HDFC Life Insurance

Why Buy HDFC Life Insurance Policy?

Introduction to HDFC Life Insurance

HDFC Life Insurance is a trusted name in the world of financial protection and wealth creation. As one of India’s leading life insurance providers, HDFC Life is committed to securing your future by offering a wide range of innovative insurance and investment solutions tailored to meet your diverse needs. Whether you’re planning for your family’s financial security, your retirement, or long-term wealth creation, HDFC Life has a solution for every stage of life.

With a legacy of trust, innovation, and excellence, HDFC Life combines robust financial products with cutting-edge technology to ensure seamless customer experiences. From comprehensive life insurance plans and retirement solutions to health and savings plans, HDFC Life caters to individuals, families, and businesses alike, helping them achieve their financial goals with confidence.

What sets HDFC Life apart is its customer-first approach, offering flexibility, transparency, and accessibility through its wide network and digital platforms. With a focus on empowering individuals to take control of their financial futures, HDFC Life not only protects your present but also paves the way for a brighter tomorrow.

Choose HDFC Life Insurance to safeguard your loved ones, grow your wealth, and enjoy peace of mind knowing that your financial future is in trusted hands.

Top 10 Reasons to Buy a Life Insurance Policy from HDFC Life Insurance

- Comprehensive Coverage Options

HDFC Life offers a variety of life insurance plans, including term insurance, ULIPs, endowment plans, and savings policies, catering to diverse needs like financial protection, wealth creation, or retirement planning. - High Claim Settlement Ratio

With a high claim settlement ratio, HDFC Life ensures a hassle-free process for your loved ones, guaranteeing financial security when they need it the most. - Tax Benefits

Premiums paid under HDFC Life insurance policies are eligible for tax benefits under Section 80C, and the maturity proceeds are tax-free under Section 10(10D) of the Income Tax Act. - Customizable Policies

The flexibility to customize your policy with riders like accidental death benefit, critical illness cover, and waiver of premium ensures enhanced protection tailored to your needs. - Digital Accessibility

HDFC Life provides user-friendly digital services, allowing you to manage your policy, pay premiums, and track investments conveniently through its website or mobile app. - Financial Strength and Credibility

Being part of the trusted HDFC Group, HDFC Life is known for its financial stability, credibility, and customer-centric approach. - Affordable Premiums

Competitive pricing ensures that you get comprehensive coverage without straining your budget, making HDFC Life a cost-effective choice for life insurance. - Long-Term Benefits

HDFC Life insurance policies provide long-term benefits, including guaranteed returns, wealth accumulation, and financial security for your family’s future. - Expert Guidance and Support

HDFC Life’s experienced advisors and robust customer support assist you in selecting the right plan and addressing any concerns throughout the policy term. - Innovative Products

HDFC Life frequently introduces innovative products, like their digital savings plans and retirement solutions, ensuring you have access to the latest and best offerings in the market.

Investing in an HDFC Life insurance policy means safeguarding your family’s future, achieving your financial goals, and enjoying peace of mind.

Join HDFC Life Insurance as a Financial Advisor

Top 10 Reasons to Join HDFC Life Insurance as a Financial Advisor

- Established Brand Reputation

HDFC Life is a trusted name in the insurance sector, backed by the renowned HDFC Group. Its credibility and financial stability give you a competitive edge when approaching clients. - Comprehensive Training Programs

HDFC Life provides industry-leading training to financial advisors, equipping you with knowledge about products, sales techniques, and client management strategies to ensure your success. - Wide Product Portfolio

With a diverse range of insurance products, including term plans, ULIPs, savings plans, and health policies, you can cater to the unique needs of your clients effectively. - High Earning Potential

The attractive commission structure, coupled with performance-based incentives, allows you to achieve financial independence and growth. - Digital Tools and Technology

HDFC Life offers state-of-the-art digital tools for advisors, including mobile apps, CRM platforms, and online policy issuance systems, enabling you to work efficiently and deliver quick solutions. - Market Leader in Claim Settlement

HDFC Life’s high claim settlement ratio instills trust among clients, making it easier for you to build and retain a strong customer base. - Flexible Working Hours

As a financial advisor, you have the freedom to set your own schedule, allowing you to balance personal and professional life effectively. - Strong Support System

HDFC Life provides dedicated support through mentor programs, sales teams, and regional offices, ensuring you are never alone in your journey. - Opportunities for Career Growth

Proven performers are given opportunities to progress within the organization, including promotions to managerial roles and additional leadership responsibilities. - Recognition and Rewards

HDFC Life recognizes and rewards top-performing advisors with accolades, international trips, and exclusive benefits, motivating you to excel.

Distinction from Competitors:

Robust Digital Infrastructure: HDFC Life stands out for its seamless digital solutions, simplifying processes for advisors and clients alike.

Brand Legacy: Unlike many competitors, HDFC Life benefits from the trust and reliability associated with the HDFC brand.

Innovative Products: Regularly introducing market-leading policies ensures you always have the latest solutions to offer.

Testimonials from Successful Advisors

“Joining HDFC Life transformed my career. Their training and support helped me build a strong client base quickly.” – Ramesh Gupta, Senior Advisor.

“The recognition I received for my performance keeps me motivated to achieve even more.” – Sneha Patel, Top Performer 2023.

Pro Tips for Aspiring Financial Advisors

- Build Trust: Focus on building long-term relationships with clients rather than just selling policies.

- Leverage Digital Tools: Use the company’s apps and CRM tools to streamline your processes.

- Stay Updated: Continuously upgrade your knowledge of the products and industry trends.

- Focus on Referrals: Satisfied clients are the best source for new business opportunities.

- Set Clear Goals: Define your financial and professional objectives to stay focused and driven.

Joining HDFC Life Insurance as a financial advisor is not just a job; it’s a journey toward professional growth, financial freedom, and the opportunity to make a difference in people’s lives.

Top 10 Best Selling Life Insurance Policy of HDFC Life Insurance

HDFC Life Insurance offers a diverse range of policies tailored to meet various financial goals and protection needs. Here are some of their top-selling life insurance policies:

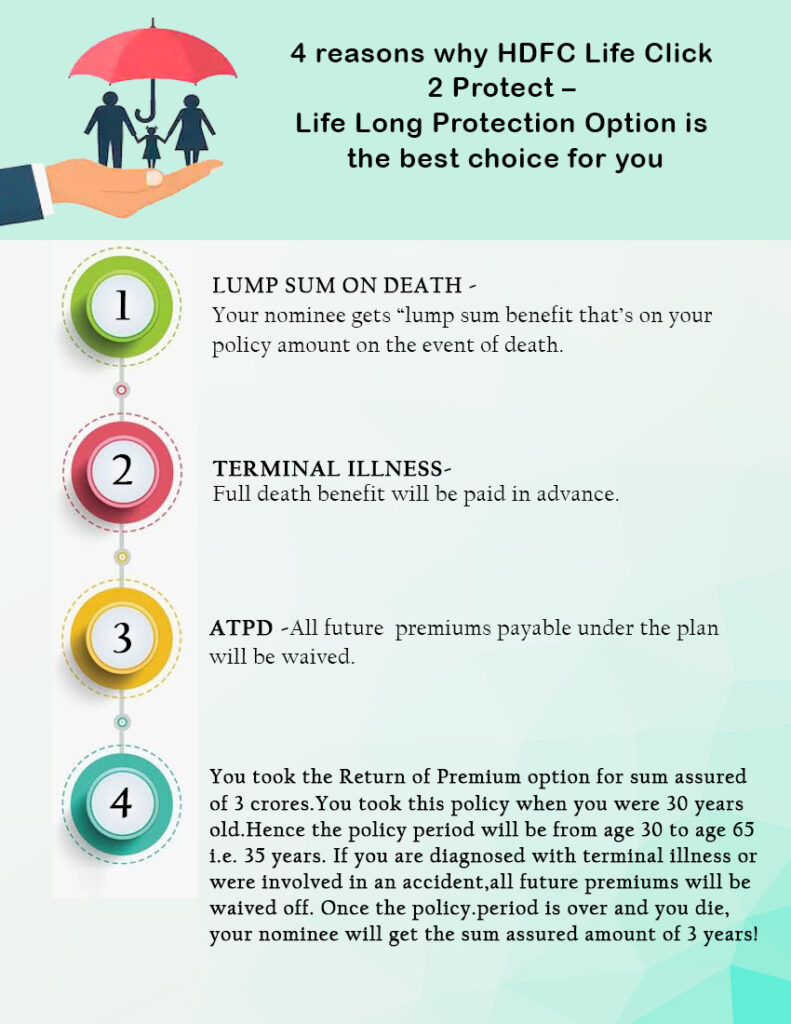

HDFC Life Click 2 Protect Life

A comprehensive term insurance plan providing financial protection with options for return of premium and coverage for critical illnesses.

3

HDFC Life Click 2 Protect Life

A comprehensive term insurance plan providing financial protection with options for return of premium and coverage for critical illnesses. 6HDFC Life Sanchay Plus

A non-participating, non-linked savings plan offering guaranteed returns, flexible payout options, and life coverage.

7

HDFC Life Sanchay Plus

A non-participating, non-linked savings plan offering guaranteed returns, flexible payout options, and life coverage. 10HDFC Life Click 2 Wealth

A unit-linked insurance plan (ULIP) that combines investment and insurance, offering market-linked returns with multiple fund options.

11

HDFC Life Click 2 Wealth

A unit-linked insurance plan (ULIP) that combines investment and insurance, offering market-linked returns with multiple fund options. 14HDFC Life Sampoorn Nivesh

A ULIP designed for long-term wealth creation, providing flexibility in fund choices and premium payment terms.

15

HDFC Life Sampoorn Nivesh

A ULIP designed for long-term wealth creation, providing flexibility in fund choices and premium payment terms. 18HDFC Life YoungStar Udaan

A traditional child insurance plan aimed at securing your child’s future educational and financial needs.

19

HDFC Life YoungStar Udaan

A traditional child insurance plan aimed at securing your child’s future educational and financial needs. 22HDFC Life Click 2 Retire

A pension plan that helps you build a retirement corpus, ensuring a steady income post-retirement.

23

HDFC Life Click 2 Retire

A pension plan that helps you build a retirement corpus, ensuring a steady income post-retirement. 26HDFC Life Pension Guaranteed Plan

An annuity plan offering guaranteed regular income for life, providing financial security during retirement.

27

HDFC Life Pension Guaranteed Plan

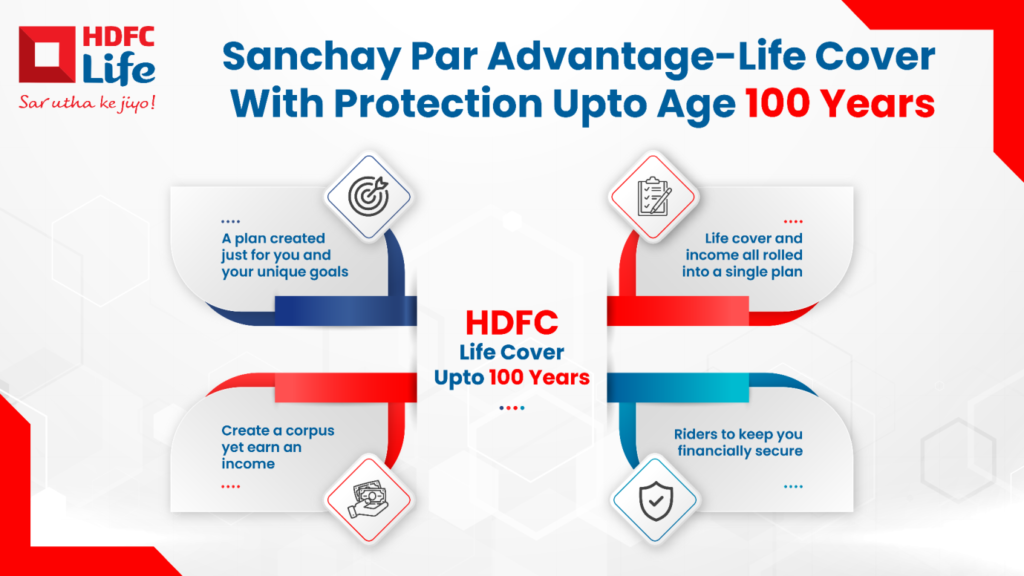

An annuity plan offering guaranteed regular income for life, providing financial security during retirement. 30HDFC Life Sanchay Par Advantage

A participating life insurance plan that offers a combination of regular income and lump-sum benefits along with life cover.

31

HDFC Life Sanchay Par Advantage

A participating life insurance plan that offers a combination of regular income and lump-sum benefits along with life cover. 34HDFC Life Click 2 Invest ULIP

An online ULIP providing market-linked returns with minimal charges, along with life insurance coverage.

35

HDFC Life Click 2 Invest ULIP

An online ULIP providing market-linked returns with minimal charges, along with life insurance coverage. 38HDFC Life Smart Pension Plan

A retirement plan that helps in accumulating a corpus for post-retirement life, ensuring financial independence.

39

HDFC Life Smart Pension Plan

A retirement plan that helps in accumulating a corpus for post-retirement life, ensuring financial independence. 42These policies cater to various life stages and financial objectives, offering solutions for protection, savings, investment, child education, and retirement planning.

Some Important Links for HDFC Life.

Sales Dairy HDFC Life Insurance

1- PRL LINK

https://instaprl.apps-hdfclife.com

2- PFC Exam Schedule Link

http://instaprl-pfc.apps-hdfclife.com/

3- Re-schedule Exam Link

https://instaprl-pfc.apps-hdfclife.com/

4- IRDA Exam Results Link

https://www.iiiexams.org/Candidates/Scorecard

5- IRDA Admit card Download Link

https://www.iiiexams.org/Candidates/Hallticket

6- Training Complete Link

https://icallinsurance.com/welcome_twfhrs_life.php

7- Insta GO

https://instago.hdfclife.com/#/

8- PAN card Search for IRDA side

https://agencyportal.irdai.gov.in/PublicAccess/LookUpPAN.aspx

For Any other Help, Contact Us:

Contai Branch, Purba Medinipur

Mobile: +91 8250452257

Email: 2myadvisers@gmail.com

Join HDFC Life Insurance as a Financial Advisor at the Contai Branch, Purba Medinipur, and unlock a rewarding career in the insurance sector. Benefit from HDFC Life’s trusted brand, expert training, and a diverse product portfolio to grow your income and achieve financial independence.

With flexible working hours, advanced digital tools, and opportunities for career advancement, you can make a meaningful impact while securing your future. Take the first step toward a successful career—join us today at Contai, Purba Medinipur (721401)!

Conclusion

HDFC Life Insurance stands as a reliable partner in your journey toward financial security and peace of mind. With its wide array of tailored plans, innovative solutions, and a legacy of trust, HDFC Life ensures that you and your loved ones are protected at every stage of life. Whether you’re planning for unforeseen circumstances, securing your family’s future, or building wealth for your dreams, HDFC Life is there to support you with expertise and care.

Choosing HDFC Life means choosing a future where your aspirations are safeguarded and your financial goals are achievable. Take the first step today to build a secure and prosperous tomorrow with HDFC Life Insurance—because your dreams and your family deserve nothing less.

Follow Us on Social Media