Getting a loan without a CIBIL score can be challenging in India due to lenders’ dependence on credit histories for risk assessment. Many traditional financial institutions hesitate to approve loans without this key score, leaving applicants with limited options. This is where My Advisers, the Best Financial Advisor in India, steps in with customized alternatives tailored to your unique financial profile.

At My Advisers, you get more than just standard solutions. Our experts provide personalized advice designed to help you explore options like secured loans, co-signers, or lenders who rely on alternative data beyond CIBIL. Working with a trusted Financial Consultant Near Me can open doors to financial support even without a credit score. For tailored guidance, don’t hesitate to Contact Us for Free Financial Consultation and start turning your financial plans into reality.

For further insights on financial planning and related solutions, see our detailed sections on financial planning services and business growth strategies.

Understanding the Role of CIBIL Score in Loan Approval

Before exploring alternatives to getting a loan without a CIBIL score, it’s important to understand why this score plays such a significant role in the loan approval process. The CIBIL score, a crucial credit score used widely across India, acts as a financial report card that tells lenders about your credit health and repayment behavior. Think of it as a snapshot of your financial discipline—showcasing how well you manage your past borrowing and repayments.

Lenders depend on this score to assess risk. A high CIBIL score suggests reliability and timely repayment, making banks more inclined to approve loans quickly and with favorable terms. On the other hand, a low or absent score raises red flags, leading to loan rejections or higher interest rates. This makes understanding this system essential for anyone seeking credit.

What Exactly Is a CIBIL Score?

The CIBIL score is a three-digit number usually ranging from 300 to 900. It summarizes all your credit activities reported to the Credit Information Bureau (India) Limited (CIBIL). This includes credit cards, personal loans, home loans, and any other form of credit there is. Lenders examine this score to judge how likely you are to repay future debts based on your history.

- Scores 750 and above are generally considered good and attract more favorable loan offers.

- Scores between 650 and 750 indicate moderate credit health but might attract higher interest rates.

- Scores below 650 often signal a higher risk to lenders.

You can think of it like a report card in school: the higher your grades (score), the more trust your lender places in you.

How Does the CIBIL Score Affect Loan Approval?

Your loan application’s fate largely hinges on your CIBIL score because it directly influences:

- Loan eligibility: Most banks require a minimum score (usually around 750).

- Interest rates: Better scores qualify you for lower rates, saving you money over the loan tenure.

- Loan amount: A good score can increase the amount a lender is willing to offer.

- Loan processing time: High scores generally speed up approval.

If your score reflects healthy financial habits, the lender views you as a less risky borrower. If your score is low or non-existent, it’s like asking for a loan without showing any proof of repayment capability. This is one reason why people with no CIBIL score face difficulties getting loans through traditional channels.

Why Some Applicants Don’t Have a CIBIL Score

Not everyone has a CIBIL score. New job entrants, self-employed individuals with cash transactions, or first-time loan applicants might lack formal credit history. This doesn’t mean they’re risky borrowers, but the traditional system lacks enough data to assess them.

Fortunately, companies like My Advisers, regarded as the Best Financial Advisor in India, specialize in alternative solutions. They offer expert advice and connect you with lenders and financial products that do not rely solely on your CIBIL score. Looking for a Financial Consultant Near Me can help you explore these paths. Don’t hesitate to Contact Us for Free Financial Consultation to get expert guidance tailored to your unique situation.

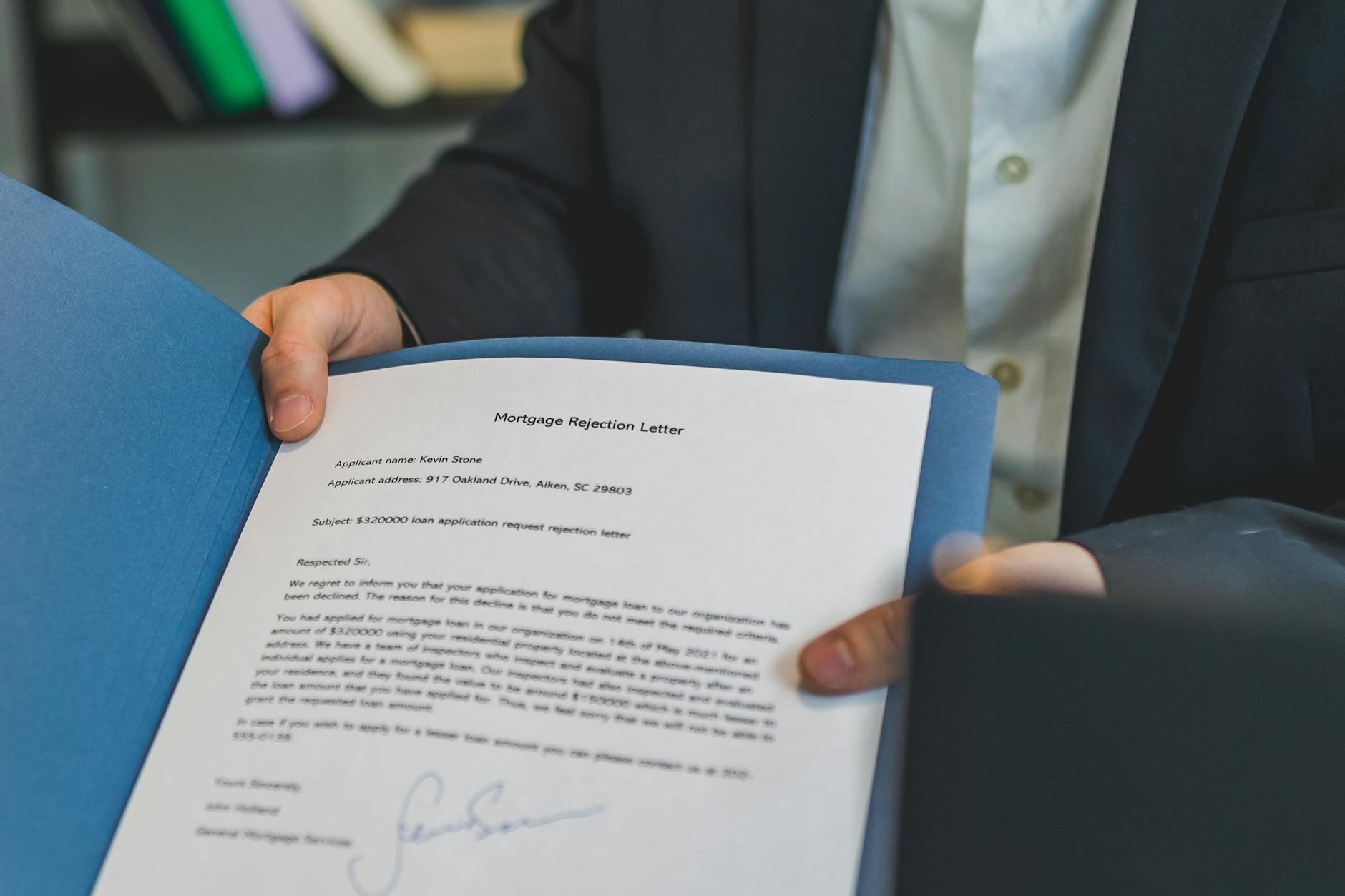

Photo by RDNE Stock project

For more on how credit scores impact financial products, see how your financial planning can adjust around your credit profile.

For additional perspective on the importance of your credit score in loan applications, resources such as Understanding CIBIL Score: What It Is and Why It Matters provide clear explanations about how this number shapes loan outcomes and financial credibility.

Alternative Ways to Secure a Loan Without a CIBIL Score

Not having a CIBIL score might feel like hitting a barrier when applying for a loan, but it doesn’t close all doors. In fact, various options exist that borrowers can explore to secure loans using different approaches. These alternatives consider factors beyond the traditional credit score, focusing more on your current financial standing, relationships, and assets. With the right strategy and support, you can overcome the lack of a CIBIL score and still access funds when needed.

Approach NBFCs and Online Lenders Using Alternative Credit Assessments

Non-Banking Financial Companies (NBFCs) and fintech lenders don’t always rely solely on CIBIL scores. Many use alternative credit assessment methods to evaluate your loan eligibility. They look at a range of other factors such as:

- Income proof: Regular salary slips or bank statements showcasing consistent cash flow.

- Employment history: Stability in your current job or profession signals reliability.

- Repayment behavior: Some platforms assess your payment habits on utilities or mobile bills.

Lenders like Lendingkart are pioneers in this space. Their systems analyze your business revenue records, cash flow, and regular inflows rather than traditional credit history. My Advisers has strong partnerships with such institutions, enabling you to tap into these options through expert guidance. This helps especially self-employed professionals, freelancers, or first-time loan seekers who may not yet have a credit score but show trustworthy financial behavior.

Exploring these avenues can give you access to quick and flexible loan options that suit your situation better than conventional banks.

Offer Collateral for Secured Loans

One of the most straightforward ways to increase your chances of loan approval without a CIBIL score is by offering collateral. Collateral acts as a safety net for lenders by significantly lowering their risk. Common collateral items include:

- Gold jewelry

- Fixed deposits (FDs)

- Residential or commercial property

By pledging something valuable, the lender feels more secure loaning you money since they can recover the asset if repayment becomes difficult. You benefit from:

- Higher loan approval chances

- Potentially lower interest rates

- Larger loan amounts, since the loan is backed by tangible assets

Secured loans through collateral are a highly practical option. My Advisers can help you navigate this process, ensuring that your collateral matches lender criteria and fits your borrowing needs.

For more about the types and benefits of secured loans, see the Best personal loan agents in Delhi who offer expert advice tailored for your area.

Photo by Edmond Dantès

Apply with a Co-Applicant or Guarantor

Another way to overcome the hurdle of no credit history is to apply with a co-applicant or a guarantor. This method involves including another individual with a positive credit record to support your application. Here’s why this works:

- The co-applicant’s or guarantor’s creditworthiness can balance your lack of score.

- Lenders feel more assured about repayment because someone responsible is backing the loan.

- It often results in quicker approvals and better loan terms.

For families or businesses, this is a useful option. For example, a salaried family member or business partner with a good credit track record can bolster your chances. My Advisers can guide you on the right way to choose and apply with a co-applicant or guarantor to maximize your approval odds.

Provide Strong Proof of Income and Employment Stability

Showing lenders that your income is stable and verifiable is essential when you don’t have a CIBIL score. Providing solid documentation reinforces your ability to repay. Important proofs include:

- Salary slips from the last 3-6 months

- Bank statements showing salary credits or business income

- Employer certifications or work contracts confirming your employment

- Tax returns for self-employed individuals

These documents build lender confidence because they show a steady flow of income and responsible financial behavior. Being transparent about your finances helps lenders look beyond the missing credit score and focus on your actual repayment capacity.

If you’re self-employed or just starting to build a credit record, learn more about tailored financing options via My Advisers’ Best instant personal loans for self-employed to strengthen your loan application.

If you’re searching for a Financial Consultant Near Me to explore these alternative loan paths or want personal support, do not hesitate to Contact Us for Free Financial Consultation. My Advisers, recognized as the Best Financial Advisor in India, is here to guide you step-by-step and connect you with the right lenders, even without a CIBIL score.

How My Advisers Can Help You Obtain a Loan Without a CIBIL Score

Getting a loan without a CIBIL score can feel like a puzzle with missing pieces. Fortunately, with My Advisers by your side, you don’t have to rely solely on traditional credit metrics. They provide smart, practical pathways designed around your unique story. Instead of treating your profile like a checklist, they customize solutions, offer expert advice, and connect you to lenders who consider more than just numbers. Here’s how they make this process smoother and more promising.

Customized Loan Solutions Tailored to Your Profile

At My Advisers, the focus is on you, not just your credit report. They start by carefully examining your financial habits, income sources, employment details, and overall financial health. This thorough evaluation helps identify the loan options best suited for your current situation, whether you’re self-employed, a new earner, or have an unconventional income source.

Some key benefits of this personalized approach include:

- Matching your financial profile with loan products that do not depend on CIBIL scores

- Finding options such as secured loans, alternative lending platforms, or specialized personal finance products

- Avoiding one-size-fits-all solutions that often lead to rejection or unfavorable terms

This tailored service helps bypass traditional rigid credit requirements, putting your actual financial behavior and repayment capacity front and center.

Expert Guidance from the Best Financial Advisor in India

Navigating loan applications without a CIBIL score requires more than just knowledge; it demands experience and insight. With My Advisers, you gain direct access to India’s top financial advisors who understand the lending landscape inside-out.

Professional guidance helps you:

- Craft loan applications that highlight your strengths, compensating for the missing CIBIL score

- Manage your overall finances to improve loan eligibility and future creditworthiness

- Understand the fine print, interest rates, and terms to avoid traps and expensive mistakes

Think of it as having a seasoned guide on a tricky financial path, ensuring you take confident steps. This hands-on support significantly boosts your chances of loan approval and helps maintain healthy financial habits for the long run.

Access to a Wide Network of Lending Institutions

What sets My Advisers apart is their established relationships with countless lenders across India—from mainstream banks to NBFCs and fintech platforms. This extensive network means they can:

- Connect you with lenders open to alternative credit assessments such as income proof, business revenue, or payment behavior

- Present multiple loan options, allowing you to pick the terms and conditions that fit you best

- Bypass loan rejection cycles by targeting institutions willing to consider your full financial picture

Having a broad pool of lenders at your disposal is like having multiple doors open instead of just one. This flexibility improves your odds of securing the right loan faster and with more favorable terms.

Photo by RDNE Stock project

If you want to explore tailored financial pathways or need expert advice, don’t hesitate to Contact Us for Free Financial Consultation. Working with a trusted Financial Consultant Near Me at My Advisers ensures you get personalized support from the Best Financial Advisor in India dedicated to turning your loan goals into reality.

For insights on financial planning that complements your loan strategy, visit our in-depth financial planning services page.

Pro Tips for Securing Loans Without CIBIL Score

Getting a loan without a CIBIL score demands a strategic approach. Since lenders can’t evaluate your credit history traditionally, you need to rely on other aspects that showcase your financial reliability. The key lies in demonstrating steady income, responsible borrowing, and gradual credit-building. Here are some pro tips to help you secure a loan effectively without a CIBIL score.

Maintain Consistent Income and Documentation

A lender’s top priority is understanding your ability to repay. Without a CIBIL score, the focus shifts heavily to your current financial status. Keeping your income consistent and your documentation organized is critical.

- Keep salary slips, bank statements, and income proofs updated for the last 3 to 6 months.

- Ensure that all financial documents such as tax returns and employment certificates are accurate and readily available.

- Consistent income reassures lenders that you have a reliable source to pay back the loan. This also applies to self-employed individuals—regular business turnover and bank deposits go a long way.

- By maintaining these documents, you make it easier for the lender to assess your financial position beyond credit scores.

Regular, documented income is like your financial fingerprint—unique proof of your repayment capacity that compensates for the absence of a CIBIL score. For help creating a solid financial profile, consider checking out the LIC Pension Plans Benefits to stabilize your financial future.

Consider Smaller Loan Amounts Initially

Think of your loan journey as building a bridge across a river—the first plank has to be sturdy. Starting with smaller loan amounts can be a practical way to establish trust with lenders who might be wary when your credit history is hidden.

- Modest loan requests reduce the perceived risk from the lender’s perspective.

- Successfully repaying smaller loans creates a positive track record, helping you gradually build a financial footprint.

- These early good impressions open doors to larger loans once you have demonstrated responsible repayment behavior.

This incremental approach is about credibility creation. It’s perfectly fine to begin small and work your way up—much like how a growing business starts with manageable steps. For guidance on business financing possibilities, you might explore this comprehensive ROK Financial Business Loan Application Guide.

Improve Your Financial Profile Continuously

Even without a CIBIL score, lenders look for signs of financial discipline. The best way to gain their confidence is by continuously improving your financial habits.

- Pay all your bills—utilities, rent, phone—on time.

- Work on reducing any existing debts; lower debt burdens improve your repayment capacity.

- Build savings and keep emergency funds; this stability makes you a safer bet.

- Avoid skipping repayments or defaulting on any borrowings. Your current payment behavior is more significant than past credit history in such cases.

- Over time, these actions help shape a financial profile that lenders will recognize and trust.

Improving your financial profile is akin to planting seeds that will grow into a healthy credit tree. It takes time and care, but the results are worth it. For tailored advice on managing and improving your finances, contacting a Financial Consultant Near Me at My Advisers can provide personalized strategies.

Photo by RDNE Stock project

If you’re ready to take the next step in securing a loan without a CIBIL score, My Advisers, known as the Best Financial Advisor in India, offers expert help tailored to your unique situation. Don’t hesitate to Contact Us for Free Financial Consultation to explore customized loan options designed just for you.

Frequently Asked Questions About Loans Without CIBIL Score

Navigating the loan landscape without a CIBIL score raises many questions. This section covers common queries to help you understand how you can still access loans despite missing that key credit number. Clear answers ensure you feel confident when exploring alternative lending options with My Advisers, the Best Financial Advisor in India.

Can I Get a Loan Without a CIBIL Score?

Yes, it is possible to get a loan without a CIBIL score. Many lenders, especially Non-Banking Financial Companies (NBFCs) and fintech firms, evaluate factors beyond credit scores. Proof of stable income, employment history, and even alternative data such as utility payments or bank transaction patterns can play a crucial role. My Advisers can connect you with these lenders who focus on your complete financial profile rather than just your credit score.

What Documents Do I Need to Apply for Such a Loan?

Without a credit score, lenders want solid proof of your repayment capacity. Documents typically required include:

- Recent salary slips or business bank statements (last 3-6 months)

- Income tax returns for self-employed individuals

- Employment or business proofs such as contracts or registration certificates

- Bank account statements showing regular inflows and outflows

Preparing these documents in advance can streamline your application process. For more detailed guidance, check our Instant Personal Loan Application Guide.

Will Interest Rates Be Higher if I Don’t Have a CIBIL Score?

Generally, interest rates might be higher for loans without a credit score because lenders view these applications as riskier. However, offering collateral or having a co-applicant with a good credit history can help reduce interest rates. Some NBFCs and fintech lenders also provide competitive rates by assessing your overall financial health carefully.

Are There Specific Lenders More Open to Loans Without a CIBIL Score?

Yes, certain lenders specialize in serving customers without traditional credit data. NBFCs, fintech companies, and some private banks assess loan eligibility using alternative credit evaluation methods such as cash flow analysis and repayment behavior on non-credit accounts. Apps offering instant personal loans without CIBIL score are also gaining popularity, providing fast and convenient options for borrowers. You can explore some popular options and tips at LendingPlate’s guide on getting instant personal loans without a CIBIL score.

How Can a Co-Applicant or Guarantor Help in Getting a Loan?

Including a co-applicant or guarantor with a good credit record strengthens your loan application by sharing the responsibility. This significantly increases the lender’s confidence in your repayment ability, often resulting in faster approvals and better loan terms. If you don’t have a credit score, this strategy is one of the most effective ways to secure a loan confidently.

Does My Employment Type Affect My Chances Without a CIBIL Score?

Employment stability matters a lot. Salaried individuals with steady income generally have an easier time proving repayment capacity. However, self-employed and freelancers are not excluded if they can provide sufficient income proof like business bank statements and tax filings. My Advisers offers specific strategies tailored for all types of employment to improve your loan eligibility.

Can I Build a CIBIL Score While Still Accessing Loans?

Building a CIBIL score starts with responsible borrowing and timely repayments. Starting with smaller loans, credit cards, or secured loans can help you establish a positive credit history. Over time, your score improves, opening doors to larger loans with better interest rates. Meanwhile, with expert financial advice from My Advisers, you can access alternative loan options without your current credit score holding you back.

Photo by Markus Winkler

For personalized assistance on loans without CIBIL scores and to explore your best options, Contact Us for Free Financial Consultation. Our Financial Consultants Near Me at My Advisers provide expert guidance tailored to your needs.

If you want to deepen your understanding of loan options and credit tips, visiting a comprehensive guide to instant personal loans in India at My Advisers offers valuable insights.

Additionally, to know about apps offering quick loans without CIBIL score, Mint provides an updated look at instant loans without CIBIL score, which can complement your research while planning your loan application.

#NoCIBILScoreLoan #LoansWithoutCreditScore #MyAdvisersFinance #FinancialConsultantNearMe #LoanFAQs

Conclusion

Securing a loan without a CIBIL score is achievable by considering alternative options that focus on your current financial abilities rather than past credit history. Offering collateral, applying with a co-applicant or guarantor, and presenting strong proof of income can open doors where traditional credit checks might close them.

My Advisers, recognized as the Best Financial Advisor in India, specializes in providing these personalized solutions, tailoring strategies to fit your unique financial profile and connecting you with lenders who value your overall financial health. For expert guidance and support, reach out to a trusted Financial Consultant Near Me at My Advisers.

Take the first step toward financial empowerment today—Contact Us for Free Financial Consultation and explore loan options that work for you, even without a CIBIL score.

#NoCIBILScoreLoan #LoansWithoutCreditScore #MyAdvisersFinance #FinancialConsultantNearMe #LoanHelpIndia

Follow Us on Social Media