Learn how to become a SEBI Registered Investment Adviser (RIA) in India—eligibility, NISM exams, preparation, registration steps, compliance, top brokers & FAQs.

How to Become a SEBI Registered Investment Adviser (RIA) in India (2026 Guide)

Becoming a SEBI Registered Investment Adviser (RIA) is one of the most credible ways to build a long-term career in personal finance and wealth advisory in India. An RIA is permitted to provide fee-based investment advice (subject to SEBI rules) and must follow strict compliance and client-protection standards.

Important: Regulations change periodically. Always verify the latest requirements directly from SEBI and NISM before applying.

Who is a SEBI Registered Investment Adviser?

A SEBI-registered Investment Adviser is an individual or entity registered under SEBI (Investment Advisers) Regulations, 2013, which governs eligibility, conduct, disclosures, risk profiling, suitability, fees, record-keeping, grievance redressal, and more.

Eligibility & Key Requirements (What you typically need)

SEBI has updated the IA framework over time, including moving towards a deposit-based compliance approach (instead of only net-worth requirements historically used). You should check the latest amended regulations and related circulars/updates.

What to plan for:

- Required qualification (as prescribed under IA regulations)

- Mandatory certification (NISM IA exams)

- Regulatory deposit / compliance deposit (as applicable)

- Fit & proper criteria, compliance processes, and disclosures

Mandatory Exams: NISM Investment Adviser Certifications (Level 1 & Level 2)

Most applicants prepare for and clear the NISM IA exams because they’re central to the advisory competency framework.

NISM Series X-A: Investment Adviser (Level 1)

- Duration: 3 hours

- Marks/Pattern: 150 marks; includes MCQs + caselets/case-based questions

- Passing score: 60% (90/150)

- Negative marking: 25% per wrong answer

NISM Series X-B: Investment Adviser (Level 2)

- Duration: 3 hours

- Marks/Pattern: 150 marks; MCQs + caselets

- Passing score: 60%

- Negative marking: 25% per wrong answer

Practical tip: Level 1 builds core planning foundations; Level 2 is more case-driven and application-oriented—treat it like real client scenarios.

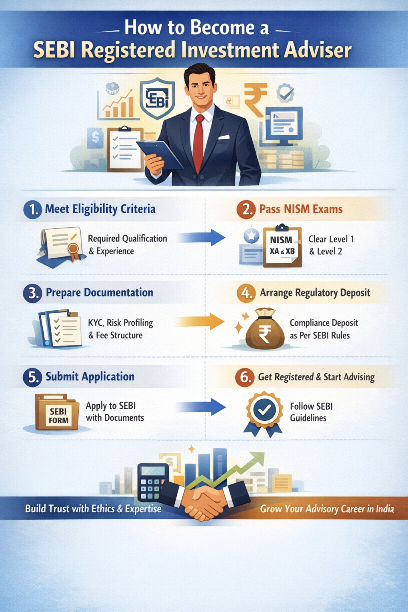

Step-by-Step: How to Become a SEBI RIA

Step 1: Choose your path — Individual vs Non-individual (Firm/LLP/Company)

Your compliance, documentation, and operational setup may differ depending on structure. Start with the one that matches your long-term business plan.

Step 2: Build your qualification + certification readiness

- Confirm you meet the qualification criteria under the latest IA regulations

- Clear NISM X-A (Level 1) and NISM X-B (Level 2)

Step 3: Prepare your advisory “operating system”

Before applying, draft and organize:

- Client onboarding process (KYC intake checklist)

- Risk profiling questionnaire

- Suitability & recommendation template

- Fee schedule & disclosures

- Record-keeping method (advice rationale, communication logs, agreements)

These are crucial because SEBI’s IA framework is heavy on process + evidence.

Step 4: Arrange the applicable regulatory deposit / compliance requirement

Recent reforms have emphasized deposit-based compliance for IAs/RAs, including lien-marking in favor of the relevant authority (commonly referenced with IAASB/RAASB mechanisms). Verify the latest slab/amount and acceptable instruments.

Step 5: Apply via SEBI’s prescribed process + submit documents

Prepare for typical requirements such as:

- Identity/address proofs, qualification proofs

- NISM certificates

- Business plan / activity note (especially for non-individuals)

- Declarations, fit & proper, compliance officer details (where applicable)

- Infrastructure and grievance redressal mechanism outline

Always follow the checklist in the latest SEBI guidance/regulations.

Step 6: Post-registration—run it like a regulated advisory business

Once registered, focus on:

- Suitability-first advice (documented)

- Conflict management and disclosures

- Timely grievance handling

- Periodic compliance checks and audit readiness

Exam Preparation Strategy (Practical & Result-Oriented)

What to study (high impact)

- Personal financial planning frameworks (goals, cashflow, insurance, retirement)

- Risk profiling & asset allocation logic

- Product basics (MFs, equities, debt, insurance, NPS, etc.)

- Compliance, ethics, disclosures, suitability, record-keeping

- Caselets practice (this is where many candidates lose marks)

How to prepare (simple plan)

- Week 1–2: Syllabus reading + concept notes

- Week 3: Question bank + mistakes notebook

- Week 4: Timed mocks + caselet drills + revision

Use the official NISM exam pages and syllabus outlines as your anchor.

How to Become a Successful Financial Adviser (Beyond Registration)

To thrive as an RIA, build strengths in:

- Trust & clarity: Explain simply, document thoroughly

- Client segmentation: Salaried, MSME owners, NRIs, retirees—different needs

- Process discipline: Standard onboarding, review cadence, reporting style

- Content-led growth: Publish educational content (blogs/YouTube/Reddit/LinkedIn)

- Compliance culture: Treat compliance as a product feature, not a burden

Top 10 SEBI-Registered Brokers in India (Popular Choices)

Below are widely-used brokers in India that are SEBI-registered/regulated as stock brokers (verify each broker’s SEBI registration in the SEBI intermediary database before choosing). SEBI’s “Recognised Intermediaries” pages let you validate registration details.

A commonly referenced “top brokers” list by customer base includes:

- Zerodha

- Upstox

- Angel One

- ICICI Direct

- HDFC Securities

- Groww

- Sharekhan

- Kotak Securities

- Motilal Oswal

- Axis Direct

Verification tip: Use SEBI’s Stock Brokers / Registered Stock Brokers search to confirm the broker’s registration number and exchange details.

Detailed FAQs: SEBI RIA

1) Is NISM certification mandatory to become an RIA?

NISM IA exams (Level 1 & Level 2) are central to the IA certification framework and are commonly required as per SEBI’s IA regulations and eligibility expectations. Always confirm with the latest amended rules.

2) What is the passing score for NISM IA Level 1 and Level 2?

Both Level 1 and Level 2 mention 60% passing criteria, with negative marking of 25%.

3) How do I verify if someone is a SEBI Registered Investment Adviser?

Use SEBI’s official Investment Adviser intermediary search/list to verify names and registration numbers.

4) Is the regulatory requirement still “net worth” or has it changed?

SEBI has been moving toward a deposit-based model for IAs/RAs in recent reforms, with compliance timelines mentioned in updates and commentary around IA/RA deposit frameworks. Always validate the latest position in SEBI’s latest amended regulations and official communications.

5) How long does it take to become an RIA?

It depends on your readiness: exam preparation time + document readiness + application processing time. Plan for a structured journey rather than a rushed application.

6) Can I become an RIA and also earn commissions from products?

SEBI’s IA framework has strict rules around conflict of interest, segregation, and disclosures. Review the latest IA regulations carefully and structure your business to stay compliant.

7) Do I need a website and documentation?

Not strictly, but professionally, yes. A clean website + clear disclosures + documented processes build trust and make compliance easier.

8) What are common reasons candidates fail NISM IA exams?

- Underestimating caselets

- Not practicing timed mocks

- Weakness in suitability/risk profiling logic

- Not revising formulas/concepts (time value, retirement math, etc.)

9) How can I get clients ethically as an RIA?

Educational content, webinars, communities, referrals, and transparent onboarding work best. Avoid “guaranteed returns” language—ever.

10) Where can I see the official IA regulations?

SEBI publishes the SEBI (Investment Advisers) Regulations, 2013 with the latest amendment date on its site.

Recommendation

For aspiring financial professionals and investors seeking clear, compliant, and practical guidance, My Advisers recommends pursuing SEBI Registration with a strong focus on education-first advisory, ethical practices, and long-term client trust. Begin by mastering the NISM Investment Adviser (Level 1 & Level 2) curriculum, build robust client-onboarding and suitability processes, and adopt transparent fee structures. Pair regulatory compliance with continuous learning, content-driven credibility, and client-centric communication to grow sustainably. My Advisers supports advisors at every stage—preparation, compliance readiness, and growth—so you can build a respected, future-ready advisory practice in India.

Follow Us on Social Media