Join ROK Financial’s Affiliate Program! Financial consultants earn top commissions by referring business clients for fast, flexible funding solutions.

💼 Become a ROK Financial Affiliate Partner: A Powerful Opportunity for Financial Consultants to Grow and Earn More

In today’s fast-paced financial landscape, professionals are constantly seeking innovative ways to provide more value to their clients while increasing their own income. One of the most effective and scalable methods? Affiliate partnerships.

If you’re a financial consultant, loan broker, accountant, or business advisor in the USA, this article is for you.

At ROK Financial, we’re inviting passionate and driven financial professionals to join our Affiliate Partner Program — a win-win model where you refer small business clients in need of funding, and we handle the rest. In return, you earn competitive commissions, enhance your client offerings, and open the door to long-term income potential.

🔍 What Is ROK Financial?

ROK Financial is one of the leading alternative business funding companies in the United States, providing fast, flexible, and accessible financing solutions to small and medium-sized businesses. Founded with the mission to empower entrepreneurs, ROK Financial specializes in products such as:

- Working Capital Loans

- Equipment Financing

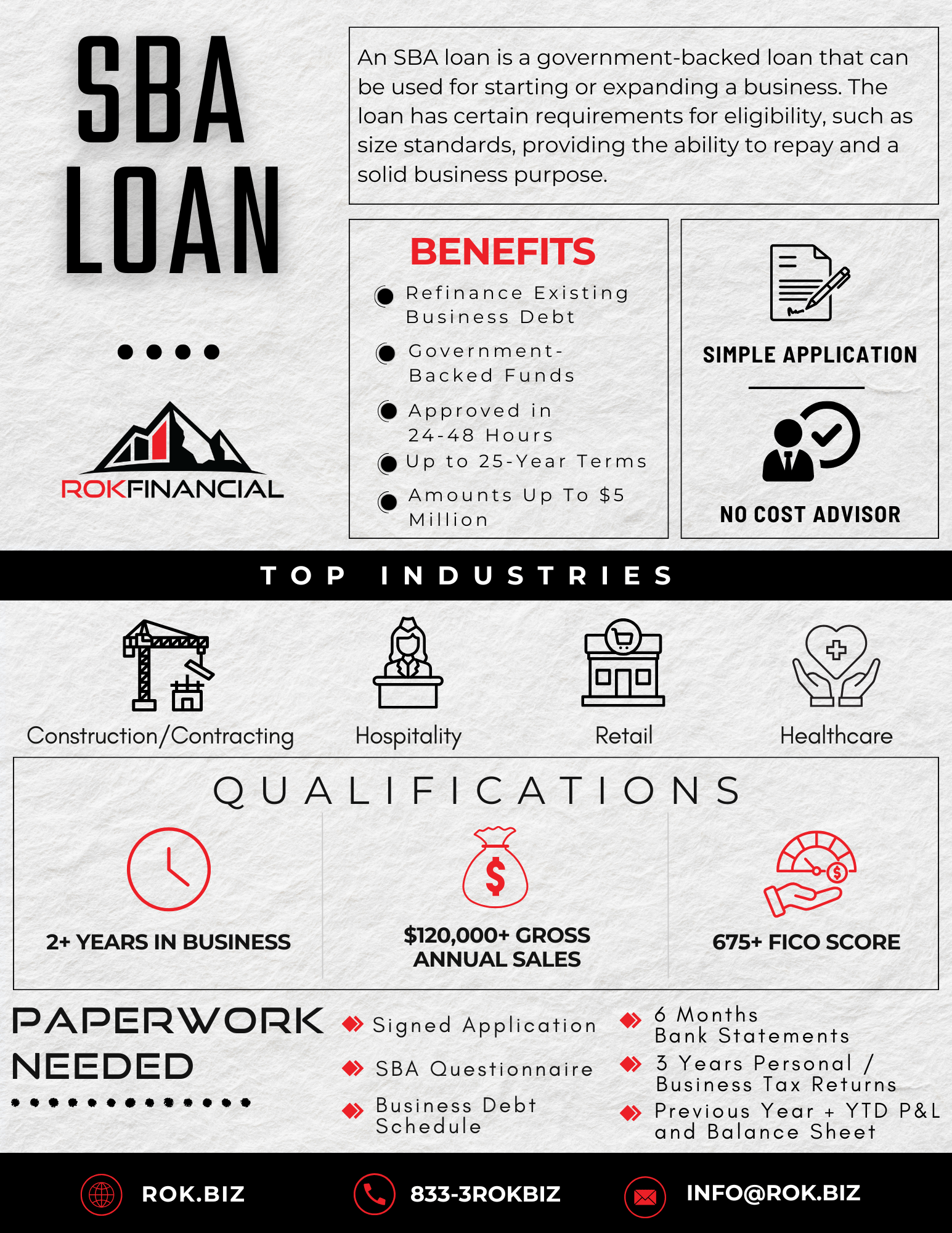

- SBA Loans

- Business Term Loans

- Lines of Credit

- Merchant Cash Advances

- Start-Up Funding Options

With a commitment to fast approvals, transparent terms, and personalized service, ROK Financial has become a trusted name in the alternative lending industry.

💡 Why Affiliate Marketing in Finance Is a Game-Changer

Affiliate marketing isn’t just for influencers and bloggers anymore. In the financial sector, it offers a low-risk, high-reward opportunity for consultants and professionals to:

- Monetize their client base

- Earn income without selling or underwriting

- Offer value-added services

- Build recurring, passive income streams

The beauty of an affiliate model is that you refer clients, and ROK Financial does the heavy lifting — underwriting, approvals, funding, and servicing.

🚀 Why Join the ROK Financial Affiliate Partner Program?

Here’s what makes ROK’s affiliate program one of the best in the U.S. finance space:

✅ Generous Commissions

We pay top-tier commissions for every successfully funded referral. As your referral volume grows, so do your earnings.

✅ High Approval Rates

Thanks to a wide range of funding solutions, we approve a large percentage of qualified applicants — helping you earn faster and more frequently.

✅ Partner Portal

Track your referrals, commissions, and funding status in real-time with our intuitive online dashboard.

✅ White Label Option

Build your brand while we do the work — our white-label affiliate options let you keep client trust while leveraging our funding expertise.

✅ Dedicated Support Team

Get hands-on assistance from a real affiliate manager. No bots. No endless tickets. Just real support from real humans.

✅ Fast Turnaround

Some deals are approved within hours and funded the next day. Your clients get money quickly — and you get paid fast.

👥 Who Can Join the ROK Affiliate Program?

We welcome a variety of professionals who regularly interact with small business owners, including:

- Financial Advisors & Consultants

- Tax Professionals & CPAs

- Loan Brokers

- Business Coaches

- Insurance Agents

- Real Estate Professionals

- Accountants

- Marketing Agencies

Even if you’re new to the finance industry but have a business-oriented network, you’re encouraged to apply.

🌟 Customer & Affiliate Testimonials

“I’ve been referring clients to ROK for over a year now. The process is seamless, the team is responsive, and the commissions have added a significant revenue stream to my business.”

— Lisa M., Financial Consultant, California

“As a CPA, I often have clients struggling to get traditional funding. ROK helps me offer solutions that banks can’t — and I get paid for it.”

— Brian T., CPA, New York

“I was skeptical at first, but after seeing how ROK handled my referrals — and how fast I got paid — I knew this was the real deal.”

— Rajiv D., Business Coach, Texas

⚖️ Pros and Cons of Becoming a ROK Financial Affiliate Partner

✔️ Pros:

- High commission potential

- Low barrier to entry

- Passive income model

- Support from experienced funders

- No cost to join

- Real-time tracking and reporting

- Expand your services without extra licensing

❌ Cons:

- You don’t control the underwriting decisions

- Commissions are dependent on successful funding

- Requires consistent client networking to scale earnings

📈 Realistic Earning Potential

Affiliates typically earn hundreds to thousands of dollars per month, depending on deal volume and size. Some of our top-performing partners are earning six figures annually — simply by referring business clients who need capital.

Let’s say you refer 5 clients per month and 3 get funded with an average commission of $1,200 — that’s $3,600 per month in additional income. Over a year, that’s $43,200 — from referrals alone.

📝 How to Join the ROK Affiliate Program

Joining is easy and free. Here’s how:

- Apply Online: Fill out the short application form on our [Affiliate Sign-Up Page].

- Get Approved: Our team will review your application and schedule a quick onboarding call.

- Start Referring: Use your dashboard, white-label links, or speak directly with clients to start earning.

📣 Final Thoughts: Grow Your Business While Helping Others Grow Theirs

The ROK Financial Affiliate Partner Program is more than a side hustle — it’s a professional opportunity to build long-term revenue while helping entrepreneurs access the funding they need.

Whether you’re an experienced consultant or just starting to expand your services, ROK’s affiliate program is designed to help you succeed with:

- No upfront cost

- No complex training

- No pressure

Just real results, real money, and real impact.

👉 Ready to Partner With ROK Financial?

Help businesses thrive — and let your income grow with them.

Join the ROK Financial Affiliate Partner Program today.

🔑 Pro Tips to Succeed as a ROK Financial Affiliate Partner

1. 🎯 Know Your Ideal Client

Understand who benefits most from ROK Financial’s funding:

- Small business owners needing fast capital

- Startups denied by traditional banks

- Seasonal businesses or those with cash flow gaps

- Clients with less-than-perfect credit

👉 Tip: Create a simple client profile sheet to prequalify referrals.

2. 💬 Educate Your Audience

Position yourself as a trusted advisor by:

- Writing blog posts about small business funding options

- Posting FAQs on LinkedIn or Facebook

- Creating short explainer videos or reels

👉 Tip: Use ROK-approved marketing content or ask your affiliate manager for white-label material.

3. 🧑💼 Leverage Your Existing Network

Reach out to:

- Past and current clients

- Local business groups and chambers

- Other professionals (CPAs, realtors, coaches) for cross-referrals

👉 Tip: Use warm introductions — “I work with a trusted funding partner who helps businesses like yours.”

4. 📲 Stay Active on LinkedIn

LinkedIn is a goldmine for finance professionals.

- Connect with business owners, accountants, or startup founders

- Share success stories of funded clients

- Message leads with a personal, non-spammy intro

👉 Tip: Use this hook: “Would you like funding options beyond the bank — with fast approval and no obligation?”

5. 📈 Track Your Performance

Use your ROK Partner Dashboard to:

- Monitor referrals

- Track payouts

- See where your best leads come from

👉 Tip: Test different channels (email, social, WhatsApp, local events) and double down on what works.

6. 🤝 Stay in Touch with Your Affiliate Manager

Your partner manager is your secret weapon. They can:

- Help with tough client scenarios

- Share insights about what’s working

- Offer exclusive promos or bonuses

👉 Tip: Schedule monthly check-ins for updates and ideas.

7. 📣 Ask for Referrals from Referrals

Once you help one client get funded, ask:

“Do you know any other business owners who might need working capital?”

👉 Tip: Offer a small referral incentive (if allowed) or just say thank you publicly on social media.

8. 🛠️ Use CRM Tools to Stay Organized

Keep track of conversations, client statuses, and follow-ups with a simple CRM like:

- Trello

- HubSpot (free plan)

- Google Sheets (with filters)

👉 Tip: Build a “pipeline” of warm leads you can follow up with every week.

9. 📞 Host a Free Finance Q&A Call

Offer a monthly Zoom or phone session where business owners can:

- Ask funding questions

- Learn about working capital

- Understand how the ROK process works

👉 Tip: Position yourself as a funding guide — not a salesperson.

10. 🧠 Keep Learning

The more you know about funding, the more trust you’ll earn. Stay updated on:

- SBA programs

- Equipment leasing

- Merchant advances

- Term loans vs LOCs

👉 Tip: Ask your ROK team for training resources or success stories to study.

💼 Final Tip: Be the Bridge Between the Problem and the Solution

Remember: You’re not just referring names — you’re helping small businesses survive and grow. Lead with value, follow up with integrity, and stay consistent.