Discover how to apply for Machinery Loan with SIDBI in Uttar Pradesh. Learn about eligibility, benefits, and the step-by-step process with expert help from My Advisers. Take your business to the next level today.

Apply for Machinery Loan with SIDBI, Uttar Pradesh: Empower Your Business Growth Through My Advisers

Table of Contents

- Introduction

- What is a SIDBI Machinery Loan?

- Why SIDBI is Ideal for Machinery Financing in Uttar Pradesh

- Key Features and Benefits of SIDBI Machinery Loans

- Eligibility Criteria for Machinery Loan

- Documents Required

- Step-by-Step Application Process

- Role of My Advisers in Getting SIDBI Machinery Loan

- SIDBI Loan Schemes Available in Uttar Pradesh

- How SIDBI Supports MSMEs in Uttar Pradesh

- Real Success Stories from Uttar Pradesh

- Comparison with Other Machinery Loans

- Frequently Asked Questions (FAQs)

- Pro Tips to Get Your Loan Approved

- Final Words: Empower Your Business with the Right Machinery

- Relevant Hashtags and Long-Tail Keywords

1. Introduction

The backbone of India’s economy lies in its small and medium enterprises (SMEs). Whether you run a small-scale manufacturing unit or an expanding enterprise in Uttar Pradesh, modern machinery is essential for boosting productivity and quality. The Small Industries Development Bank of India (SIDBI) offers machinery loans tailored to MSMEs.

If you’re a business owner in Uttar Pradesh, applying for a SIDBI Machinery Loan through My Advisers could be your turning point toward industrial excellence.

🔖 Long-tail keyword: “How to apply for machinery loan with SIDBI in Uttar Pradesh through My Advisers”

#BusinessLoanUttarPradesh #SIDBIMachineryLoan #MyAdvisersSupport

2. What is a SIDBI Machinery Loan?

SIDBI offers term loans specifically designed for the purchase, upgrade, or repair of industrial equipment and machinery. These loans are part of their mission to strengthen MSMEs and facilitate modernization across sectors like textile, engineering, agro-processing, handicrafts, and manufacturing.

Loan Highlights:

- Loan Amount: ₹10 lakhs to ₹5 crores

- Tenure: Up to 7 years

- Interest Rate: Starting from 8.25% p.a.

- Collateral: Often covered under CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

🔖 Long-tail keyword: “SIDBI industrial machinery term loan for MSMEs”

3. Why SIDBI is Ideal for Machinery Financing in Uttar Pradesh

Uttar Pradesh, with its fast-growing industrial cities like Kanpur, Agra, Lucknow, Moradabad, and Noida, is a hotspot for MSMEs. SIDBI has identified this potential and offers region-specific advantages:

- State Government Support: Collaborations for interest subsidies

- Sectoral Preference: Handicrafts, agro-industries, and textiles

- Special Schemes: Targeted programs for artisans and women entrepreneurs

✅ #MachineryLoanUP #SIDBIinUttarPradesh #UPMSMEs

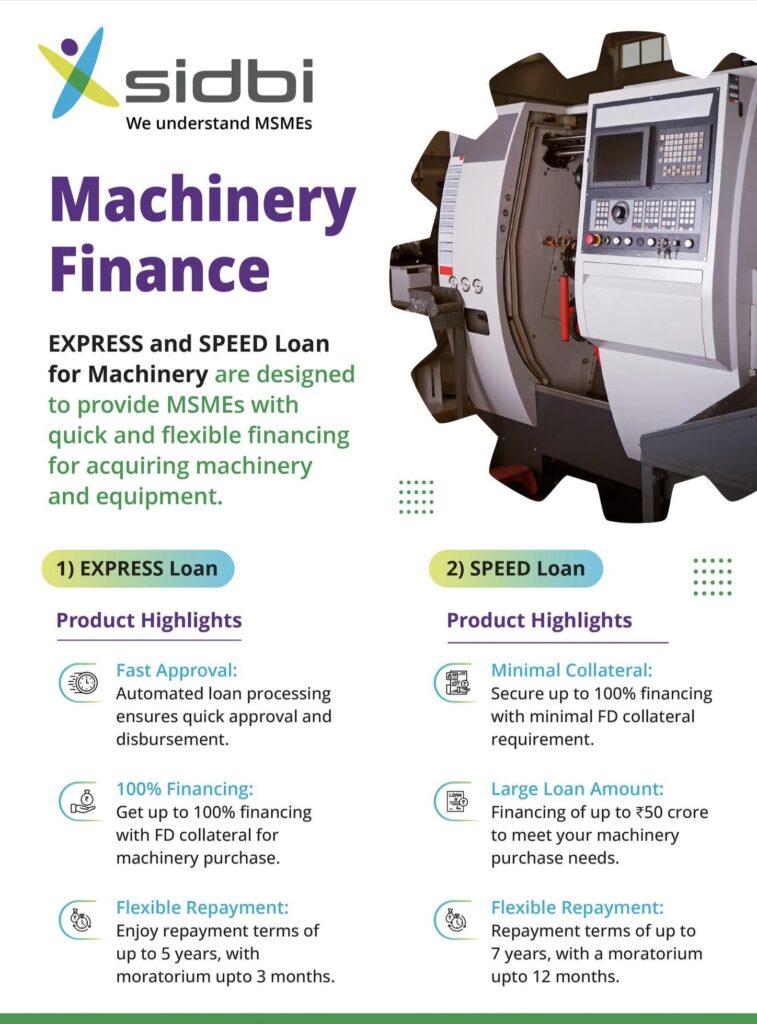

4. Key Features and Benefits of SIDBI Machinery Loans

- High Loan Amounts: Up to ₹5 crore depending on business scale

- Flexible Repayment: Tenures ranging from 3 to 7 years

- Minimal Collateral: Covered under credit guarantee schemes

- Online Application: Apply digitally through My Advisers

- Fast Processing: Disbursement in as little as 7–10 working days

📈 Boost production, reduce downtime, and scale operations faster.

#SIDBIBenefits #LoanForBusinessGrowth

5. Eligibility Criteria for Machinery Loan

To apply for a SIDBI Machinery Loan in Uttar Pradesh, you must:

- Be registered as an MSME

- Have a valid GSTIN and PAN

- Have a minimum of 2 years of business operation

- Show consistent turnover and profit trends

- Possess business premises (owned or rented)

🔖 Long-tail keyword: “SIDBI loan eligibility for small manufacturers in UP”

6. Documents Required

Having the correct documents is critical. Here’s what you need:

Personal Documents:

- PAN Card

- Aadhaar Card

- Passport-size photo

Business Documents:

- GST Certificate

- Udyam Registration

- Last 3 years’ ITR

- Bank Statements (6–12 months)

- Audited Financials

Machinery Quotes:

- Proforma Invoice of machinery

- Supplier’s profile (if needed)

🗂️ Make sure your documents are up to date to avoid loan rejection.

#LoanDocumentsUP #SIDBIApplicationChecklist

7. Step-by-Step Application Process

Applying for a machinery loan has never been easier, especially with My Advisers guiding you through the steps:

Step 1: Visit My Advisers

Click on “Apply for SIDBI Machinery Loan.”

Step 2: Fill in the Loan Form

Provide basic business and personal details.

Step 3: Upload Documents

Submit KYC, GST, bank statements, and machinery invoices.

Step 4: Verification and Assessment

My Advisers will help verify and improve your financial profile if needed.

Step 5: SIDBI Approval

Loan sanction, documentation, and final disbursement.

💡 My Advisers ensures no step is missed in your loan journey.

#OnlineSIDBILoan #MyAdvisersLoanHelp

8. Role of My Advisers in Getting SIDBI Machinery Loan

My Advisers is a trusted financial consultancy platform helping businesses across India. Here’s how they assist:

- Free Loan Consultation

- Document Preparation

- Credit Profile Analysis

- SIDBI Loan Matching

- Follow-up & Approval Guidance

🤝 Thousands of UP businesses trust My Advisers for quick and stress-free financing.

#MyAdvisersReviews #LoanExpertsIndia

9. SIDBI Loan Schemes Available in Uttar Pradesh

SIDBI offers various schemes under its umbrella, including:

- SIDBI Make in India Soft Loan Fund for Micro Small and Medium Enterprises (SMILE)

- Standup India Scheme

- SIDBI-Startup Mitra

- Credit Guarantee Fund Scheme (CGTMSE)

- SIDBI’s TReDS Platform for Invoice Financing

These schemes offer low interest, faster approvals, and state-level assistance.

🏭 Use these schemes to fuel your business dreams in UP.

#SIDBISchemes2025 #UPBusinessLoan

10. How SIDBI Supports MSMEs in Uttar Pradesh

- SIDBI Regional Offices: Located in Lucknow, Kanpur, Agra, Varanasi

- Tie-ups with District Industries Centres (DICs)

- Workshops on Financial Literacy and Loan Awareness

- Special Outreach Programs for Backward Regions

💬 SIDBI doesn’t just give loans—it builds ecosystems.

#SIDBIUPSupport #MSMEIndiaGrowth

11. Real Success Stories from Uttar Pradesh

Case 1: Textile Unit in Lucknow

Received ₹45 lakhs loan with My Advisers’ help; scaled up exports by 70%.

Case 2: Engineering Workshop in Kanpur

Took a ₹25 lakh machinery loan; turnover doubled in 2 years.

🏆 These stories inspire thousands. You could be next!

#SIDBISuccessUP #RealBusinessStories

12. Comparison with Other Machinery Loans

| Criteria | SIDBI Machinery Loan | Private Bank Loan | NBFC Loan |

|---|---|---|---|

| Interest Rate | 8.25–10% | 11–15% | 16–24% |

| Processing Time | 7–10 Days | 15–30 Days | 5–10 Days |

| Collateral Requirement | Not Always | Usually Required | Depends |

| State Support Available? | Yes | No | No |

| Repayment Flexibility | High | Medium | Low |

📊 SIDBI wins with affordability and long-term support.

#CompareLoans #BestMachineryLoan

13. Frequently Asked Questions (FAQs)

Q1: Can startups apply for SIDBI machinery loans?

A: Yes, under schemes like SMILE and Startup Mitra.

Q2: What’s the maximum tenure?

A: Up to 7 years, including a moratorium of 6–12 months.

Q3: Can I apply online without visiting any office?

A: Yes, My Advisers makes it 100% online.

Q4: Is there any processing fee?

A: SIDBI typically charges 1% of the loan amount as processing fee.

💡 Have more questions? Contact My Advisers today!

#SIDBIFAQs #LoanHelplineUP

14. Pro Tips to Get Your Loan Approved

✅ Maintain a good CIBIL score (Above 700)

✅ Keep your GST and ITR filings up to date

✅ Submit a detailed project report

✅ Include quotes from reputed machinery suppliers

✅ Take expert help from My Advisers to fast-track approvals

🧠 Smart planning = Fast disbursal. Don’t delay your growth.

#LoanApprovalTips #FinanceGrowthUP

15. Final Words: Empower Your Business with the Right Machinery

In 2025, access to the latest machinery is not just a benefit—it’s a necessity for survival. Whether you’re a startup or an established manufacturer in Uttar Pradesh, the SIDBI Machinery Loan is your gateway to competitive edge, growth, and global outreach.

With My Advisers, you get more than just assistance—you get a partner in your financial journey.

🚀 Start your SIDBI Machinery Loan journey today with My Advisers

#ApplyNow #GrowYourBusinessWithSIDBI

16. Relevant Hashtags and Long-Tail Keywords

Hashtags: #SIDBILoanUP #MachineryLoanIndia #MyAdvisersHelp #UPBusinessSupport #IndustrialLoan2025 #SIDBIFinance #MSMELoanUP #SIDBIMSME

Long-Tail Keywords:

- Apply for SIDBI machinery loan in Uttar Pradesh

- SIDBI MSME loan for machinery purchase

- Best financial advisor in UP for SIDBI loans

- My Advisers machinery loan assistance

- Industrial loan schemes for small businesses in UP

I conceive you have observed some very interesting details , appreciate it for the post.

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with a few pics to drive the message home a bit, but instead of that, this is great blog. An excellent read. I’ll certainly be back.

incrível este conteúdo. Gostei bastante. Aproveitem e vejam este site. informações, novidades e muito mais. Não deixem de acessar para saber mais. Obrigado a todos e até a próxima. 🙂