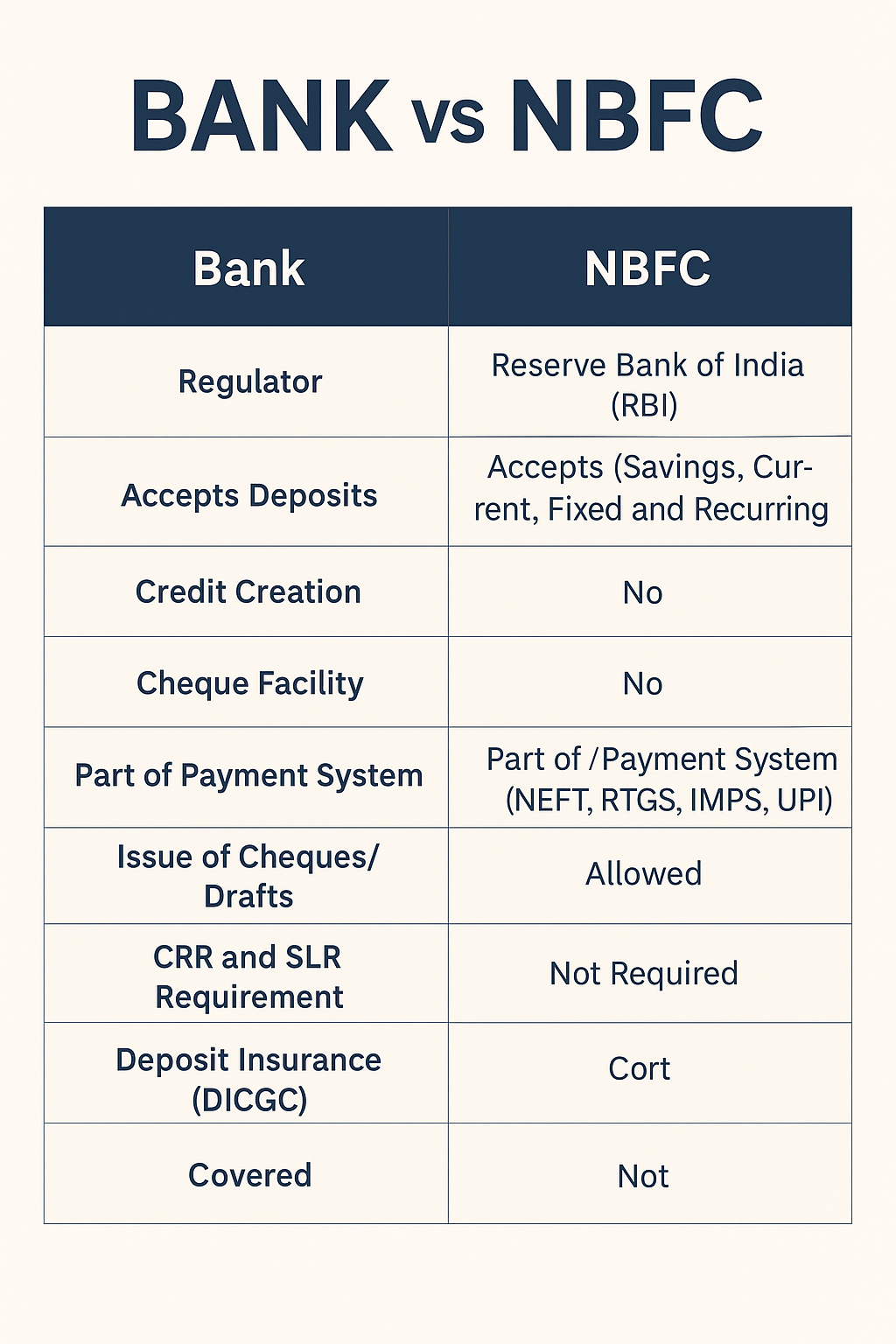

🏦 Difference Between Bank and NBFC

| Feature | Bank | NBFC |

|---|---|---|

| Regulator | RBI | RBI |

| Accept Deposits | Yes (Savings & Current) | No (Only time deposits if approved) |

| Issue Cheque Book | Yes | No |

| Credit Creation | Yes | No |

| CRR/SLR Maintenance | Mandatory | Not Required |

| Payment System Access | Full | Limited |

🕵️ Govt Role in Monitoring NBFCs

The Indian Government ensures NBFCs are well-regulated and transparent through:

- RBI Inspections & Audits

- SEBI (for investment-related NBFCs)

- Ministry of Finance – Policy framework

- FIU-IND – Tracks suspicious financial transactions

- National Company Law Tribunal (NCLT) – Handles NBFC insolvency

📚 Importance of TaxGuru for Sharing Financial Awareness

Throughout my journey, TaxGuru has been a savior. Whether it’s understanding RBI circulars or tax implications of NBFC activities, their simplified articles helped me and thousands of professionals.

TaxGuru helps:

- Stay updated with GST, Income Tax, RBI compliance

- Educate financial startups

- Provide legal drafts & templates

- Clarify doubts via expert opinions

I highly recommend every aspiring NBFC owner to follow www.taxguru.in.

✅ Conclusion

Registering an NBFC in India isn’t just about paperwork. It’s a commitment to ethical financial service. With the right guidance, awareness, and compliance, you can build a robust financial institution that empowers people and contributes to the economy.

This guide is based on my hands-on experience and professional practice. Whether you’re planning to start your own NBFC or just exploring the opportunity, this blog should set you in the right direction.

Want to learn more or need assistance with NBFC registration? Connect with me and let’s grow together.

📌 Relevant Hashtags

#NBFCRegistration #HowToRegisterNBFC #NBFCIndia #FinanceInIndia #RBICompliantNBFC #FinancialAwareness #NBFCGuide2025 #StartNBFC #TaxGuruIndia #DigitalFinance #FinancialServicesIndia #MyAdvisers #BiswajitBarman #RBIRegistration #FinanceConsultingIndia

Woah! I’m really enjoying the template/theme of this blog. It’s simple, yet effective. A lot of times it’s very difficult to get that “perfect balance” between superb usability and visual appearance. I must say that you’ve done a awesome job with this. Additionally, the blog loads extremely quick for me on Firefox. Superb Blog!