A Complete Guide on Business Loans in India (2025)

Eligibility, Documents, Best Lenders, Interest Rates, EMI Strategy & Real-Life Examples

India’s business ecosystem—from kirana stores and MSMEs to startups and exporters—runs on working capital, credit access, and cash-flow timing.

A business loan is not just money; it is leverage. Used correctly, it accelerates growth. Used poorly, it destroys margins.

This guide is written as a Business Loan Advisor’s Handbook—not marketing fluff. It explains which loan to choose, why, from whom, and how to repay without stress.

PART A: BEST BUSINESS LOAN BY BUSINESS TYPE (DECISION GUIDE)

Different businesses require different loan structures. Choosing the wrong lender is the #1 reason businesses struggle with EMIs.

1️⃣ Best Business Loan for Shopkeepers & Traders (Retail / Kirana / Wholesale)

Ideal Loan Type

- Working Capital Loan

- OD (Overdraft)

- Merchant Cash Advance (for digital payment users)

Best Lenders

Banks

- SBI

- Bank of Baroda

- Punjab National Bank

NBFCs

- Bajaj Finserv

- Tata Capital

- Lendingkart

Why These Work

- Regular daily cash flow

- Short inventory cycle

- GST turnover easily verifiable

Eligibility Snapshot

- Business vintage: 2+ years

- GST registration preferred

- Monthly turnover: ₹1.5–2 lakh+

- CIBIL: 650+

Pros

✔ Lower interest than personal loan

✔ Flexible repayment

✔ OD facility helps seasonal sales

Cons

✖ Documentation heavy (banks)

✖ Collateral may be required for higher amounts

Example

A wholesaler borrows ₹10 lakh OD at 11%. Uses only ₹6 lakh average.

Interest paid only on used amount, not sanctioned limit.

2️⃣ Best Business Loan for Manufacturers

Ideal Loan Type

- Term Loan

- Machinery Loan

- Working Capital + Term Loan combo

Best Lenders

Banks

- SBI

- Union Bank

- Canara Bank

NBFCs

- Tata Capital

- HDFC Bank (mid-corporate)

- SIDBI (MSME focus)

Eligibility Snapshot

- Vintage: 3+ years

- Turnover: ₹50 lakh+

- ITR + GST mandatory

- CIBIL: 680+

Pros

✔ Lower interest (9–12%)

✔ Longer tenure (5–10 years)

✔ Higher ticket size

Cons

✖ Slow processing

✖ Collateral often required

Real-Life Insight

A small manufacturing unit takes:

- ₹30 lakh term loan (machinery)

- ₹15 lakh working capital

This separation improves cash flow and reduces interest burden.

3️⃣ Best Business Loan for Service-Based Businesses (IT, Consultants, Agencies)

Ideal Loan Type

- Unsecured Term Loan

- OD against receivables

Best Lenders

- HDFC Bank

- ICICI Bank

- Axis Bank

- FlexiLoans

Eligibility

- Consistent bank credits

- ITR showing profits

- Minimal fixed assets needed

Pros

✔ No collateral

✔ Fast disbursal

✔ Higher flexibility

Cons

✖ Higher interest than manufacturing loans

4️⃣ Best Business Loan for Startups & New Businesses

Reality Check

Most banks do NOT fund startups without revenue.

Best Options

- Mudra Loan (Shishu / Kishore)

- SIDBI Startup Loan

- NBFCs (cash-flow based)

- Fintech lenders (higher cost)

Pros

✔ Low documentation (Mudra)

✔ Government support

Cons

✖ Limited amount

✖ High rejection if no income proof

5️⃣ Best Loan for Low CIBIL Score (Below 650)

Practical Strategy

- Avoid banks initially

- Use NBFC short-term loan

- Improve score → refinance later

Best Lenders

- Lendingkart

- NeoGrowth

- Indifi

Warning

High interest is temporary, not permanent.

Use it to rebuild profile, then switch.

PART B: BUSINESS LOAN ELIGIBILITY – HOW BANKS & NBFCs REALLY CALCULATE

Eligibility is not random. It is formula-driven.

1️⃣ Core Eligibility Factors

| Factor | Weightage |

|---|---|

| Turnover | High |

| Net Profit | High |

| CIBIL Score | Medium–High |

| GST Filing | Medium |

| Banking Pattern | Very High |

| Business Vintage | Medium |

2️⃣ Simplified Eligibility Formula

Eligible Loan ≈ 20–30% of Annual Turnover

But lenders also check EMI affordability.

3️⃣ EMI Eligibility Formula

Total EMI ≤ 30–40% of Monthly Net Cash Inflow

4️⃣ Real-Life Eligibility Examples

Case 1: Small Trader

- Turnover: ₹60 lakh/year

- Monthly inflow: ₹5 lakh

- EMI capacity (35%): ₹1.75 lakh

Eligible Loan:

- ₹15–20 lakh (depending on tenure)

Case 2: Service Business

- Annual profit: ₹12 lakh

- Monthly net: ₹1 lakh

- EMI capacity: ₹35,000

Eligible Loan:

- ₹8–10 lakh (unsecured)

5️⃣ Why Loans Get Rejected (Hidden Reasons)

❌ Cash deposits without explanation

❌ GST mismatch with bank credits

❌ Frequent cheque bounces

❌ High personal loan EMIs already running

PART C: INTEREST RATE, EMI & SMART REPAYMENT STRATEGY

This section saves businesses lakhs of rupees.

1️⃣ Interest Rate Types Explained

Flat Rate (Dangerous)

- Interest calculated on full amount

- EMI looks low, cost is high

Reducing Balance (Preferred)

- Interest reduces as principal reduces

- Always choose this

2️⃣ Bank vs NBFC Interest Rates (2025)

| Lender Type | Interest Range |

|---|---|

| PSU Banks | 8.75% – 11.5% |

| Private Banks | 9.5% – 14% |

| NBFCs | 13% – 24% |

| Fintech | 18% – 36% |

3️⃣ EMI Planning Strategy (Expert Rule)

❌ Wrong Thinking

“How much EMI can I pay?”

✅ Correct Thinking

“How much EMI keeps business liquid even in bad months?”

4️⃣ Smart EMI Structuring (Pro Tips)

✔ Choose longer tenure, prepay later

✔ Keep EMI < 30% of average monthly profit

✔ Never block working capital for EMI

5️⃣ When Higher Interest Loan Is Better

If:

- Faster approval saves business opportunity

- Loan helps generate higher ROI than interest cost

Example

Loan at 18% helps earn 30% margin → Net positive.

FINAL ADVISORY: HOW TO USE BUSINESS LOANS LIKE A PROFESSIONAL

✔ Borrow for income-generating purpose only

✔ Separate personal & business loans

✔ Refinance every 18–24 months

✔ Use OD instead of term loan where possible

✔ Improve CIBIL deliberately

Conclusion: Business Loan Is a Tool, Not a Burden

A business loan is neither good nor bad.

It becomes powerful when aligned with:

- Cash flow

- Growth stage

- Repayment strategy

Used correctly, it accelerates scale.

Used blindly, it kills profitability.

PART D: BUSINESS LOAN OFFERS FROM TOP BANKS & NBFCs IN INDIA (2025)

1️⃣ State Bank of India (SBI) – Best for Low-Cost Business Loans

Loan Types Offered

- SME Term Loan

- Cash Credit (CC)

- Overdraft (OD)

- Machinery Loan

- CGTMSE-backed loans

Interest Rates (2025)

- 8.75% – 11.25% (reducing balance)

Loan Amount

- ₹10 lakh to ₹20 crore

Tenure

- Up to 10 years (term loan)

- 12 months renewable (OD/CC)

Eligibility Snapshot

- Business vintage: 3+ years

- Strong GST + ITR

- Collateral preferred (not mandatory under CGTMSE)

Pros

✔ Lowest interest rates

✔ Government-backed schemes

✔ Ideal for manufacturers & exporters

Cons

✖ Slow processing (30–60 days)

✖ Heavy documentation

✖ Not startup-friendly

Best For

Manufacturing units, exporters, wholesalers, established MSMEs

2️⃣ HDFC Bank – Best for Fast Processing & OD Facilities

Loan Types

- Business Term Loan

- OD against property

- Working Capital Finance

Interest Rates

- 9.5% – 14%

Loan Amount

- ₹10 lakh to ₹50 crore

Processing Time

- 7–15 working days

Pros

✔ Fast approval

✔ Strong OD products

✔ Relationship-based flexibility

Cons

✖ Slightly higher rates than PSU banks

✖ Strict eligibility

Best For

Service businesses, traders, professionals

3️⃣ ICICI Bank – Best for Digital & SME Banking Integration

Loan Types

- Insta Business Loan

- OD & CC

- Equipment Finance

Interest Rates

- 10% – 16%

Unique Advantage

- Digital approval for existing customers

Pros

✔ Tech-driven process

✔ Faster disbursal

✔ Integrated SME banking tools

Cons

✖ Aggressive recovery if default

✖ Higher interest for unsecured loans

Best For

SMEs with strong banking history

4️⃣ Axis Bank – Balanced Option for Growing Businesses

Loan Types

- Secured & unsecured business loans

- OD facilities

- Supply chain finance

Interest Rates

- 10.25% – 15.5%

Pros

✔ Flexible repayment

✔ Competitive mid-market pricing

Cons

✖ Processing fees higher

✖ Conservative sanctioning

Best For

Growing mid-size businesses

5️⃣ Bajaj Finserv – Fastest NBFC Loan (High Approval Rate)

Loan Types

- Unsecured Business Loan

- Flexi Loan (OD-like)

Interest Rates

- 13% – 22%

Loan Amount

- Up to ₹50 lakh (unsecured)

Processing Time

- 24–72 hours

Pros

✔ Lightning-fast approval

✔ Minimal documentation

✔ Flexible EMI options

Cons

✖ Higher interest

✖ Penal charges if delayed

Best For

Urgent working capital needs

6️⃣ Tata Capital – Best NBFC for Structured Business Finance

Loan Types

- Business Term Loan

- Working Capital

- Machinery Finance

Interest Rates

- 11% – 18%

Pros

✔ Transparent terms

✔ Relationship-based lending

✔ Lower NBFC risk perception

Cons

✖ Approval slower than Bajaj

✖ Requires better documentation

Best For

MSMEs seeking stability over speed

7️⃣ Lendingkart – Best for Small Businesses & Low CIBIL

Loan Types

- Short-term business loan

Interest Rates

- 16% – 27%

Loan Amount

- ₹50,000 to ₹2 crore

Pros

✔ No collateral

✔ Startup-friendly

✔ Fully digital

Cons

✖ High interest

✖ Short tenure

Best For

New businesses, low-credit profiles

8️⃣ Indifi – Best for Merchants & Online Sellers

Loan Types

- Merchant cash advance

- E-commerce seller loans

Interest Rates

- 18% – 30%

Pros

✔ Works with Amazon/Flipkart sellers

✔ Cash-flow based lending

Cons

✖ High cost

✖ Frequent repayments

9️⃣ SIDBI – Best Government-Backed MSME Support

Loan Types

- Growth capital

- Equipment loans

- Startup assistance

Interest Rates

- 8% – 11%

Pros

✔ Government trust

✔ Startup-friendly programs

Cons

✖ Limited availability

✖ Long approval cycle

🔟 NBFC vs Bank – Strategic Comparison

| Parameter | Bank | NBFC |

|---|---|---|

| Interest | Low | High |

| Approval Speed | Slow | Fast |

| Documentation | Heavy | Light |

| Startup Friendly | ❌ | ✅ |

| OD Facility | Strong | Limited |

PART E: REAL-LIFE BUSINESS LOAN CASE STUDIES (IMPORTANT FOR E-E-A-T)

Case Study 1: Kirana Store Expansion

- Loan: ₹8 lakh OD (SBI)

- Interest: 9.25%

- Result: 22% revenue growth in 12 months

Case Study 2: Digital Marketing Agency

- Loan: ₹12 lakh unsecured (HDFC)

- Interest: 13.5%

- Used for hiring → ROI achieved in 6 months

Case Study 3: Low CIBIL Trader

- Loan: ₹5 lakh (Lendingkart)

- Interest: 22%

- After 18 months → refinanced at 12% from Axis Bank

FINAL PROFESSIONAL RECOMMENDATION

Best overall strategy:

- Start with NBFC if urgent

- Improve profile

- Refinance with bank

- Use OD instead of repeated loans

PART F: COMPLETE BUSINESS LOAN DOCUMENT CHECKLIST (BANKS vs NBFCs)

1️⃣ Mandatory Documents for All Business Loans

These documents are non-negotiable, regardless of lender.

A. Identity Proof (Any One)

- Aadhaar Card

- PAN Card

- Passport

- Voter ID

👉 Why it matters: KYC + fraud prevention

B. Address Proof (Any One)

- Aadhaar

- Electricity Bill

- Rent Agreement

- Property Tax Receipt

👉 Why it matters: Business location verification & jurisdiction risk

C. Business Proof (Depends on Business Type)

| Business Type | Accepted Documents |

|---|---|

| Proprietorship | GST Registration / Shop Act |

| Partnership | Partnership Deed |

| LLP | LLP Agreement |

| Pvt Ltd | COI + MOA + AOA |

👉 Red flag: No formal registration = very limited loan options

D. Income Proof (Critical Section)

- Last 2–3 years ITR

- Balance Sheet & P&L

- Bank Statements (12 months)

- GST Returns (GSTR-1 & GSTR-3B)

👉 Lender logic:

“If numbers don’t match → reject or higher interest.”

2️⃣ Additional Documents for Secured Business Loans

If you’re applying for a loan against property or machinery:

- Property documents

- Chain deed

- Valuation report

- Encumbrance certificate

- NOC (if applicable)

3️⃣ Startup & New Business Documentation (0–2 Years)

Startups usually fail at banks, but NBFCs consider:

- CA-certified projected financials

- Business plan (12–36 months)

- Founder bank statements

- Invoices / contracts

- Marketplace dashboards (Amazon, Flipkart, Swiggy, Zomato)

PART G: HOW BANKS ACTUALLY EVALUATE BUSINESS LOAN APPLICATIONS

1️⃣ The 5-Factor Credit Evaluation Model

1. Cash Flow (Most Important)

Banks don’t lend on profit — they lend on cash flow.

Ideal EMI to Net Monthly Inflow Ratio:

- Below 30% → Excellent

- 30–45% → Acceptable

- Above 45% → High risk

2. CIBIL & Credit Behavior

- CIBIL 750+ → Best rates

- 650–749 → Moderate approval

- Below 650 → NBFC territory

⚠️ Even one EMI bounce in last 6 months can reduce approval chances.

3. Business Stability

- Vintage > 3 years → Strong

- Same industry continuity → Positive

- Frequent business changes → Negative

4. GST Consistency

Banks cross-verify:

- Monthly GST filing

- Tax paid vs turnover

- Cash vs digital sales ratio

5. Banking Discipline

Banks analyze:

- Average bank balance

- Cheque returns

- Daily credits

- OD utilization

PART H: BUSINESS LOAN INTEREST RATE COMPARISON (2025)

| Lender Type | Interest Range | Best Use Case |

|---|---|---|

| PSU Banks | 8.5% – 11% | Long-term growth |

| Private Banks | 9.5% – 14% | Working capital |

| NBFCs | 12% – 24% | Speed & flexibility |

| Fintech NBFCs | 16% – 30% | Low CIBIL / startups |

PART I: STEP-BY-STEP BUSINESS LOAN APPLICATION GUIDE (ZERO MISTAKES)

Step 1: Diagnose Your Profile

Ask:

- Do I need speed or low cost?

- Can I provide collateral?

- Is my GST consistent?

Step 2: Choose Correct Lender

❌ Applying everywhere reduces CIBIL

✅ Apply strategically (max 2–3 lenders)

Step 3: Prepare Documents Professionally

- Use CA-verified financials

- Match GST + bank + ITR

- Clean bank statement before applying

Step 4: Negotiate Terms (Most People Don’t)

You can negotiate:

- Processing fees

- Prepayment charges

- EMI structure

PART J: COMMON BUSINESS LOAN MISTAKES THAT DESTROY BUSINESSES

❌ Taking short-term high-interest loans for long-term assets

❌ Using OD limit fully without revenue buffer

❌ Multiple NBFC loans → debt trap

❌ Ignoring refinancing opportunities

PART K: SMART BUSINESS LOAN STRATEGY (EXPERT FRAMEWORK)

The Ideal Model:

- Start with NBFC (if urgent)

- Build repayment history

- Improve CIBIL & GST

- Shift to bank loan

- Convert term loan to OD

- Refinance every 18–24 months

PART L: BUSINESS LOAN FAQ (SCHEMA-READY)

Q1. Can I get a business loan without GST?

Yes, but mostly from NBFCs with higher interest.

Q2. What is the minimum turnover required?

₹10–20 lakh annually for most lenders.

Q3. Can startups get business loans?

Yes, but mainly from NBFCs or SIDBI schemes.

Q4. Is collateral mandatory?

Only for large or low-profile loans.

FINAL VERDICT: THE RIGHT WAY TO USE BUSINESS LOANS IN INDIA

A business loan is not money — it is leverage.

Used correctly:

- Accelerates growth

- Improves cash flow

- Builds creditworthiness

Used wrongly:

- Kills margins

- Creates stress

- Leads to debt spiral

PART M: BUSINESS LOAN VS EQUITY FUNDING — THE FOUNDER’S DECISION FRAMEWORK

One of the most critical mistakes Indian entrepreneurs make is choosing funding without understanding capital psychology.

Let’s break it down clearly.

1️⃣ What Is Business Loan Funding?

A business loan is borrowed capital with:

- Fixed or floating interest

- Defined repayment timeline

- Zero ownership dilution

Best suited for:

- Stable businesses

- Predictable cash flow

- Asset-backed expansion

- Working capital cycles

2️⃣ What Is Equity Funding?

Equity funding means:

- Selling ownership (shares)

- No EMI pressure

- Long-term strategic involvement

Best suited for:

- High-growth startups

- Tech, SaaS, D2C brands

- Businesses prioritising scale over profit

3️⃣ Business Loan vs Equity — Comparison Table

| Factor | Business Loan | Equity Funding |

|---|---|---|

| Ownership | 100% retained | Diluted |

| Cost | Interest-based | Share of future profits |

| Control | Full control | Investor influence |

| Risk | EMI pressure | Growth pressure |

| Approval Speed | Fast (NBFCs) | Slow (VCs/Angels) |

| Tax Benefit | Interest deductible | No tax benefit |

👉 Expert Insight:

If your business is cash-flow positive, always choose debt before equity.

PART N: GOVERNMENT BUSINESS LOAN SCHEMES IN INDIA (COMPLETE GUIDE)

1️⃣ Pradhan Mantri Mudra Yojana (PMMY)

Loan Types

- Shishu: Up to ₹50,000

- Kishor: ₹50,001 – ₹5 lakh

- Tarun: ₹5 lakh – ₹10 lakh

Eligibility

- Proprietors, MSMEs, traders

- No collateral required

Pros

✔ Zero collateral

✔ Low interest

✔ Easy access

Cons

❌ Limited loan amount

❌ Paperwork-heavy via banks

2️⃣ CGTMSE (Credit Guarantee Scheme)

This scheme guarantees loans taken from banks/NBFCs.

- Coverage up to ₹2 crore

- Ideal for MSMEs without collateral

👉 Pro Tip:

Most bank relationship managers don’t proactively suggest CGTMSE — you must ask.

3️⃣ Stand-Up India Scheme

Designed for:

- Women entrepreneurs

- SC/ST entrepreneurs

Loan range:

- ₹10 lakh to ₹1 crore

4️⃣ SIDBI Loan Programs

SIDBI supports:

- Manufacturing MSMEs

- Export-oriented units

- Green energy businesses

PART O: BUSINESS LOAN REFINANCING & RESTRUCTURING PLAYBOOK

1️⃣ What Is Business Loan Refinancing?

Replacing an existing loan with:

- Lower interest

- Longer tenure

- Better EMI structure

2️⃣ When Should You Refinance?

✔ CIBIL improved by 50+ points

✔ GST turnover increased

✔ Business vintage crossed 3 years

✔ Market interest rates dropped

3️⃣ Refinancing Example (Real-Life)

Original Loan

- Amount: ₹25 lakh

- Interest: 18%

- EMI: ₹63,500

After Refinancing

- Interest: 11%

- EMI: ₹49,000

👉 Monthly saving: ₹14,500

👉 Annual saving: ₹1.74 lakh

4️⃣ Loan Restructuring vs Refinancing

| Aspect | Restructuring | Refinancing |

|---|---|---|

| Purpose | Financial stress | Cost optimisation |

| Impact on CIBIL | Neutral/Negative | Positive |

| Lender | Same | New |

| Best For | Crisis | Growth |

PART P: LENDER-WISE ELIGIBILITY CHEAT SHEET (INDIA)

PSU Banks

- Vintage: 3+ years

- CIBIL: 700+

- GST mandatory

Private Banks

- Vintage: 2+ years

- CIBIL: 680+

- Strong banking history

NBFCs

- Vintage: 6 months+

- CIBIL: 600+

- Flexible documentation

Fintech Lenders

- Marketplace sellers

- Digital footprints

- API-based underwriting

PART Q: BUSINESS LOAN TAX BENEFITS (LEGAL & PRACTICAL)

1️⃣ Interest Deduction

Interest paid on business loans is 100% tax deductible under Income Tax Act.

2️⃣ Depreciation + Interest Combo

Loan-funded asset =

✔ Depreciation benefit

✔ Interest deduction

👉 Powerful tax shield when structured correctly.

PART R: INDUSTRY-SPECIFIC BUSINESS LOAN STRATEGIES

Manufacturing

- Machinery loans

- SIDBI-backed credit

- Longer tenure required

Retail & Trading

- OD + WC loans

- Inventory-based funding

Service Businesses

- Unsecured loans

- Invoice discounting

E-commerce Sellers

- Marketplace-based lending

- Short tenure, fast disbursal

PART S: FINAL EXPERT FRAMEWORK — THE “SMART DEBT PYRAMID”

Top level (Cheapest Money):

- Bank Term Loans

- OD Facilities

Middle:

- NBFC Loans

- Government-backed loans

Bottom (Use Carefully):

- Fintech & instant loans

CONCLUSION: THE BUSINESS LOAN MINDSET SHIFT

A business loan is not survival capital.

It is strategic leverage.

Used wisely:

- Accelerates growth

- Builds credit power

- Improves negotiation strength

Used blindly:

- Destroys margins

- Increases stress

- Traps businesses in debt cycles

FINAL CHECKLIST BEFORE APPLYING

✔ Financials match GST & bank

✔ EMI < 30% of net inflow

✔ Correct lender selection

✔ Refinancing roadmap ready

PART T: STATE-WISE MSME & BUSINESS LOAN BENEFITS IN INDIA (2025 UPDATED)

Most Indian entrepreneurs apply for business loans without leveraging state-level incentives, which results in higher interest, lower limits, and missed subsidies.

Each Indian state runs parallel MSME credit support programs that stack on top of bank/NBFC loans.

1️⃣ Maharashtra – Industry-Friendly Capital Support

Key Schemes

- Chief Minister Employment Generation Programme (CMEGP)

- Interest Subsidy Scheme (IPS)

Benefits

✔ Interest subsidy up to 5%

✔ Capital subsidy for manufacturing units

✔ Priority funding for women & SC/ST entrepreneurs

Best For

- Manufacturing MSMEs

- Export-oriented units

- Startup hubs (Mumbai, Pune, Nashik)

2️⃣ Gujarat – MSME Capital Powerhouse

Key Schemes

- Gujarat MSME Policy 2020

- Capital Investment Subsidy (CIS)

Benefits

✔ Subsidy up to ₹35 lakh

✔ Power tariff subsidy

✔ Easy CGTMSE access

Best For

- Textile

- Chemicals

- Engineering industries

3️⃣ Tamil Nadu – Industrial Growth Engine

Key Schemes

- NEEDS Scheme

- TAIDCO Business Loan Support

Benefits

✔ Margin money subsidy

✔ Interest subvention

✔ Industrial estate infrastructure support

4️⃣ Karnataka – Startup & Tech Funding Hub

Key Schemes

- Elevate Karnataka

- Startup Karnataka Fund

Benefits

✔ Equity + debt blend

✔ Credit guarantee support

✔ Special NBFC tie-ups

5️⃣ Uttar Pradesh – MSME Credit Expansion

Key Schemes

- Mukhyamantri Yuva Udyami Yojana

- ODOP-linked credit programs

Benefits

✔ Subsidized interest

✔ Cluster-based lending

✔ Higher loan eligibility for rural entrepreneurs

PART U: WHY BUSINESS LOANS GET REJECTED (AND HOW TO FIX IT)

Loan rejection is not random. It follows predictable financial red flags.

Top 12 Business Loan Rejection Reasons

1️⃣ CIBIL Below 650

Fix:

- Clear credit card dues

- Avoid settlements

- Maintain EMI discipline for 6 months

2️⃣ GST & Bank Mismatch

Banks cross-verify:

- GST turnover

- Bank deposits

- Profit margins

Fix:

Align cash sales through banking channels.

3️⃣ Excessive Existing Debt

If EMI > 40% of net inflow → rejection likely.

Fix:

Refinance before applying fresh credit.

4️⃣ New Business (Low Vintage)

Most banks require 2–3 years.

Fix:

Use NBFC or fintech bridge funding initially.

5️⃣ Industry Risk Perception

Certain industries are marked “high risk”:

- Trading

- Real estate brokerage

- Seasonal businesses

Fix:

Provide strong cash-flow projections + OD models.

Expert Tip: The “Soft Pull” Strategy

Apply via platforms that soft-check eligibility before hard CIBIL pulls.

Multiple hard enquiries reduce approval chances.

PART V: REAL-LIFE BUSINESS LOAN CASE STUDIES (INDIA)

Case Study 1: Retail Business (Delhi NCR)

Profile

- Electronics showroom

- Turnover: ₹1.2 crore

- CIBIL: 705

Problem

- Cash blocked in inventory

Solution

- ₹30 lakh OD facility at 10.75%

- Inventory-based funding

Result ✔ Stock rotation improved

✔ Revenue up by 38%

✔ No EMI pressure

Case Study 2: Manufacturing Unit (Ahmedabad)

Profile

- Textile processing unit

- Turnover: ₹3.8 crore

Loan Strategy

- ₹75 lakh term loan

- CGTMSE-backed

- SIDBI refinancing

Outcome ✔ Interest reduced from 14.5% → 9.8%

✔ Monthly saving ₹48,000

Case Study 3: Startup Founder (Bengaluru)

Profile

- SaaS startup

- 14 months old

- No profits yet

Funding Used

- Fintech revenue-based loan

- ₹20 lakh, 12-month tenure

Why Not Equity?

- Wanted control

- Short runway need

PART W: BUSINESS LOAN MYTHS VS REALITY

| Myth | Reality |

|---|---|

| Loans are bad for business | Bad loans are bad |

| Only big companies get loans | MSMEs get priority |

| Collateral always required | CGTMSE removes it |

| Banks reject startups | NBFCs & fintechs fund them |

| High interest means bad lender | Risk-based pricing |

PART X: FUTURE OF BUSINESS LOANS IN INDIA (2025–2030)

1️⃣ AI-Driven Credit Underwriting

Banks now analyze:

- GST APIs

- Bank statement AI

- Marketplace sales data

2️⃣ Embedded Finance

Loans integrated into:

- E-commerce dashboards

- Accounting software

- POS machines

3️⃣ Cash-Flow Based Lending

Profitability less important than cash velocity.

4️⃣ Green & ESG Loans

Lower interest for:

- Renewable energy

- Sustainable manufacturing

- Women-led enterprises

FINAL MASTER FRAMEWORK: HOW TO USE BUSINESS LOANS LIKE THE TOP 1%

Step-by-Step Wealth-Building Loan Strategy

1️⃣ Build credit before need

2️⃣ Borrow when business is stable

3️⃣ Refinance aggressively

4️⃣ Never over-leverage

5️⃣ Treat debt as capital, not cash

THE GOLDEN RULE OF BUSINESS FINANCE

“The right loan at the right time accelerates growth.

The wrong loan at the wrong time destroys businesses.”

FINAL RECOMMENDATION

If you are:

- Growing → Use loans strategically

- Struggling → Restructure, don’t borrow

- Scaling → Combine debt + government support

PART Y: BANK-WISE BUSINESS LOAN APPLICATION WALKTHROUGH (INDIA – 2025)

This section removes guesswork. Most entrepreneurs fail not because they are ineligible, but because they apply to the wrong lender with the wrong structure.

Below is a bank-by-bank, NBFC-by-NBFC application intelligence guide.

1️⃣ SBI Business Loan – India’s Backbone Lender

Best SBI Schemes

- SME Smart Score

- SME Asset Backed Loan

- SME Credit Plus

- Mudra + CGTMSE Combination

Eligibility Snapshot

✔ Business vintage: 2+ years

✔ CIBIL: 650+

✔ Turnover: ₹50 lakh+

Interest Rate (2025)

- 9.65% – 11.50% (lowest among PSU banks)

Step-by-Step Application Strategy

- Apply through branch MSME desk, not online portal

- Submit GST + bank statements together

- Push for CGTMSE coverage

- Negotiate processing fee waiver

Pros

✔ Lowest interest

✔ Large loan limits

✔ Long tenures

Cons

✘ Slow processing

✘ Heavy documentation

Expert Verdict:

Best for manufacturing, exporters, asset-heavy businesses

2️⃣ HDFC Bank Business Loan – Speed + Structure

Key Products

- Business Growth Loan

- Business Instalment Loan

- Overdraft against property

Eligibility

✔ Vintage: 3 years

✔ CIBIL: 700+

✔ High banking turnover

Interest Rate

- 10.75% – 16%

Application Intelligence

- Works best if salary + current account already exists

- OD products convert faster than term loans

Pros

✔ Fast disbursal

✔ Digital process

✔ Flexible OD

Cons

✘ Higher interest

✘ Strict credit filters

Expert Verdict:

Ideal for traders, service businesses, consultants

3️⃣ Axis Bank Business Loan – Structured Credit

Best For

- Doctors

- Professionals

- Franchise owners

Interest Rate

- 11% – 15%

Unique Advantage

- Custom OD limits

- POS-linked lending

Hidden Tip

Axis prefers stable cash flow over profit margins.

4️⃣ ICICI Bank – GST-Linked Lending Leader

Standout Feature

- GST-based credit underwriting

Interest Rate

- 10.50% – 15.50%

Best For

✔ E-commerce sellers

✔ GST-heavy businesses

5️⃣ Bajaj Finserv – The Fastest NBFC

When to Use Bajaj

- Urgent funding

- Weak documentation

- Low vintage

Interest Rate

- 14% – 28%

Pros

✔ Disbursal in 48 hours

✔ Minimal paperwork

Cons

✘ Expensive

✘ Aggressive recovery

Use Bajaj only as bridge capital.

6️⃣ Tata Capital – Balanced NBFC Choice

Best Products

- Working capital loan

- Term loan for MSMEs

Interest Rate

- 11.5% – 18%

Advantage

✔ Professional handling

✔ Transparent charges

PART Z: DOCUMENT CHECKLIST (LENDER-WISE & ERROR-FREE)

Universal Documents (All Lenders)

- PAN (Business + Individual)

- Aadhaar

- GST Returns (12–24 months)

- Bank statements (12 months)

- Business registration proof

Manufacturing / Trading

- Purchase invoices

- Sales register

- Stock statements

Service Businesses

- Client contracts

- Service invoices

- Payment receipts

Proprietorship

- Shop Act

- UDYAM certificate

Partnership / LLP

- Partnership deed / LLP agreement

- Board resolution

Private Limited

- MOA / AOA

- ROC filings

- Shareholding pattern

Common Documentation Mistakes

❌ GST turnover inflated

❌ Cash deposits unexplained

❌ Inconsistent profit figures

PART AA: EMI OPTIMISATION – HOW SMART BUSINESSES BORROW

Rule #1: EMI ≤ 30% of Average Monthly Cash Inflow

Rule #2: OD Over Term Loan for Working Capital

OD allows: ✔ Interest only on used amount

✔ Flexible repayments

Example: EMI Optimization Case

Loan Option A

- ₹50 lakh term loan

- EMI: ₹1.15 lakh

Loan Option B

- ₹35 lakh term + ₹15 lakh OD

- EMI: ₹68,000

- OD interest only when used

✔ Same capital

✔ 40% lower EMI stress

PART AB: INTEREST RATE NEGOTIATION PLAYBOOK

Banks don’t offer best rates upfront.

How to Negotiate Like a Pro

1️⃣ Carry competing sanction letters

2️⃣ Ask for risk premium reduction

3️⃣ Push for processing fee refund

4️⃣ Convert unsecured → secured after 6 months

PART AC: BUSINESS LOAN TAXATION & ACCOUNTING

Interest = 100% Tax Deductible

Under Section 36(1)(iii) of Income Tax Act.

Processing Fee

- Capitalized or expensed based on tenure

GST on Loan

✔ No GST on interest

✘ GST on processing fee (18%)

PART AD: BUSINESS LOANS VS EQUITY – STRATEGIC DECISION

| Factor | Loan | Equity |

|---|---|---|

| Ownership | Retained | Diluted |

| Cost | Fixed | Variable |

| Control | Full | Shared |

| Risk | EMI burden | Loss of control |

Golden Rule:

Use debt for predictable growth, equity for uncertain innovation.

PART AE: SECTOR-WISE LOAN STRATEGY (ADVANCED)

Retail

✔ OD + inventory finance

Manufacturing

✔ Term loan + subsidy stacking

Startups

✔ Revenue-based NBFC loans

Exporters

✔ Packing credit + post-shipment finance

PART AF: THE BUSINESS CREDIT SCORE FORMULA (SECRET)

Banks evaluate:

- 30% CIBIL

- 25% Banking discipline

- 20% GST consistency

- 15% Business vintage

- 10% Industry risk

Improve banking + GST first, not just CIBIL.

FINAL MASTER CHECKLIST (PRINT THIS)

✅ Clean credit

✅ Structured bank statements

✅ GST aligned with banking

✅ Right lender selection

✅ Subsidy utilization

✅ EMI optimization

✅ Refinancing discipline

FINAL WORD: THE ENTREPRENEUR’S FINANCE MANIFESTO

“Capital is not the enemy.

Ignorance of capital is.”

Businesses don’t fail due to lack of loans.

They fail due to bad financial decisions disguised as urgency.

PART AG: 2025–2026 BUSINESS LOAN INTEREST RATE COMPARISON (INDIA)

Understanding interest rates is not about finding the lowest number — it’s about finding the lowest effective cost of capital after fees, tenure, flexibility, and refinancing options.

📊 Business Loan Interest Rate Comparison (Updated 2025)

| Lender | Loan Type | Interest Rate (p.a.) | Tenure | Hidden Costs | Best For |

|---|---|---|---|---|---|

| SBI | Term / OD | 9.65% – 11.50% | Up to 10 yrs | Low | Asset-heavy MSMEs |

| HDFC Bank | Term / OD | 10.75% – 16% | Up to 7 yrs | Medium | Traders, Services |

| ICICI Bank | Term / GST Loan | 10.50% – 15.50% | Up to 7 yrs | Medium | GST-driven firms |

| Axis Bank | OD / Term | 11% – 15% | Up to 6 yrs | Medium | Professionals |

| Tata Capital | Term / WC | 11.5% – 18% | Up to 6 yrs | Transparent | Balanced borrowers |

| Bajaj Finserv | Unsecured | 14% – 28% | Up to 5 yrs | High | Emergency funding |

| Lendingkart | Digital MSME | 13% – 24% | 3–4 yrs | High | New businesses |

| SIDBI | MSME Loans | 8.75% – 11% | Up to 10 yrs | Very Low | Manufacturing |

🔍 Expert Insight

- PSU banks offer low rates but rigid structures

- NBFCs offer speed but high IRR

- Digital lenders price risk, not relationship

PART AH: BUSINESS LOAN APPLICATION — REAL-LIFE WALKTHROUGH

Let’s break the exact process an entrepreneur should follow, step by step.

🧠 Case Study: Retail Business Loan (₹75 Lakh)

Business: FMCG distributor

Vintage: 4 years

Turnover: ₹6.2 crore

CIBIL: 720

Step 1: Financial Grooming (30 Days Before Applying)

✔ Reduce overdraft usage

✔ Avoid cash deposits

✔ Ensure GST = banking sales

Step 2: Lender Shortlisting

- SBI for ₹45L term loan

- HDFC OD ₹30L for working capital

Step 3: Documentation Submission

- GST 3B + GSTR 1 (24 months)

- 12-month current account statements

- Stock statement

- UDYAM certificate

Step 4: Credit Appraisal

- Cash flow stress test

- Debt Service Coverage Ratio (DSCR)

- Industry risk mapping

Step 5: Sanction & Negotiation

- Initial rate offered: 11.75%

- Negotiated to: 10.90%

- Processing fee waived

Step 6: Disbursal

✔ Term loan credited

✔ OD activated in 7 days

📈 Outcome After 18 Months

- Inventory turnover ↑ 32%

- Revenue ↑ ₹1.9 crore

- EMI serviced comfortably

- Loan refinanced at 9.95%

PART AI: BUSINESS LOAN ELIGIBILITY — HOW BANKS ACTUALLY DECIDE

Forget “minimum turnover” myths.

Banks use algorithmic + human scoring.

🧮 Core Eligibility Matrix

| Parameter | Weightage |

|---|---|

| Banking discipline | 25% |

| GST consistency | 20% |

| CIBIL score | 20% |

| Business vintage | 15% |

| Industry risk | 10% |

| Collateral | 10% |

🚫 Why Good Businesses Get Rejected

- Sales mismatch between GST & bank

- Irregular EMI payments (even ₹500 bounce matters)

- Excessive short-term loans

- Industry marked “negative outlook”

PART AJ: INDUSTRY RISK HEATMAP (2025–2026)

🟢 Low-Risk Industries (Easy Loans)

✔ FMCG distribution

✔ Pharma manufacturing

✔ Healthcare services

✔ Export-oriented units

🟡 Medium-Risk Industries

⚠ Restaurants

⚠ E-commerce sellers

⚠ Construction contractors

🔴 High-Risk Industries

✘ Real estate broking

✘ Gambling / gaming

✘ Crypto trading firms

PART AK: GOVERNMENT SUBSIDIES & SCHEMES (MUST-USE)

🔹 CGTMSE (Game Changer)

- Collateral-free loans up to ₹5 crore

- Covers 75–85% default risk

- Applicable to banks & NBFCs

🔹 PMEGP

- Margin subsidy up to 35%

- Ideal for first-time entrepreneurs

🔹 Credit Linked Capital Subsidy Scheme

- Manufacturing equipment subsidy

- Reduces effective loan cost

PART AL: LOAN REFINANCING & BALANCE TRANSFER STRATEGY

Smart borrowers never keep the same loan forever.

When to Refinance

✔ After 12–18 months

✔ CIBIL improves

✔ Business stabilizes

Typical Interest Reduction

- From 14% → 10.5%

- EMI drops 20–30%

PART AM: COMMON BUSINESS LOAN MYTHS (DESTROYED)

❌ “Higher turnover = automatic approval”

✔ Cash flow matters more

❌ “NBFC loans are bad”

✔ Only bad if misused

❌ “Loans hurt business”

✔ Bad loans hurt; smart loans grow

PART AN: PSYCHOLOGY OF DEBT — WHY MOST ENTREPRENEURS FAIL

The problem is not EMI.

The problem is using loans for lifestyle.

Wrong Usage

- Buying luxury cars

- Personal expenses

- Speculative investments

Correct Usage

- Inventory

- Capacity expansion

- Marketing ROI

- Technology upgrades

PART AO: FINAL BUSINESS LOAN DECISION FRAMEWORK

Before taking any loan, answer:

1️⃣ Will this loan increase revenue?

2️⃣ Will it reduce cost or risk?

3️⃣ Can EMI be paid even in a bad month?

4️⃣ Is there an exit/refinance plan?

If any answer is “NO” → do not borrow.

CONCLUSION: THE ULTIMATE BUSINESS LOAN PHILOSOPHY

A business loan is not money.

It is a responsibility with leverage.

Those who understand this grow faster, scale cleaner, and survive longer.

This guide is designed not just to help you get a business loan, but to help you master capital as a business weapon.

Business Loan FAQs (India) – Expert Answers to 50+ Real Questions

🔹 SECTION 1: BASIC BUSINESS LOAN QUESTIONS

1. What is a business loan?

A business loan is borrowed capital used exclusively for business purposes such as working capital, inventory purchase, expansion, machinery, marketing, or cash-flow management. Unlike personal loans, repayment capacity is assessed based on business cash flow, not salary.

2. Who is eligible for a business loan in India?

Eligibility depends on:

- Business vintage (usually 2+ years)

- Turnover consistency

- Banking discipline

- GST compliance (if applicable)

- CIBIL score (650+ preferred)

Both proprietors, partnerships, LLPs, and Pvt Ltd companies are eligible.

3. Can a new business get a business loan?

Yes, but with limitations:

- Banks usually require 2–3 years vintage

- New businesses can access:

- Mudra Loans

- PMEGP

- NBFC startup loans

- Fintech digital lenders (higher interest)

4. What is the minimum CIBIL score required?

- Banks: 700+

- NBFCs: 650+

- Digital lenders: 600+

However, banking behaviour often matters more than CIBIL.

5. Is collateral mandatory for a business loan?

No. Many business loans are collateral-free, especially:

- Working capital loans

- OD/CC facilities

- CGTMSE-backed loans

Collateral helps reduce interest rate but is not compulsory.

🔹 SECTION 2: INTEREST RATE & COST QUESTIONS

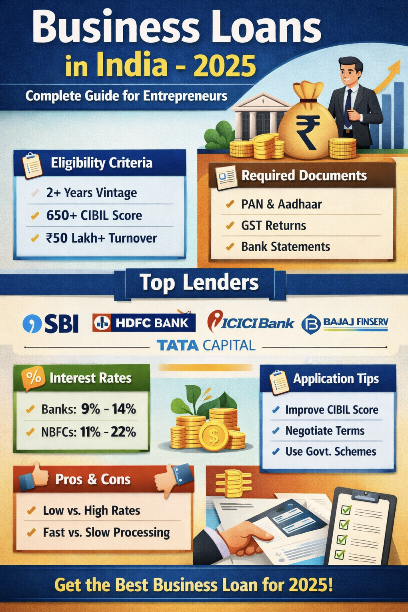

6. What is the average business loan interest rate in India?

As of 2025:

- Banks: 9% – 14%

- NBFCs: 11% – 22%

- Fintech lenders: 14% – 30%

The effective cost depends on processing fees, tenure, and EMI structure.

7. Why do two businesses get different interest rates?

Because lenders price:

- Risk profile

- Industry category

- Cash-flow predictability

- Past repayment history

Same turnover ≠ same risk.

8. What hidden charges should I watch for?

- Processing fee (0.5%–3%)

- Insurance premium

- Legal & valuation charges

- Foreclosure penalty

- Late payment penalty

Always ask for APR (Annual Percentage Rate).

9. Is reducing EMI better than reducing tenure?

Depends:

- Reduce EMI → better cash flow

- Reduce tenure → lower total interest

Growth-stage businesses prefer EMI comfort.

10. Can business loan interest be claimed as an expense?

Yes. Interest paid on business loans is fully tax-deductible under the Income Tax Act, provided the loan is used for business purposes.

🔹 SECTION 3: DOCUMENTATION & PROCESS

11. What documents are required for a business loan?

Common documents include:

- PAN & Aadhaar

- Business registration proof

- GST returns (if applicable)

- ITR (2–3 years)

- Bank statements (12 months)

- Financial statements

12. Is GST mandatory for a business loan?

Not mandatory for all cases, but:

- GST improves approval chances

- Most banks prefer GST-registered businesses

- Non-GST businesses rely more on banking data

13. Can I get a loan without ITR?

Yes, via:

- NBFCs

- Digital lenders

- Banking turnover models

But interest rates are higher.

14. How long does approval take?

- Banks: 7–21 working days

- NBFCs: 3–7 days

- Fintech platforms: 24–72 hours

15. Can rejected loans be reapplied?

Yes — after correcting rejection reasons such as:

- Improving banking discipline

- Reducing EMI burden

- Correcting GST mismatches

🔹 SECTION 4: WORKING CAPITAL & OD LOANS

16. What is a working capital loan?

A loan used for:

- Inventory

- Daily operations

- Vendor payments

- Salary expenses

Usually structured as OD or CC.

17. What is the difference between Term Loan and OD?

| Term Loan | OD/CC |

|---|---|

| Fixed EMI | Interest on usage |

| Long-term | Short-term |

| Asset creation | Liquidity |

18. Is OD better than a term loan?

For cash-flow businesses — yes.

You pay interest only on the amount used.

19. Can GST turnover increase OD limit?

Yes. Banks calculate OD limits based on:

- Monthly GST sales

- Stock cycle

- Receivables period

20. Can OD be converted to term loan?

Yes. Many businesses convert OD into term loans during restructuring or refinancing.

🔹 SECTION 5: GOVERNMENT & SUBSIDY SCHEMES

21. What is CGTMSE?

A government guarantee scheme that allows collateral-free loans up to ₹5 crore for MSMEs.

22. Who is eligible for CGTMSE?

- MSME-registered businesses

- Manufacturing & service units

- New and existing businesses

23. What is Mudra Loan?

A government scheme offering loans up to ₹10 lakh:

- Shishu (₹50k)

- Kishor (₹5 lakh)

- Tarun (₹10 lakh)

24. Can I combine government schemes with bank loans?

Yes, many loans are co-branded with subsidies.

🔹 SECTION 6: LOAN REJECTION & PROBLEMS

25. Why do banks reject business loans?

Top reasons:

- GST & bank mismatch

- High cash transactions

- Irregular EMIs

- Low DSCR

- Negative industry outlook

26. Does cash deposit affect loan approval?

Yes. Excessive cash deposits raise red flags about:

- Tax compliance

- Income authenticity

27. Can multiple loans reduce approval chances?

Yes. High leverage reduces eligibility unless cash flow supports it.

28. Does personal credit affect business loans?

Yes. Proprietor/Director CIBIL is checked.

29. Can I negotiate loan terms?

Absolutely. Interest rate, processing fees, and foreclosure terms are negotiable, especially with good profiles.

30. Can loans be refinanced?

Yes. After 12–18 months, you can:

- Transfer balance

- Reduce interest

- Improve cash flow

🔹 SECTION 7: SPECIAL SCENARIOS

31. Can women entrepreneurs get special benefits?

Yes. Many banks offer:

- Lower interest

- Reduced processing fees

- Priority processing

32. Can startups get business loans?

Startups rely more on:

- NBFCs

- Startup schemes

- Venture debt

- Revenue-based financing

33. Can traders get business loans?

Yes, but banks prefer:

- GST consistency

- Stable margins

- Low inventory risk

34. Can online sellers get loans?

Yes. Platforms like Amazon, Flipkart, and Meesho partner with lenders.

35. Are unsecured business loans safe?

Safe if:

- Used for growth

- EMI ≤ 30% of monthly profit

🔹 SECTION 8: STRATEGY & BEST PRACTICES

36. How much loan should a business take?

Rule of thumb:

EMI should not exceed 30–35% of net monthly cash flow

37. Is prepayment good or bad?

Good if:

- Interest savings > foreclosure charges

- Business cash flow is stable

38. Should loans be taken during expansion?

Yes — expansion without leverage slows growth.

39. Can business loans improve CIBIL?

Yes, if EMIs are paid on time.

40. Can one business have multiple loans?

Yes, if DSCR supports it.

🔹 SECTION 9: ADVANCED QUESTIONS

41. What is DSCR?

Debt Service Coverage Ratio measures ability to service debt.

Banks prefer DSCR ≥ 1.25.

42. What is FOIR?

Fixed Obligation to Income Ratio — total EMIs vs income.

43. What is balance sheet funding?

Loans based on net worth and assets.

44. Can family income be clubbed?

Sometimes, in proprietary businesses.

45. Does industry matter?

Yes. Some industries are flagged as high risk.

🔹 SECTION 10: FINAL DECISION QUESTIONS

46. When should I NOT take a business loan?

- To repay another loan

- For lifestyle expenses

- Without revenue clarity

47. Is taking a loan a sign of weakness?

No. It’s a growth accelerator if used correctly.

48. Can bad loans kill a business?

Yes. Wrong loan structure = cash-flow death.

49. Who should advise before taking a loan?

- CA

- Financial advisor

- Experienced lender consultant

50. What is the golden rule of business borrowing?

Borrow to grow, not to survive.

🔚 Conclusion: Choosing the Right Business Loan Is a Strategic Decision, Not Just a Financial One

A business loan, when used wisely, is not a burden—it is a growth engine. Throughout this guide, we’ve seen that successful borrowing in India depends far less on how much money you need and far more on why you need it, how you structure it, and who you borrow from.

In today’s Indian lending ecosystem—where banks, NBFCs, fintech platforms, and government-backed schemes coexist—business owners have more options than ever. But with more choice comes more complexity. The businesses that thrive are the ones that understand a few core truths:

- Cash flow matters more than profit on paper

- Loan structure is more important than loan amount

- Discipline and compliance unlock cheaper capital

- Leverage accelerates growth only when aligned with revenue cycles

A well-planned business loan can help you:

- Expand operations without draining reserves

- Improve working capital and supplier negotiations

- Invest in technology, manpower, or marketing at the right time

- Build a strong credit profile for future, larger funding

On the other hand, a poorly chosen loan—wrong tenure, high EMI, or mismatched purpose—can choke cash flow and stall growth. That’s why every entrepreneur should treat borrowing as a strategic decision, not an emotional or urgent one.

The Smart Borrower’s Mindset

Before taking any business loan, ask yourself:

- Will this loan increase my revenue or efficiency?

- Can my business comfortably service the EMI in a slow month?

- Is this the lowest-cost and best-structured option available to me?

- Am I borrowing to grow—or just to survive?

When these questions are answered honestly, loans stop being risky and start becoming powerful tools.

Final Takeaway

India’s business loan ecosystem rewards prepared, informed, and disciplined borrowers. Whether you’re an MSME owner, a trader, a startup founder, or a scaling enterprise, understanding eligibility, documentation, lender behavior, and repayment strategy gives you a decisive edge.

Borrow with clarity. Structure with foresight. Repay with discipline.

That’s how business loans turn into business success.

Follow Us on Social Media