Apply for Manappuram Gold Loan easily with My Advisers. Get instant loan approval, expert assistance, low interest rates, and fast disbursement. Safe, secure, and hassle-free process online or offline.

Apply for Manappuram Gold Loan with My Advisers: A Complete Guide

Gold has long been more than just a precious metal in Indian households—it’s a trusted financial asset. Whether it’s for education, marriage, medical emergencies, or business expansion, pledging gold to avail a quick loan has become increasingly popular. Among the top providers of such financial solutions is Manappuram Finance Ltd, a trusted name known for its secure and fast gold loan services.

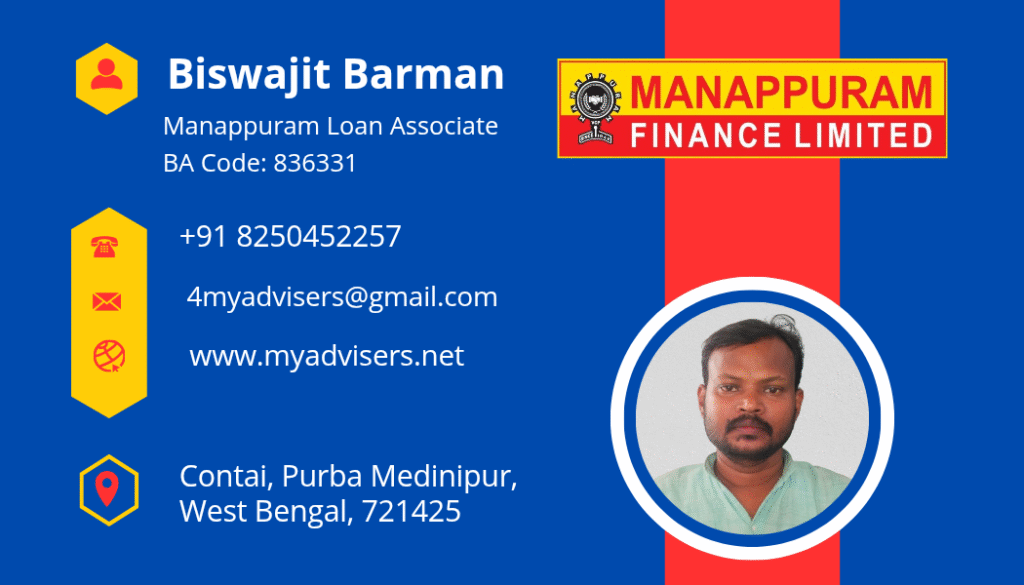

But while Manappuram offers a straightforward application process, many individuals still face confusion when applying online or choosing the right loan scheme. This is where My Advisers, a trusted financial consultancy platform, steps in. My Advisers bridges the gap between customers and financial institutions, offering guidance, documentation support, eligibility checks, and more.

In this article, we’ll dive deep into the benefits of a Manappuram Gold Loan, how My Advisers simplifies the loan application process, and why combining both can help you unlock your financial potential quickly and securely.

Table of Contents

- What is a Manappuram Gold Loan?

- Why Choose Manappuram for a Gold Loan?

- Role of My Advisers in Helping You Apply

- Eligibility Criteria for Manappuram Gold Loan

- Documents Required

- Step-by-Step Process to Apply via My Advisers

- Gold Loan Schemes Offered by Manappuram

- Interest Rates and Repayment Options

- Benefits of Applying through My Advisers

- FAQs about Manappuram Gold Loan

- Pro Tips for Faster Loan Approval

- Why Choose My Advisers for Gold Loans?

- Conclusion

1. What is a Manappuram Gold Loan?

A Manappuram Gold Loan is a secured loan where you pledge your gold ornaments or coins as collateral to receive immediate cash or credit. The loan amount depends on the purity and weight of your gold. You can use the funds for any purpose—medical needs, business expansion, educational expenses, or personal requirements.

2. Why Choose Manappuram for a Gold Loan?

Manappuram Finance is one of India’s oldest and most reliable NBFCs in the gold loan sector. Here’s why millions prefer it:

- Quick Disbursement: Get the loan amount within minutes.

- High Loan-to-Value (LTV): Up to 75% of your gold’s value.

- Wide Network: Over 5000 branches across India.

- Transparent Charges: No hidden fees.

- Safe Custody: Gold is stored in high-security vaults with full insurance.

- Flexible Repayment: Choose from several repayment options.

3. Role of My Advisers in Helping You Apply

Applying for a gold loan can be overwhelming if you’re unsure about the process, eligibility, or documents. This is where My Advisers helps:

- Personalized Assistance: Free consultation based on your financial need.

- Pre-Eligibility Check: Know your loan eligibility before applying.

- Document Preparation: Help in collecting and submitting required documents.

- Branch Locator: Guidance on the nearest Manappuram branch.

- Online Application Support: Help in submitting your application online or offline.

- Follow-up & Approval Tracking: Get updates on the status of your application.

With My Advisers, you get a hassle-free, fast-tracked, and guided loan process.

4. Eligibility Criteria for Manappuram Gold Loan

To apply for a gold loan, you must meet the following criteria:

- Age: 18 years or older

- Ownership: Must own the gold to be pledged

- Nationality: Indian resident

- Employment: Open to salaried, self-employed, housewives, students, and farmers

No income proof or credit score is required for most gold loan schemes.

5. Documents Required

Manappuram gold loan application requires minimal documentation. My Advisers helps collect and verify the following:

- Identity Proof (any one):

- Aadhaar Card

- Voter ID

- PAN Card

- Passport

- Driving License

- Address Proof (any one):

- Aadhaar Card

- Electricity/Water Bill

- Rent Agreement

- Passport

- Photographs: Passport-size photo(s)

In some schemes, PAN Card is mandatory for higher loan amounts or to comply with RBI norms.

6. Step-by-Step Process to Apply via My Advisers

Here is how My Advisers simplifies your gold loan journey:

Step 1: Contact My Advisers

Visit My Advisers or contact their support. Discuss your requirement with a financial advisor.

Step 2: Share Basic Information

Provide your name, city, gold quantity, and preferred loan amount.

Step 3: Get Eligibility Confirmation

Receive confirmation on the eligible loan amount based on your inputs.

Step 4: Submit Documents

My Advisers helps in collecting digital or physical copies of your documents.

Step 5: Choose Nearest Branch

Get the list of Manappuram branches nearest to you for gold deposit.

Step 6: Visit for Gold Valuation

Visit the branch for physical gold verification and valuation.

Step 7: Receive Disbursement

Upon successful evaluation, funds are transferred to your bank account or provided as cash.

7. Gold Loan Schemes Offered by Manappuram

Manappuram offers multiple gold loan schemes tailored to different needs:

a) Gold Loan for Personal Use (GLP)

Low interest, flexible repayment. Ideal for household or emergency expenses.

b) Business Gold Loan (BGL)

Higher loan amount with overdraft facility. Suitable for MSMEs and traders.

c) Agricultural Gold Loan

Special scheme for farmers with lower interest rates and relaxed repayment.

d) Online Gold Loan (OGL)

Existing customers can apply online and get instant approval with zero visits.

e) Term-Based Schemes

Pay interest monthly, quarterly, or at maturity. Choose from 3 to 12 months.

8. Interest Rates and Repayment Options

Interest rates start from 6.90% to 24% per annum, depending on the loan amount and tenure.

Repayment can be made in multiple ways:

- Bullet Repayment: Pay full interest and principal at the end.

- EMI Scheme: Pay monthly installments.

- Part-Payment: Repay in small chunks anytime before maturity.

My Advisers helps you choose the most cost-effective repayment plan.

9. Benefits of Applying through My Advisers

Here’s why applying through My Advisers makes a huge difference:

- ✅ Free Loan Consultation

- ✅ Faster Application Process

- ✅ Priority Processing with Manappuram

- ✅ No Service Charges

- ✅ Assistance in Documentation

- ✅ Local Language Support

- ✅ Full Transparency

- ✅ Real-time Status Tracking

- ✅ Pre and Post Loan Guidance

10. FAQs about Manappuram Gold Loan

Q1. How much gold loan can I get from Manappuram?

You can get up to ₹5 lakhs or more depending on your gold’s purity and weight.

Q2. How long does the loan process take?

With My Advisers, it can be completed in 30 minutes to 2 hours.

Q3. Can I apply for the loan online?

Yes, My Advisers assists you in online as well as offline applications.

Q4. What happens if I don’t repay on time?

Interest accumulates, and after the due period, your gold may be auctioned. My Advisers helps you avoid this by setting reminders.

Q5. Is my gold safe?

Absolutely. Manappuram stores it in fully insured vaults with CCTV and biometric security.

11. Pro Tips for Faster Loan Approval

- 💡 Carry original documents to the branch

- 💡 Ensure your gold is hallmarked or of 18–24 carats

- 💡 Use My Advisers’ eligibility check to avoid rejection

- 💡 Apply in the morning for same-day disbursement

- 💡 Choose schemes with a flexible tenure based on your cash flow

12. Why Choose My Advisers for Gold Loans?

My Advisers is not just a middleman—it’s your financial partner. They ensure:

- Smooth documentation and verification

- Transparent communication with no hidden conditions

- Friendly support via call, WhatsApp, and email

- Experienced consultants with expertise in gold loan products

- Multilingual support for applicants from rural and urban areas

Whether you’re applying from Kolkata, Delhi, Mumbai, Bangalore, or any Tier-2/3 city, My Advisers is equipped to handle your query with utmost professionalism.

13. Conclusion

A gold loan can be your lifeline in times of financial need. But navigating the loan application, understanding schemes, or choosing the right repayment plan can be daunting. That’s why applying for a Manappuram Gold Loan through My Advisers is a smart and safe option.

From documentation to disbursement, My Advisers ensures your journey is smooth, transparent, and stress-free. So, don’t let your gold sit idle—unlock its potential with My Advisers today.

💰 Need Help? Apply Now with My Advisers and Get Instant Assistance!

📞 Call/WhatsApp: +91-8250452257

🌐 Visit: www.myadvisers.net

Hashtags:

#GoldLoan #ManappuramGoldLoan #MyAdvisers #ApplyGoldLoanOnline #GoldLoanIndia #FinancialFreedom #LoanConsultancyIndia

Thank you for the auspicious writeup. It in fact was once a entertainment account it. Glance complicated to more brought agreeable from you! However, how can we be in contact?

fantástico este conteúdo. Gostei muito. Aproveitem e vejam este conteúdo. informações, novidades e muito mais. Não deixem de acessar para descobrir mais. Obrigado a todos e até a próxima. 🙂