Looking to apply for a loan? Learn how My Advisers simplifies the loan application process with expert guidance and easy steps. Apply today for personal, business, or home loans.

How to Apply for a Loan with My Advisers: A Simple Step-by-Step Guide

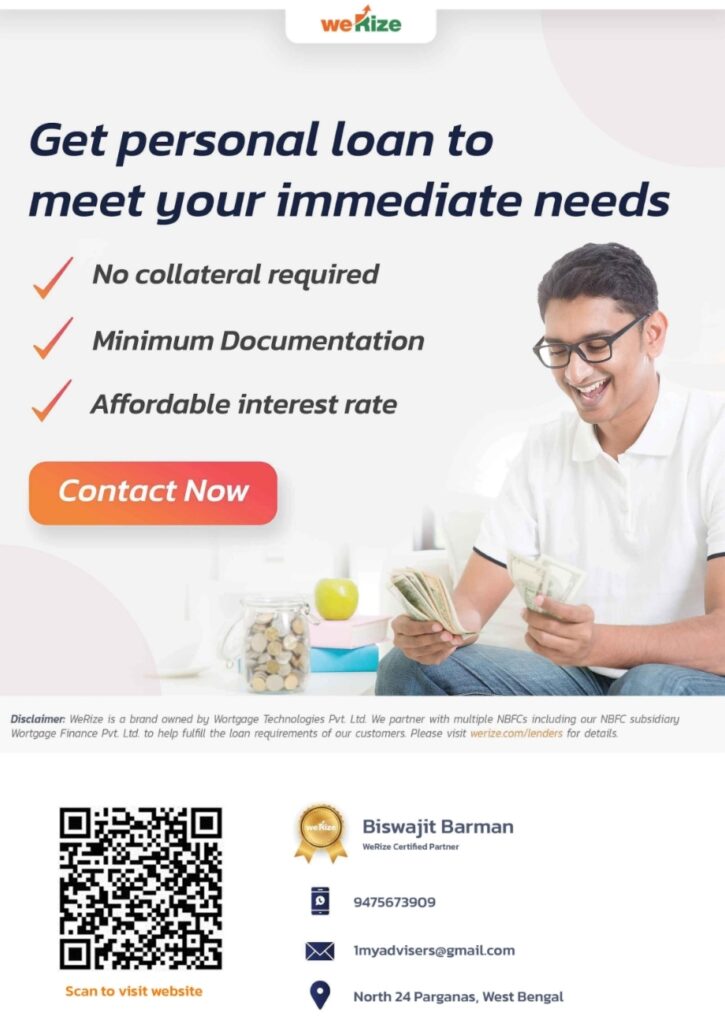

When it comes to securing a loan, finding the right support can make all the difference. Whether you’re planning to start a business, manage personal expenses, or handle an emergency, My Advisers is here to guide you every step of the way. With over 9 years of experience in financial consulting, Mr. Biswajit Barman and his team offer personalized, transparent, and hassle-free loan services to help you meet your financial goals.

Here’s a detailed blog article on how to apply for a loan with My Advisers, tailored for your platform.

Loan Services with My Advisers: Your Trusted Path to Financial Freedom

In today’s fast-paced world, accessing a loan can be a daunting process, especially when you need expert advice and guidance to make informed decisions. Whether it’s for personal needs, business expansion, or a home purchase, My Advisers provides a seamless, user-friendly process to help you get your loan approved quickly and efficiently.

[bbp-single-forum id=1877]

This step-by-step guide will walk you through how to apply for a loan with My Advisers, covering all aspects from eligibility to documents required and the application process.

Why Choose My Advisers for Your Loan Application?

Before diving into the application process, let’s highlight why My Advisers is the best platform to help you secure a loan:

- Expert Guidance: Receive personalized loan advice based on your needs and financial situation.

- Seamless Process: Apply easily through an online form, with expert consultants to guide you.

- Variety of Loans: Personal loans, business loans, home loans, education loans, and more.

- Quick Processing: Fast approval process with minimal documentation and hassle.

- Transparency: No hidden fees, clear terms, and conditions.

- Free Service: My Advisers helps you apply for loans without any charges.

Now, let’s look at how you can apply for a loan with My Advisers.

Eligibility Criteria for Loan Application

Before you begin the loan application process, it’s important to ensure that you meet the eligibility requirements for your desired loan. While each type of loan may have specific criteria, here are the general eligibility guidelines:

- Personal Loan:

- Minimum age of 21 years and maximum age of 58 years.

- Steady income source (salaried or self-employed).

- A good credit score (typically above 650).

- Stable employment or business with a minimum work experience of 1 year.

- Business Loan:

- Minimum age of 21 years and maximum age of 65 years.

- Business running for at least 2 years.

- Proof of business revenue and financial documents (tax returns, balance sheets).

- Good credit history.

- Home Loan:

- Age between 23 and 60 years.

- Proof of income and employment.

- Good credit score (preferably 700+).

- A clear property title and relevant legal documents.

- Education Loan:

- Applicant must be a student or a co-applicant.

- A confirmed admission in a recognized institution.

- Proof of academic performance and future employability.

Documents Required

To ensure a smooth loan application process, make sure you have the following documents ready:

1. For Personal Loan:

- KYC documents (Aadhaar card, PAN card, passport, etc.)

- Latest salary slips or income proof (for salaried individuals)

- Bank statements (last 3 months)

- Proof of residence (utility bills, rent agreement, etc.)

- Credit score (if applicable)

2. For Business Loan:

- KYC documents (Aadhaar card, PAN card, etc.)

- Business tax returns and financial statements (2 years)

- Bank statements of business account (6 months)

- GST returns and business registration documents

- Proof of business revenue

3. For Home Loan:

- KYC documents (Aadhaar card, PAN card)

- Income proof (salary slips or income tax returns)

- Property documents (title deed, agreement to sell)

- Bank statements (last 3-6 months)

- Credit score report

4. For Education Loan:

- KYC documents

- Admission letter from the institution

- Academic transcripts and certificates

- Guarantor’s income proof (if applicable)

- Loan application form

How to Apply for a Loan with My Advisers

Now that you have your documents and eligibility sorted, follow these simple steps to apply for a loan with My Advisers:

Step 1: Visit My Advisers Website

Head over to My Advisers and locate the Loan Application section on the homepage or under the financial services tab.

Step 2: Fill Out the Loan Application Form

Complete the online form with basic information:

- Type of loan (personal, business, home, or education)

- Loan amount required

- Contact details (phone number, email)

- Employment or business information

- Other relevant financial details

Step 3: Submit Documents

Once the form is submitted, you will be prompted to upload the necessary documents. Ensure all files are clear and legible for smooth processing.

Step 4: Consultation with a Loan Expert

A My Advisers financial consultant will review your application and contact you for a personalized consultation. They will guide you through the best options available and help you choose the loan product that fits your needs.

Step 5: Loan Processing & Approval

Once the details are confirmed, the loan will be processed with the relevant lender. My Advisers will keep you updated on the status and any additional steps required.

Step 6: Loan Disbursement

After approval, the loan amount will be disbursed directly to your bank account. My Advisers will assist with any post-loan formalities.

Why Choose My Advisers for Loan Application?

My Advisers stands out for its holistic approach to financial services, making it easier to access loans with guidance. Here’s why My Advisers should be your go-to platform for loan applications:

- Expert Advisors: Get personalized assistance from financial experts who help you select the right loan product.

- Comprehensive Loan Options: From personal loans to business loans and home loans, we cover it all.

- Quick Processing: We ensure that your loan application is processed quickly, with minimal paperwork.

- Seamless Experience: Enjoy a smooth, hassle-free experience with user-friendly online applications and follow-up.

- No Hidden Fees: We offer transparent services with no hidden charges, ensuring that your financial journey is stress-free.

Loan Application Tips

- Check Your Credit Score: Ensure your credit score is in a good range before applying. A higher score increases your chances of approval and may result in lower interest rates.

- Choose the Right Loan Type: Choose a loan product that fits your financial situation and purpose. A personal loan might be ideal for immediate needs, while a business loan is better for long-term growth.

- Submit Complete Documents: Incomplete documentation can delay the loan process. Double-check before submission.

- Understand Loan Terms: Make sure you understand the loan’s interest rate, tenure, and any hidden fees.

- Keep a Backup Plan: Always have a backup in case your loan application is rejected. Exploring different lenders can give you more flexibility.

Applying for a loan doesn’t have to be complicated. With My Advisers, you can ensure a smooth, transparent, and quick loan application process. Whether it’s a personal loan, business loan, home loan, or education loan, My Advisers is here to help you make informed financial decisions and secure the funds you need.

Start your journey with My Advisers today, and experience a smarter way to apply for loans!

Why My Advisers Stand Out?

At My Advisers, we understand that every financial situation is unique. That’s why we provide a wide range of loan solutions backed by expert guidance:

1. Personalized Consultation

Our experienced advisors assess your financial profile and help you choose the best loan option tailored to your needs—whether it’s a personal loan, business loan, home loan, or loan against property.

2. Multiple Loan Options from Leading Institutions

We collaborate with trusted financial institutions like Bajaj Finance, IIFL Finance, and others to offer you competitive interest rates and flexible repayment terms.

3. Easy Application Process

With My Advisers, applying for a loan is simple and smooth. From document collection to application submission, we handle everything so you can focus on your financial planning.

4. Transparent Advice

We believe in clarity and honesty. You get full details about your eligibility, interest rates, repayment schedule, and any charges involved—no hidden surprises.

Types of Loans Offered by My Advisers

- Personal Loans: Quick funds for any personal need—medical, travel, education, or home renovation.

- Business Loans: Capital to grow or manage your business, with flexible repayment options.

- Loan Against Property: Unlock the value of your assets with attractive interest rates.

- Home Loans: Affordable EMI plans to help you buy your dream home.

- Gold Loans & Other Secured Loans: Fast disbursal with minimal documentation.

What Makes Us Different?

- 9+ Years of Experience

- One-on-One Guidance

- 100% Paperless Options

- Fast Loan Approvals

- Ongoing Support After Disbursal

Whether you’re a salaried individual, self-employed professional, or small business owner, My Advisers is your go-to partner for all loan needs.

Get in Touch Today

Take the first step toward financial empowerment with a free consultation.

- WhatsApp: +91 8250452257

- Email: 4myadvisers@gmail.com

- Website: https://myadvisers.net

- Blog: https://2myadvisers.blogspot.com

Secure your future. Simplify your finances. Apply for your loan today with My Advisers.

I’m just writing to make you be aware of what a perfect discovery our child found studying the blog. She picked up too many issues, most notably what it is like to possess a very effective helping spirit to have men and women really easily master some impossible topics. You truly exceeded readers’ desires. Many thanks for offering such priceless, trusted, edifying and in addition unique thoughts on the topic to Jane.

I’m very happy to read this. This is the kind of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this greatest doc.

I’d also like to say that most of those who find themselves devoid of health insurance are normally students, self-employed and those that are out of work. More than half of the uninsured are really under the age of Thirty-five. They do not come to feel they are in need of health insurance simply because they’re young in addition to healthy. Their income is normally spent on real estate, food, as well as entertainment. Many individuals that do go to work either full or in their free time are not offered insurance by their work so they get along without because of the rising price of health insurance in the country. Thanks for the tips you reveal through this blog.

Hey there! I know this is somewhat off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Competitive rates amazing results, proves you don’t need to overpay. Smart spending choice made. Affordable appreciation.

Nice post. I was checking constantly this blog and I’m impressed! Extremely useful info specially the last part 🙂 I care for such information much. I was looking for this certain info for a very long time. Thank you and best of luck.

I see something genuinely interesting about your blog so I saved to my bookmarks.

Thanks a bunch for sharing this with all people you actually recognise what you’re talking approximately! Bookmarked. Kindly additionally talk over with my site =). We could have a hyperlink alternate contract between us!

Someone essentially help to make seriously posts I would state. This is the very first time I frequented your website page and thus far? I surprised with the research you made to make this particular publish extraordinary. Wonderful job!

Excellent read, I just passed this onto a colleague who was doing a little research on that. And he actually bought me lunch because I found it for him smile Therefore let me rephrase that: Thank you for lunch!

Some truly interesting info , well written and broadly user friendly.