Looking for The Best Financial Consultancy in India. Welcome to My Advisers: Your Trusted Partner for Smart Financial Solutions. With a reputation as the Best Financial Advisor in India, we provide expert services for credit cards, loans, insurance, and investments. Compare, apply, and get personalized financial solutions online with ease.

My Advisers: Best Financial Consultancy in India. Your Trusted Partner for Smart Financial Solutions

My Advisers is the best financial consultant in India offering expert services for credit cards, loans, insurance, and investments. Compare, apply, and get personalized financial solutions online with ease.

Compare. Choose. Apply. Simple, Fast, Transparent.

Looking for the best financial consultancy services but tired of complex processes and confusing offers?

My Advisers is here to simplify your journey. Whether you need a credit card, loan, insurance policy, or investment guidance, we help you make informed decisions with ease.

Apply for Financial Services

Why Choose My Advisers?

My Advisers, the Best Financial Consultant in India, offers a range of services to meet your financial needs. Apply for Unsecured Business Loan, Instant Personal Loan, Buy Insurance Policy, or Apply for a Credit Card with us. Whether you have questions about loans, credit cards, insurance, investments, or need personalized financial advice, our expert team is ready to assist you.

1. One Platform, Multiple Solutions

Access a wide range of financial products from India’s top banks, NBFCs, and insurers—all in one place.

2. Expert Advisory Support

Get personalized recommendations from experienced financial advisors to choose the right product for your needs.

3. Transparent Comparison & Best Offers

Compare interest rates, benefits, fees, and eligibility criteria with complete transparency—no hidden charges.

4. 100% Digital & Hassle-Free Process

Apply online in minutes with minimal documentation and real-time application tracking.

5. Trusted by Thousands Across India

Join our growing community of happy customers who trust My Advisers for their financial growth.

Our Services

At My Advisers, we offer a comprehensive range of financial services designed to help you make smart and informed decisions. From finding the best credit cards to applying for loans, securing insurance, and planning your investments, we provide personalized solutions tailored to your needs. Compare top products from leading banks, NBFCs, and insurance providers—all in one place.

Check Our Services

Credit Cards

Discover and apply for the best credit cards with exclusive rewards, cashback, fuel benefits, and travel perks, matched to your lifestyle and credit score.

CreditCardIndia #BestCreditCards #CreditCardOffers #RewardPoints #CashbackCreditCard

Loans

Get instant access to personal loans, home loans, business loans, and loan against property at competitive interest rates with flexible repayment options.

PersonalLoan #BusinessLoan #HomeLoan #LoanAgainstProperty #QuickLoanApproval

Insurance

Protect your family and secure your health with carefully selected life insurance, health insurance, and term insurance plans from trusted providers.

#LifeInsurance #HealthInsurance #TermInsurance #InsuranceMadeEasy #SecureYourFuture

Investments

Grow your wealth with expert-guided investment options like mutual funds, SIPs, and other financial instruments for long-term financial security.

InvestSmart #MutualFundsIndia #SIPPlans #WealthManagement #FinancialFreedom

How It Works

Step 1: Choose Your Service (Credit Card, Loan, Insurance, Investment)

Step 2: Compare Available Options

Step 3: Get Free Expert Advice (Optional)

Step 4: Apply Online Securely

Step 5: Track Your Application & Get Approved

Submit Your Request

Benefits of Using My Advisers

- Simplified Comparison Tools

- Tailored Financial Recommendations

- No Hidden Fees or Bias

- End-to-End Digital Support

- Fast Processing & Reliable Partnerships

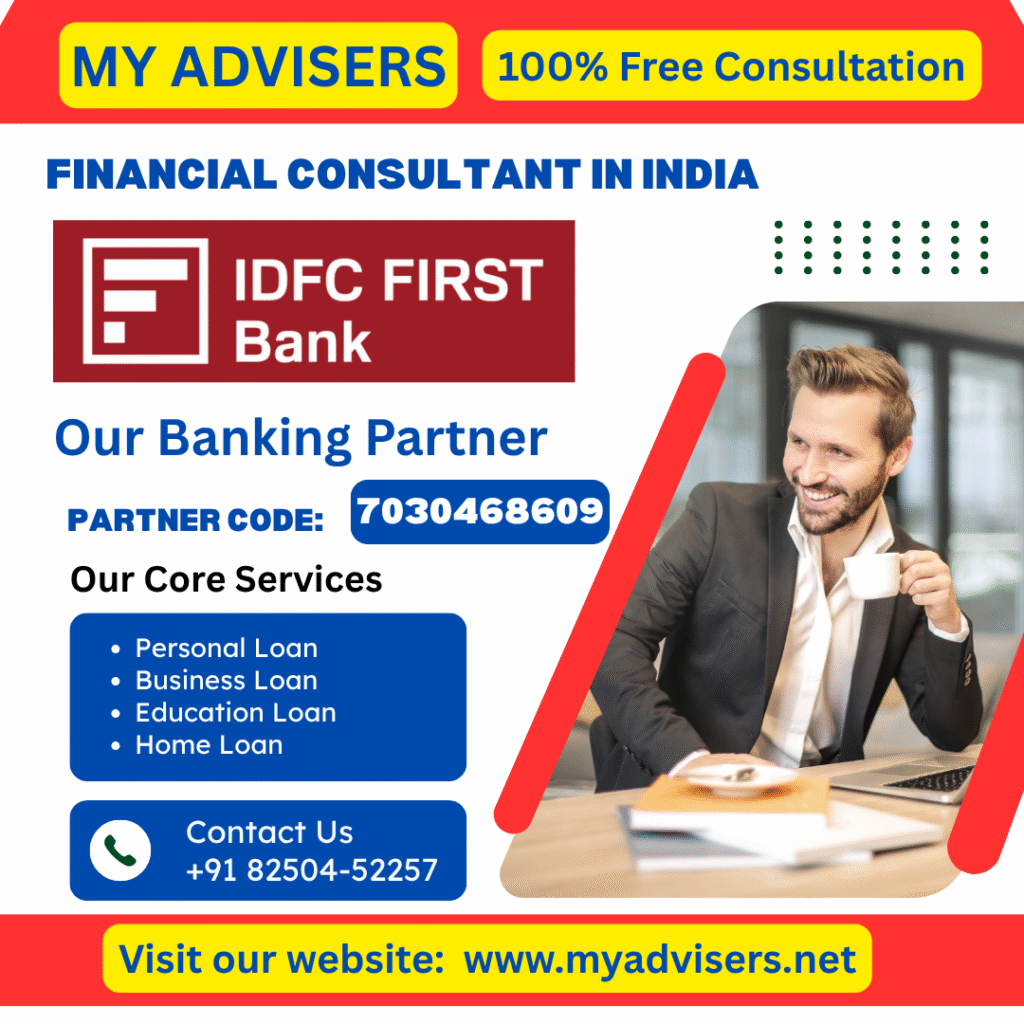

Our Trusted Partners — Together for Your Financial Growth

At My Advisers, we collaborate with India’s most trusted banks, NBFCs, insurance companies, and financial institutions to bring you the best financial products and services. Our partnerships ensure you get exclusive offers, competitive rates, and reliable financial solutions tailored to your needs.

Banking Partners

We work with leading public and private sector banks to offer you a wide range of credit cards, personal loans, home loans, and business loans with transparent terms and quick approvals.

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

- SBI (State Bank of India)

- IDFC FIRST Bank

- Yes Bank

- IndusInd Bank

(and more)

NBFC Partners

Partnered with top NBFCs to provide flexible loan options, financing solutions, and credit facilities for salaried and self-employed individuals.

- Bajaj Finserv

- Tata Capital

- IIFL Finance

- Aditya Birla Capital

- Shriram Finance

- Poonawalla Fincorp

(and more)

Insurance Partners

Secure your future with insurance policies from reputed providers offering life, health, term, and general insurance plans with high claim settlement ratios.

- LIC of India

- HDFC Life

- ICICI Prudential Life Insurance

- Max Life Insurance

- SBI Life Insurance

- Star Health & Allied Insurance

- Care Health Insurance

(and more)

Investment Partners

Grow your wealth with the help of top mutual fund houses, SIP providers, and investment platforms.

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- SBI Mutual Fund

- Axis Mutual Fund

- Nippon India Mutual Fund

(and more)

Why Our Partnerships Matter

- Access to a wide range of trusted financial products

- Exclusive offers & better interest rates

- Faster approvals & reliable services

- End-to-end support from application to approval

- Transparent and customer-first approach

With our strong network of partners, My Advisers ensures you always get the best financial solutions.

Success Stories from Our Happy Clients

“Applying for my first credit card was so easy with My Advisers. The team guided me well, and I got approval within days.”

— Ankita Sharma, Mumbai

“Thanks to My Advisers, I secured a personal loan at the lowest interest rate with zero hassle. Highly recommended!”

— Rohit Verma, Delhi

Top 10 Financial Consultants in India – Compare, Choose & Grow with My Advisers.

Financial consultants in India play a crucial role in shaping personal and business finances. From retirement planning to tax optimization, investment strategies to loan advisory—these experts simplify money matters and help individuals and businesses make informed decisions.

With hundreds of firms offering financial advice, choosing the right financial consultant in India can be overwhelming. To help you out, we’ve listed the top 10 financial consultants, with their strengths, limitations, and how they compare.

List of Top 10 Financial Consultants in India

- Scripbox

- Groww

- Zerodha Varsity

- ET Money

- Melvin Joseph (Founder – Finvin Financial Planners)

- Shilpa Wagh (Founder – Wagh Financials)

- Preeti Zende (ApnaPlan.com)

- Suhas Harshe

- Ujwal Jaitwar

- My Advisers

1. Scripbox

Overview:

Scripbox is an online financial advisory platform offering goal-based investing, mutual fund recommendations, and portfolio tracking.

Pros:

- User-friendly app and website

- SEBI-registered investment advisory

- Automated and research-backed plans

Cons:

- Primarily focused on mutual funds

- Limited scope for customized financial planning

2. Groww

Overview:

Originally a mutual fund platform, Groww has now become a one-stop investment destination for stocks, FDs, gold, and more.

Pros:

- Seamless onboarding and KYC

- Zero commission on direct mutual funds

- Popular among millennial investors

Cons:

- Less personalized financial planning

- Customer support could be more detailed

3. Zerodha Varsity

Overview:

Zerodha Varsity is an educational platform by Zerodha that helps users understand trading, investing, and personal finance.

Pros:

- Rich content for beginners

- Free learning platform

- Backed by India’s largest stockbroker

Cons:

- Only educational, no advisory services

- Not ideal for people looking for active consulting

4. ET Money

Overview:

A Times Group initiative, ET Money offers mutual fund tracking, insurance planning, loans, and expense management tools.

Pros:

- Well-integrated app experience

- Instant investment insights

- Linked to verified financial institutions

Cons:

- Too focused on app-based automation

- Lack of human financial advisors

5. Melvin Joseph – Finvin Financial Planners

Overview:

Melvin Joseph is one of the most respected SEBI-registered fee-only financial advisors in India.

Pros:

- 100% conflict-free advice

- Transparent fee structure

- Strong ethical foundation

Cons:

- Premium charges for personalized advice

- Not ideal for DIY investors

6. Shilpa Wagh – Wagh Financials

Overview:

Shilpa Wagh specializes in helping individuals plan their finances with a special focus on women and first-time investors.

Pros:

- Empowering approach for women investors

- Personalized attention

- Focus on financial literacy

Cons:

- Smaller operational scale

- Limited online tools

7. Preeti Zende – ApnaPlan.com

Overview:

Preeti Zende is a fee-only financial advisor and one of the most vocal advocates of financial independence and literacy.

Pros:

- Affordable fee-only model

- Educates clients during advisory

- Strong online presence

Cons:

- Works with a selective client base

- Consultation slots fill up quickly

8. Suhas Harshe

Overview:

Suhas Harshe is known for simplified wealth advisory for salaried individuals and long-term investors.

Pros:

- Strong trust factor

- Focus on long-term value creation

- Straightforward advice

Cons:

- Limited online presence

- Focused on a niche audience

9. Ujwal Jaitwar

Overview:

Ujwal is a financial coach with a mission to make financial planning accessible to the masses through online media and group sessions.

Pros:

- Engaging content through YouTube and webinars

- Easy-to-understand strategies

- Motivational approach

Cons:

- General advice, not highly customized

- Focus more on awareness than advisory

10. My Advisers

Overview:

My Advisers is a rapidly growing platform in India offering end-to-end financial services—including loans, insurance, business registrations, tax filings, credit cards, and investment advice—all under one roof.

Pros:

- One-stop solution for all financial needs

- Free advisory & documentation help

- Dedicated experts for loans, insurance, tax, and investments

- Active referral and earning programs

- Available across India with digital onboarding

Cons:

- New compared to traditional firms

- Expanding its offline network gradually

Comparative Analysis of Top Financial Consultants

| Consultant | Personalized Advice | Fee Model | Services Covered | Digital Platform | Support |

|---|---|---|---|---|---|

| Scripbox | Low | Commission-based | Mutual Funds | High | Medium |

| Groww | Low | Free | Stocks, FDs, Gold | High | Medium |

| Zerodha Varsity | No (Only Learning) | Free | Education | High | Low |

| ET Money | Medium | Freemium | MF, Loans, Insurance | High | Medium |

| Melvin Joseph | High | Fee-only | Financial Planning | Medium | High |

| Shilpa Wagh | High | Fee-based | Personalized Planning | Medium | Medium |

| Preeti Zende | High | Fee-only | Investment Planning | Medium | High |

| Suhas Harshe | Medium | Fee-based | Wealth Planning | Low | Medium |

| Ujwal Jaitwar | Medium | Free | Financial Education | High | Medium |

| My Advisers | High | Free/Hybrid | Loans, Insurance, Tax, Biz | High | High |

Why My Advisers Stands Out?

In a competitive field dominated by niche consultants and tech platforms, My Advisers brings a fresh, inclusive, and multi-service approach:

- 📌 Customized Financial Advisory for salaried, self-employed, and small business owners

- 📌 No hidden costs, transparent documentation

- 📌 Covers loan approvals, insurance support, credit card suggestions, and business registration—all in one place

- 📌 Offers affiliate partnership and Refer & Earn benefits

- 📌 Real human support with local and digital consultants

- 📌 Backed by growing community trust and proven results

Whether you’re looking for tax saving, investment guidance, or just starting a business—My Advisers is your all-in-one financial partner.

Choose Smart. Choose My Advisers.

Each financial consultant in India offers something unique. Some focus on mutual funds, others on fee-only advice, while a few excel at education. But if you’re seeking a comprehensive, user-friendly, and result-driven platform, My Advisers is the best blend of personal service, tech integration, and financial diversity.

Don’t just manage your money—grow it with confidence.

Start your journey with My Advisers today!

Start Your Financial Journey Today

Don’t let complicated processes slow you down.

Whether you want to save, invest, protect, or borrow—My Advisers is your trusted financial partner.

Compare. Apply. Achieve your financial goals with confidence.

We are always happy to help you.

Become Loan Partner

FAQ Section

Q1: Is My Advisers free to use?

A: Yes, our platform and advisory services are absolutely free for users.

Q2: How secure is my personal data?

A: We follow industry-standard data protection protocols to ensure your information remains safe.

Q3: How long does loan or credit card approval take?

A: Approval timelines vary by provider, but we ensure the fastest possible processing.

Contact Us — We’re Here to Help You!

At My Advisers: Best Financial Consultant in India, we believe in providing you with the best financial guidance and support at every step. Whether you have questions about loans, credit cards, insurance, investments, or need personalized financial advice, our expert team is ready to assist you.

Get in Touch with Us

Phone: +91-8250452257

Email: 4myadvisers@gmail.com

Customer Support Hours: Monday to Saturday | 10:00 AM to 6:00 PM

Visit Our Office:

My Advisers

Champai Nagar, Udbadal

Contai, West Bengal, India, Pin- 721425

Contact Us Today

Connect with Us on Social Media

Stay updated with the latest offers, financial tips, and more!

Why Contact My Advisers?

- Get expert answers to your financial queries

- Assistance with loan, credit card, and insurance applications

- Personalized financial advisory

- Quick response from our support team

- Trusted by thousands of satisfied clients

Your financial journey begins with the right advice. Reach out to My Advisers today!

Subscribe on WordPress

Important Links

List of Important Government Links for Financial Services.

1. RBI – Reserve Bank of India

https://www.rbi.org.in

Regulates banking, NBFCs, and monetary policy. Check guidelines, interest rates, and complaints.

2. SEBI – Securities and Exchange Board of India

https://www.sebi.gov.in

Regulates stock markets, mutual funds, and investment advisors.

3. NSDL – National Securities Depository Limited

https://www.nsdl.co.in

Manage your PAN, demat account, and e-KYC services.

4. Income Tax Department

https://www.incometax.gov.in

File ITR, check refund status, and access tax tools and services.

5. GST Portal – Goods and Services Tax

https://www.gst.gov.in

For GST registration, return filing, and compliance.

6. Udyam Registration (MSME)

https://udyamregistration.gov.in

Register your business as an MSME and get access to government schemes.

7. PMEGP – Prime Minister’s Employment Generation Programme

https://www.kviconline.gov.in/pmegpeportal

Apply for government-subsidized loans to start a small business.

8. Jan Dhan Yojana

https://pmjdy.gov.in

Access details about zero-balance savings accounts and financial inclusion initiatives.

9. Credit Information (CIBIL)

https://www.cibil.com

Check and manage your credit report and score (note: not government-owned, but widely used).

10. NPS – National Pension System

https://enps.nsdl.com

Open and manage your NPS account for retirement savings.

General Hashtags for My Advisers:

#MyAdvisers #FinancialAdvisor #FinanceMadeEasy #CompareChooseApply #SmartFinancialSolutions #TrustedFinancialPartner #DigitalFinance #PersonalFinanceIndia #FinanceSimplified #GrowWithMyAdvisers #FintechIndia #FinancialPlanning #PassiveIncome #FinancialGoals #MoneyManagement #DigitalIndia #OnlineApplication #FinanceGrowth #SimplifyFinance

Great insights! While reading this, I was reminded of how important it is to plan finances smartly. If anyone here is looking to start investing, using a SIP Calculator really helps in visualizing long-term growth. I personally found the Best Platfrom for SIP where it’s super easy to compare funds, calculate returns, and start investing—all in one place. Worth checking out if you’re planning your financial journey!

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!