Assessing the Real Cost of Equipment Financing: What You Need to Know

Equipment financing is a critical option for many businesses looking to acquire essential tools without upfront costs. Understanding this financing can seem tricky, especially when trying to assess its true cost. It’s more than just the monthly payments; hidden fees, interest rates, and maintenance can quickly add up and impact your bottom line.

This post will guide you through evaluating the total cost involved in equipment financing. You’ll learn how to factor in various elements—like interest, duration, and any additional fees—to get a real picture of what financing will truly cost you.

Getting this right can help you make informed decisions that benefit your business in the long run. Ready to uncover the actual costs? Let’s dive in!

Understanding Equipment Financing

Equipment financing is a way for businesses to obtain the tools they need to operate without needing to pay the full amount upfront. This approach can help maintain cash flow while allowing companies to acquire essential machinery, vehicles, or technology. By understanding the different financing options available, businesses can make better decisions when looking for funding solutions.

Types of Equipment Financing

Several common types of equipment financing cater to various business needs. Here’s a quick overview of the most popular options:

- Leasing: Leasing allows businesses to use equipment for a set time while making periodic payments. At the end of the lease, you can choose to purchase the equipment or return it. This option is great for those who want to avoid large upfront costs.

- Operating Lease: Typically shorter in duration, these leases don’t include the option to purchase at the end.

- Capital Lease: Closer to ownership, this type demands a larger commitment but allows for eventual ownership.

- Loans: Equipment loans let you borrow a specific amount to buy equipment outright. This means you make monthly payments until you’ve paid off the loan, after which you own the equipment completely.

- SBA Loans: Backed by the Small Business Administration, these loans can provide favorable terms and lower rates.

- Traditional Bank Loans: Useful for businesses with solid credit history and significant resources.

- Lines of Credit: A flexible option allowing businesses to withdraw funds as needed, up to a certain limit. Businesses can use a line of credit to purchase equipment when required, providing unique cash flow flexibility.

Learn more about types of equipment financing to choose what’s right for your business.

Benefits of Equipment Financing

Opting for equipment financing offers several advantages that can positively impact your business’s financial health:

- Preserves Capital: Financing allows you to keep more of your cash on hand for other essential expenses. Instead of draining your budget, monthly payments let you invest in growth or cover operating costs.

- Access to Better Equipment: With financing, you can afford higher-quality equipment that might be out of reach if you were paying upfront. This can enhance operational efficiency.

- Flexible Terms: Many financing options come with varying terms tailored to fit your financial situation, helping you align payments with cash flow.

- Tax Benefits: Depending on your situation, monthly payments might be tax-deductible, providing additional cash savings for your business.

- Easier Approval: Equipment financing loans often have less stringent approval criteria compared to traditional loans, making it easier for businesses to secure necessary funds.

Learn more about the benefits of equipment financing and see how they could help your business thrive.

Photo by Anna Nekrashevich

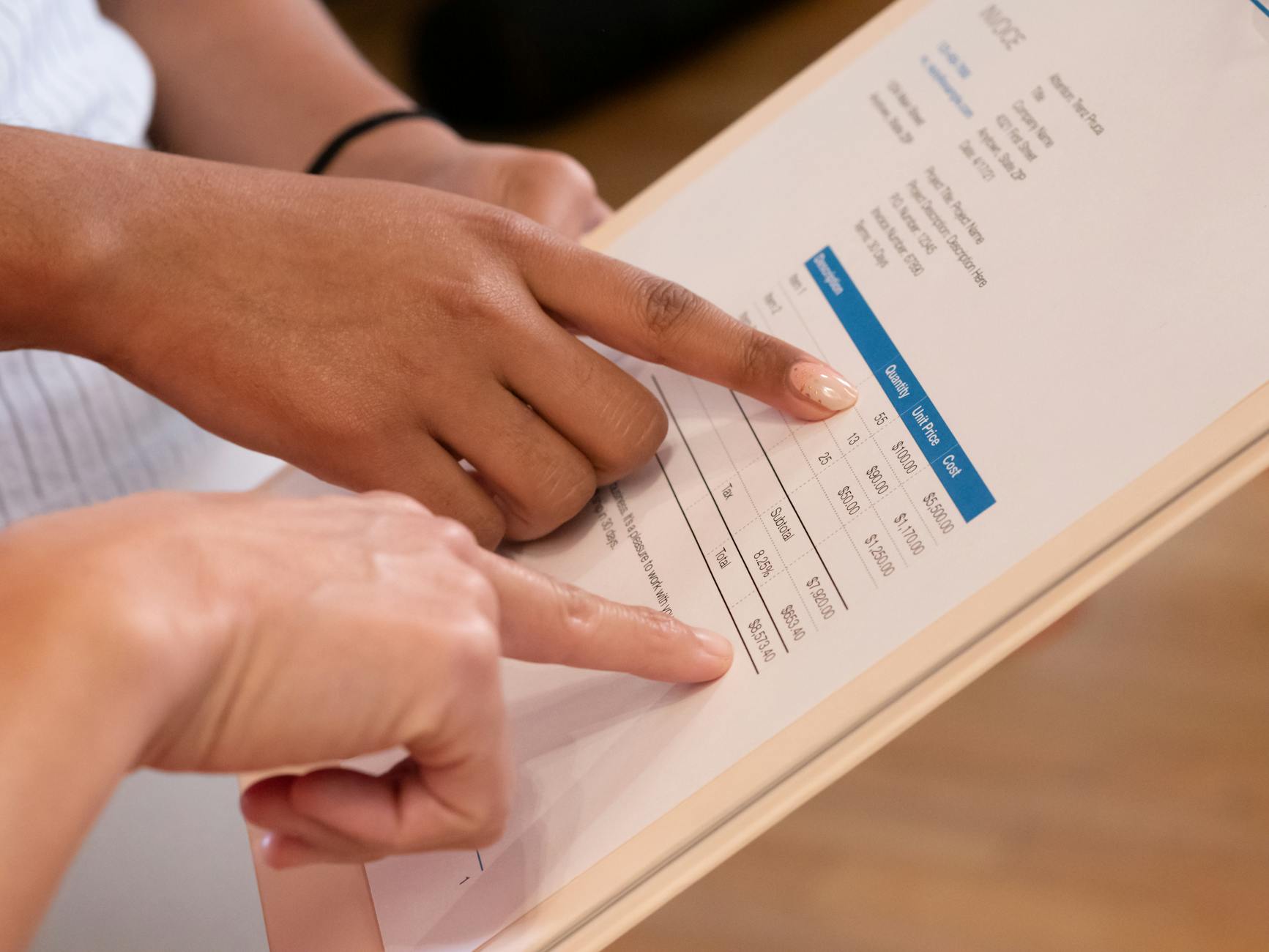

Calculating the Total Cost of Ownership

Assessing the total cost of ownership (TCO) is vital when deciding how to finance equipment. It’s not just about the initial purchase price; several interconnected factors influence the overall expense. Think about it: the true cost of ownership extends beyond what you pay upfront. Let’s break down the key elements that shape your TCO so you can make an informed financial decision.

Initial Purchase Price

The first number that comes to mind is the initial purchase price of equipment. This is the sum you pay right off the bat. But why should this number matter so much? Because it sets the foundation for all future calculations concerning financing. The more you spend initially, the higher your financing costs will likely be. Consider how this cost integrates with other expenses, like interest rates or depreciation.

Moreover, estimating the purchase price accurately goes beyond just what’s on the invoice. Will there be taxes? Licensing fees? Curling all those costs into your total is essential. Learn more about the intricacies of calculating the TCO from Investopedia.

Financing Costs

Next up are financing costs. This includes the interest you’re required to pay on loans or leases. It can eat into your budget significantly. The higher the interest rate, the more you will ultimately pay over the life of the equipment.

Term lengths matter, too. A longer term may appear cheaper monthly, but those costs add up over time. Break it down: short-term loans usually come with higher monthly payments but lower overall interest paid, whereas long-term loans often yield lower monthly costs but translate to richer interest in the long haul. All these factors will contribute to your TCO. For a deeper dive into calculating financing costs, refer to this guide from Graco.

Operational Costs

Now let’s talk about operational costs. These include expenses such as maintenance, insurance, and even potential downtime—especially critical functions that can directly affect productivity. Neglecting these can lead to underestimating your TCO.

Routine maintenance ensures your equipment runs efficiently and extends its life. Think about repair costs; they can be a nasty surprise if not planned for. Downtime, whether through mechanical failure or lack of available equipment, can freeze operations, hitting productivity hard. Including these costs in your TCO will help portray a more realistic financial picture.

Residual Value

Finally, don’t overlook residual value. This is the expected resale or trade-in value of the equipment at the end of its lifecycle. Understanding this area can be a game-changer. A high residual value lowers your effective TCO because that resale money becomes part of the equation.

Assessing this value can be tricky. Research market trends and historical data to gauge how much you could recover when you eventually part with the equipment. This step is essential for balancing your upfront expenditures with future financial potential. Explore more about residual value and its impact on TCO through TechTarget.

Photo by Kindel Media

Hidden Costs of Equipment Financing

When considering equipment financing, many business owners focus solely on the monthly payment. However, it’s essential to explore the hidden costs that can silently strain your budget. Let’s examine a few crucial areas where these costs may appear.

Fees and Charges

Think you’re equipped to handle equipment financing? Think again! Hidden fees can add dollars to your monthly payments. Common charges include:

- Origination Fees: This upfront cost is charged for processing your loan and is often calculated as a percentage of the total loan amount.

- Processing Fees: Similar to origination fees, these costs cover administrative expenses in handling your transaction.

- Late Payment Fees: If your payment is late, expect these fines to escalate further.

- Documentation Fees: Lenders may charge for preparing various legal or financial documents related to the financing process.

These fees can add up quickly, leading to significantly higher overall costs. For a detailed overview of common hidden costs allied to equipment financing, check out this guide on managing equipment costs.

Insurance Requirements

Securing insurance can be a significant part of your financing agreement. In many cases, lenders require specific insurance coverage on financed equipment to protect their investment. Here’s what you need to know:

- Types of Insurance: You might be obligated to acquire general liability insurance and property insurance. This protects against damage, loss, or theft.

- Costs: While it’s crucial coverage, insurance can raise your overall expenses. Be sure to factor this into your budgeting.

- Proof of Insurance: Lenders often require proof of insurance before releasing funds for equipment purchasing. This process can add extra steps in your financing journey.

Understanding the insurance requirements will aid you in budgeting accordingly. Learn more about insurance specifics in equipment financing through this comprehensive review.

Penalties for Early Termination

Thinking about paying off your equipment lease early? It might cost more than you expect. Equipment financing agreements often include terms about early termination, which can have serious implications. Here’s what to keep in mind:

- Prepayment Penalties: Many leases come with penalties for paying off early, making it crucial to read your agreement.

- Fee Structure: These penalties may be structured as a percentage of the remaining balance or based on the total interest expected over the lease term.

- Financial Impact: Be aware that these fees can inflate your total payments by 20-30%. Understanding these details is essential for planning your exit strategy.

To explore the nuances of these penalties further, you can check out this insightful guide.

Photo by Kaboompics.com

Evaluating Financing Offers

When searching for the right financing for equipment, comparing offers is essential. Many factors come into play, making it necessary to look beyond flashy advertisements to find what actually benefits your business. Understanding interest rates, loan terms, and overall costs equips you to make the best financial decision.

Interest Rate Comparisons

Evaluating interest rates is vital when considering equipment financing. Rates can significantly impact your overall costs, so knowing how to compare them is essential. Start by gathering quotes from multiple lenders to see how their rates align.

- Credit Score Impact: Your credit score plays a crucial role. A higher score usually gets you lower rates. Research shows that a strong credit history can save you thousands in interest over time. Companies like National Business Capital provide insights on how credit directly affects financing options.

- Loan Type Differences: Be mindful that different types of equipment loans (e.g., lease vs. loan) usually have varying rates. Research sources like Great America to understand these distinctions more thoroughly.

- Comparative Calculation: Look for calculators that let you input different loan values and terms to see potential monthly payments. Tools at sites like Nerdwallet can streamline this process.

Understanding these factors helps you select a financing option that delivers real savings.

Loan Terms and Flexibility

Next on your evaluation list is understanding loan terms and the flexibility they might offer. Recognizing the details of these terms is key to assessing the overall fit for your business.

- Length of the Loan: Equipment financing terms can range from a few months to several years. The duration directly affects monthly payments—shorter terms might mean higher payments but can minimize total interest paid. Longer terms can reduce monthly stress but may inflate the overall payment significantly.

- Prepayment Options: Is there an option to pay off the loan early without penalties? Finding a lender that allows prepayment without fees can prove beneficial, especially if your business has a sudden influx of capital. Check resources like Corporate Finance Institute to explore various factors that influence financing options.

- Flexibility in Payments: Loan structures that allow for seasonal payment adjustments or payment deferrals can be lifesaving for businesses with fluctuating revenue. This flexibility can help you avoid cash flow crunches during slower months.

Understanding these elements can sharpen your assessment of the financing terms on offer.

Total Cost Analysis

Calculating and comparing the total cost associated with different financing options lays a solid foundation for decision-making. A methodical approach ensures you capture all expenses involved.

- Monthly Payment Estimation: Start by determining the projected monthly payments from different quotes. Use an equipment loan calculator to help visualize this compared to your budget.

- Added Costs: Don’t overlook additional costs like processing fees, insurance, and potential penalties. These can add significant amounts to your overall expenses.

- Total Value Comparison: Total costs also consider any available tax incentives or the residual value of the equipment at the end of its life. Understanding the effective cost of ownership can aid in comparing offers more intelligently.

Successfully evaluating these various components allows you to make an informed choice, aligning with your business’s financial goals and operational needs.

Using Financial Tools and Calculators

Financial tools and calculators can simplify your assessment of equipment financing. They let you analyze costs, returns, and overall investment quickly. With a few clicks, you can grasp the numbers behind your financing decisions, helping you choose what suits your business best.

Equipment Financing Calculators

Online calculators are essential for estimating the total costs associated with equipment financing. They allow you to input numbers like interest rates, term lengths, and down payments to receive accurate monthly payment estimates. Here’s how to use them:

- Gather Your Information: Before diving in, collect details about the equipment cost, interest rate, and loan term. This information will be crucial.

- Utilize Calculators: Many websites offer specialized equipment financing calculators. These can give you insights into your potential payments:

- Analyze the Output: Once you enter your details, view the estimated monthly payment and the total cost over the loan duration. This data helps you understand how financing can fit into your budget and operations.

- Play with Scenarios: Don’t hesitate to alter inputs (like varying interest rates or terms) to see how it impacts payments. Experimenting can lead to new insights that help you make better decisions.

By understanding these calculators, you position your business to navigate costs smartly.

Photo by Kaboompics.com

ROI Analysis Tools

Assessing the Return on Investment (ROI) for financed equipment is crucial for understanding its potential impact on your bottom line. Several tools can assist in this evaluation, allowing you to make more informed financial choices.

- Calculate ROI: Use dedicated ROI calculators to assess the profitability of your equipment investments. They factor in costs, expected revenue, and operational efficiency. Here are a few resources:

- Consider All Factors: A comprehensive analysis should include purchase price, maintenance costs, and potential savings or additional revenue generated by using the equipment.

- Track Performance: Post-investment, track actual outcomes against your projections. This helps refine future investment strategies.

Using these ROI analysis tools keeps you focused on maximizing the value of every dollar spent. You’ll make decisions that contribute to sustainable growth and financial health.

Conclusion

Making a thorough assessment of equipment financing is not just a formality—it’s a strategic choice that can significantly affect your financial health. It’s all about digging deep into the actual costs involved, especially when considering hidden fees, interest rates, and repayment terms.

The Importance of Cost Assessment

Knowing the true cost of equipment financing can be the difference between prospering and barely scraping by. Many business owners underestimate how small fees can accumulate into substantial amounts over time. Understanding costs helps align your financial strategies with your business goals.

- Comparative Analysis: Understanding and comparing different financing options offers clarity. Incremental differences in interest rates may translate to thousands of dollars over the loan term. More insights on financing evaluation can be found in this guide on evaluating equipment financing.

- Cash Flow Management: Proper assessment allows you to maintain better control over cash flow. This is crucial not just for sustaining operations but also for growth opportunities. Delve deeper into this aspect from Pitney Bowes.

- Long-term Financial Health: Every penny counts. Ensuring you choose the best possible option can save you from unnecessary costs and help you invest in other critical areas of your business. Read more about cost management at Bankrate.

Take Your Time

Before making any decisions about equipment financing, take time to evaluate all aspects carefully. Consider using debt and money-saving tools where needed and don’t overlook the importance of your credit score when negotiating terms with lenders. Financing decisions can ripple through your business finances—make sure that ripple is positive. Always aim to ask questions and seek clarity where needed; your financial future could depend on it.

Photo by Nataliya Vaitkevich